Shares of fitness equipment maker Peloton were trading over 11% higher in pre markets on Friday after posting better than expected earnings in the fiscal fourth quarter. Bank of America (BofA) sees more upside in the stock even as it has more than tripled this year.

Peloton released its fiscal fourth quarter 2020 results after markets on Thursday and reported a 172% increase in revenues to $607.1mn. Analysts polled by Refinitiv were expecting revenues at $582.5mn. Peloton’s gross margins also expanded to 47.6% in the quarter.

Pelton’s earnings shatter estimates

The company’s earnings per share of 27 cents also shattered analysts’ estimate of 10 cents. Peloton had posted a loss per share of $2.07 in the fourth quarter of fiscal 2019. While the pandemic has hit many industries due to the stay at home orders, it lifted demand for Peloton products as more people preferred to work out at home.

“The strong tailwind we experienced in March as the COVID-19 pandemic took hold has continued to propel the demand for our products into the fourth quarter and the first couple months of the Q1 fiscal year 2021,” said John Foley, Peloton’s CEO during the company’s earnings call

Peloton’s revenues in the fiscal year 2020 were 24% above the guidance the company had provided after its IPO last year.

At the end of fiscal 2020, Peloton had 1.09 million connected fitness subscribers, up 113% year over year. These connected fitness subscribers pay $39 per month to sync their Peloton equipment with workout classes.

Peloton expects strong growth in the coming years

In its earnings release, Peloton termed the fiscal year 2020 “a transformative year for Peloton.” It ended the fiscal year with $1.8bn in cash and cash equivalents and another $250mn in undrawn revolving credit facility. The company would need to grow its supply to meet customer demand “for years and years,” according to Foley.

New products could take Peloton shares higher

On Tuesday, Peloton announced two new products, a high-priced Bike variant called Bike+ and a lower-priced tread. “It has long been our goal to democratize access to fitness and lowering the price of our bike, along with the introduction of our lower-priced Peloton Tread, are important steps in achieving this goal,” said Foley during the earnings call.

Peloton’s guidance was also better than expected

If Peloton’s fiscal fourth quarter 2020 were better than expected, its guidance for fiscal 2021 also shattered Wall Street estimates. The company expects its sales in the fiscal year 2021 to be between $3.5bn and $3.65bn. At the midpoint of the guidance, it would mean a 96% year over year rise in the company’s revenues. The guidance was way ahead of the $2.7bn that analysts surveyed by Refinitiv were expecting.

It expects its gross profit margin at 41% in fiscal 2021, that’s lower than what it posted in the fiscal fourth quarter of 2020. The company expects to post adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) between $200-$275mn in fiscal 2021, which at the midpoint would represent an EBITDA margin of 6.6%.

The company pointed to strong order backlogs and said that it entered fiscal 2021 with a $230mn backlog in Bike deliveries. “While we have significantly increased our production capacity in recent months and continue to grow our manufacturing capabilities, we do not expect to return to normalized order-to-delivery windows in the United States prior to the end of Q2 FY 2021,” said the company in its release.

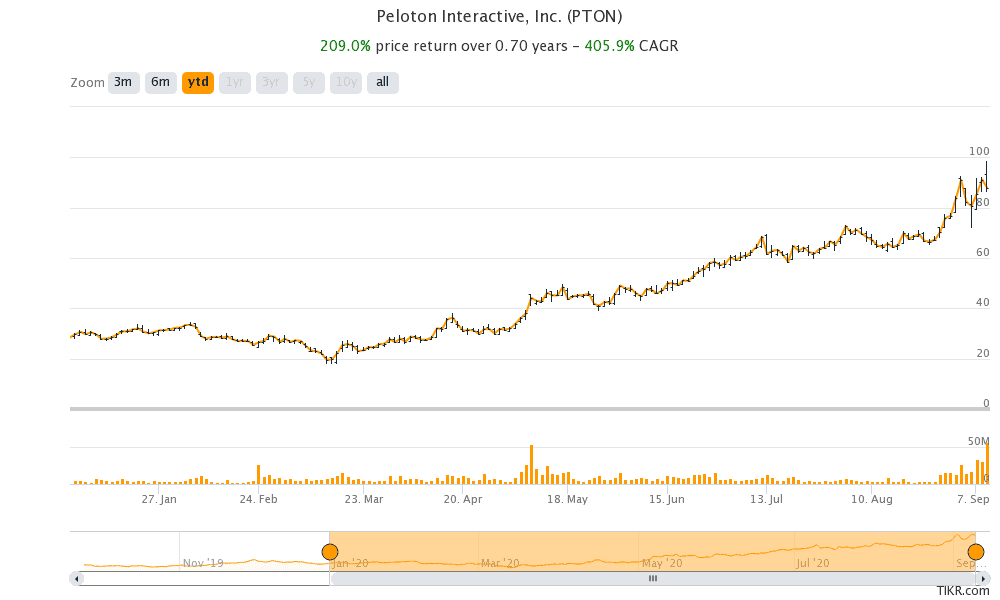

Peloton shares have gained almost 210% this year and some brokerages see even more upside for the stock. On Tuesday, Bank of America analysts raised Peloton’s target price from $72 to $101, a premium of 15% over Thursday’s closing prices.

Analysts see more upside in Peloton shares

While Bank of America analysts pointed to elevated valuations, they said “elevated health concerns and new product launches could drive strong holiday demand and continued upside to street expectations.”

Last week, JMP Securities analyst Ron Josey had also raised Peloton’s target price from $59 to $109 with an outperform rating.

While valuations for tech and growth companies could be getting stretched, Peloton’s strong earnings have shown that investors are paying a valuation premium for a reason. Some of the tech stocks like Zoom and Amazon have also continued to surge even as many analysts see them overvalued.

We’ve compiled a guide on how you can buy Peloton stock. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account