PayPal (NYSE: PYPL) stock price has lost more than 9% of value in the last month alone after hitting an all-time high of $120 a share. Lower than expected financial numbers for the second quarter along with meeker outlook negatively impacted the stock price.

Before the latest selloff, the PayPal stock price has gained 35% of value since the beginning of this year. The sharp rally in PayPal stock price has increased its valuations compared to the industry average.

The stock looks expensive based on price to sales ratio of 8 and price to earnings ratio of 52, when compared to with industry average of 2 and 20 times, respectively. PYPL stock price also appears expensive based on price to book ratio of 8 relative to the industry average of 3 times.

Lower than expected financial numbers could also halt its share price performance. Although its Q2 revenue of $4.3 billion grew 12% year over year, its revenue missed consensus estimate by $28 million.

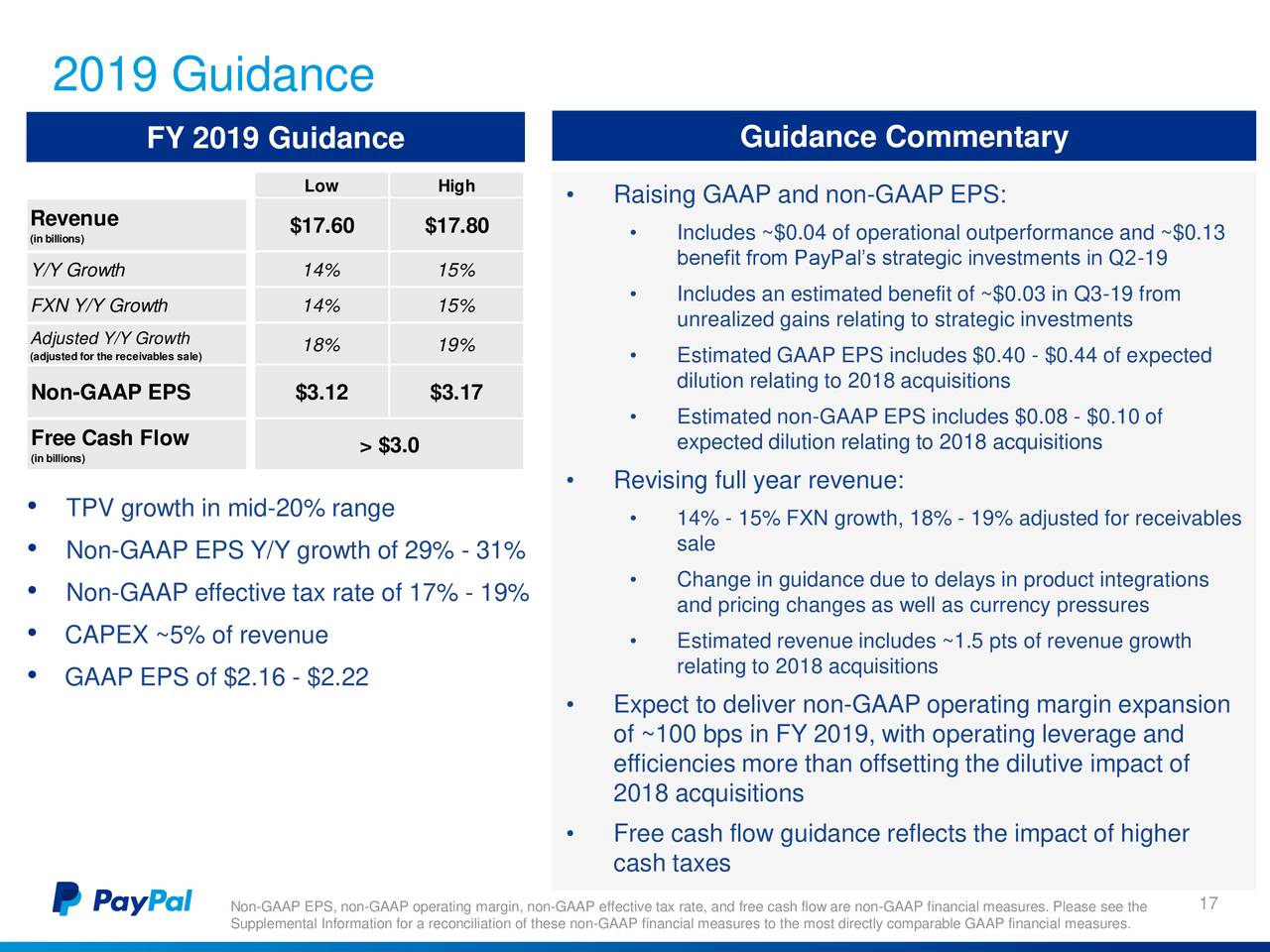

Moreover, the company has reduced its financial guidance for the third quarter and a full year. They now expect Q3 revenue to stand in the range of $4.33B, falling short of the $4.45B consensus. Investors blame forex pressures and delays in products integrations along with pricing changes for lower revenue outlook.

On the positive side, its earnings guidance remains robust. The company has boosted adjusted EPS outlook to $3.17 from previous guidance of $3.01; the analysts’ consensus estimate stands around $3.12.

BTIG analyst Mark Palmer says PayPal’s Q3 included “much to encourage the stock’s proponents,” but expectations had been high given the stock’s YTD climb.

Moreover, the growth in customer engagement, active accounts, and FXN merchant services remain strong. Despite some positive factors, the PayPal stock price has not been receiving support from technical factors. Its valuations are significantly higher from the industry average – which indicates that the stock is overvalued based on current financial numbers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account