Pfizer (NYSE: PFE) stock price tumbled sharply after missing estimates for the second quarter. In addition, lower than expected guidance for the following two quarters negatively impacted investors sentiments.

The stock price lost more than 17% of value since the earnings announcement in July. The shares are currently trading slightly high from a 52-weeks low of $34 a share. Pfizer stock price has hit a 52-weeks high of $46 a share at the end of the first half.

The steep decline in share price has created an attractive entry point for new investors.

Pfizer could also be a good play for dividend investors. The company offers a dividend yield of 4%. In addition, it has recently raised the quarterly dividend by 6%. This marks the 321st consecutive quarterly dividend paid by Pfizer.

Pfizer has also been offering cash returns to investors in the form of share buybacks. It has recently announced a new $10 billion share repurchase program.

Pfizer chairman says, “We are confident in the business and focused on maximizing total shareholder return, of which the dividend remains a key component.”

Although its revenue growth outlook is sluggish, the company’s strong earnings and cash generation potential supports dividend increase. The company has generated high mid-single-digit growth in earnings during the first half despite flat revenue. Its adjusted earnings per share grew 8% in H1 compared to the past year.

Consequently, its free cash flows also grew at a similar pace. It has returned $12.9 billion to investors in the form of cash. It returned $4.0 billion through dividends and $8.9 billion in the form of share repurchases.

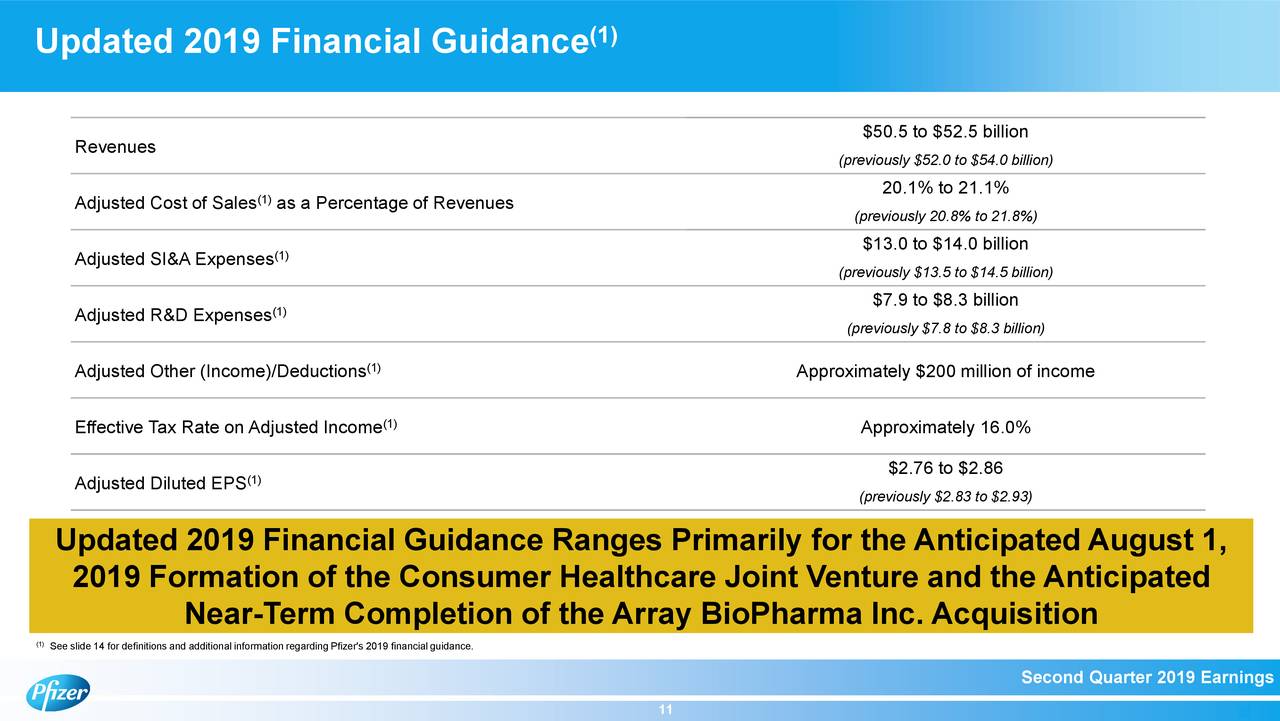

Though the company has slightly reduced its full-year outlook, Pfizer stock price looks undervalued based on valuations.

Its shares are trading around 12 times to earnings and 3 times to sales. The stock could remain under pressure in the short-term. However, long-term prospects are strong amid its presence in both developed and emerging markets.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account