PayPal (NASDAQ: PYPL) stock price has been under pressure over the past couple of months; the stock is trading in a narrow range of $100 to $110. The underperformance in the last few months is blamed on increasing market competition.

In addition, lofty valuations are also hurting PayPal stock price performance. Investors are waiting for a further decline in share price for correction in valuations.

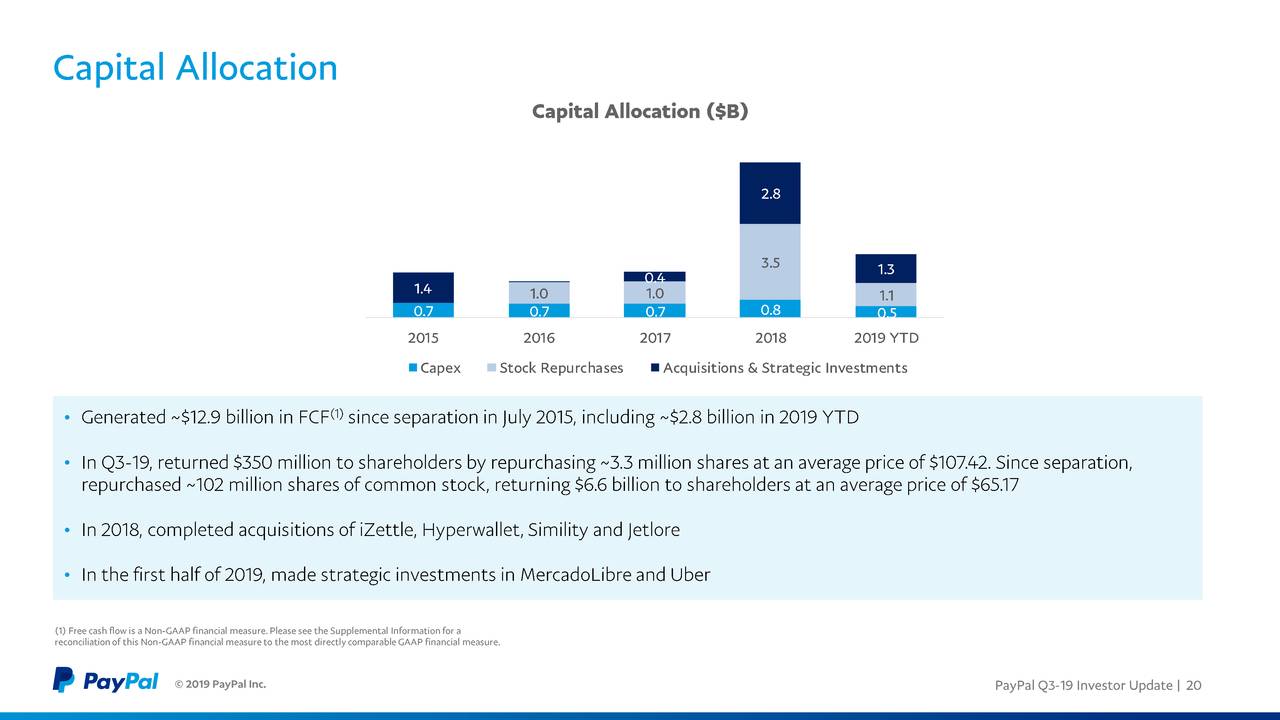

On the positive side, the company appears in a position to support valuations through financial growth. It generated robust revenue and earnings growth in the previous quarter; the digital payment company has also increased its guidance for the full year. Moreover, the company’s cash generation potential is permitting it to make several acquisitions to boost revenues.

Financial Numbers are Strong

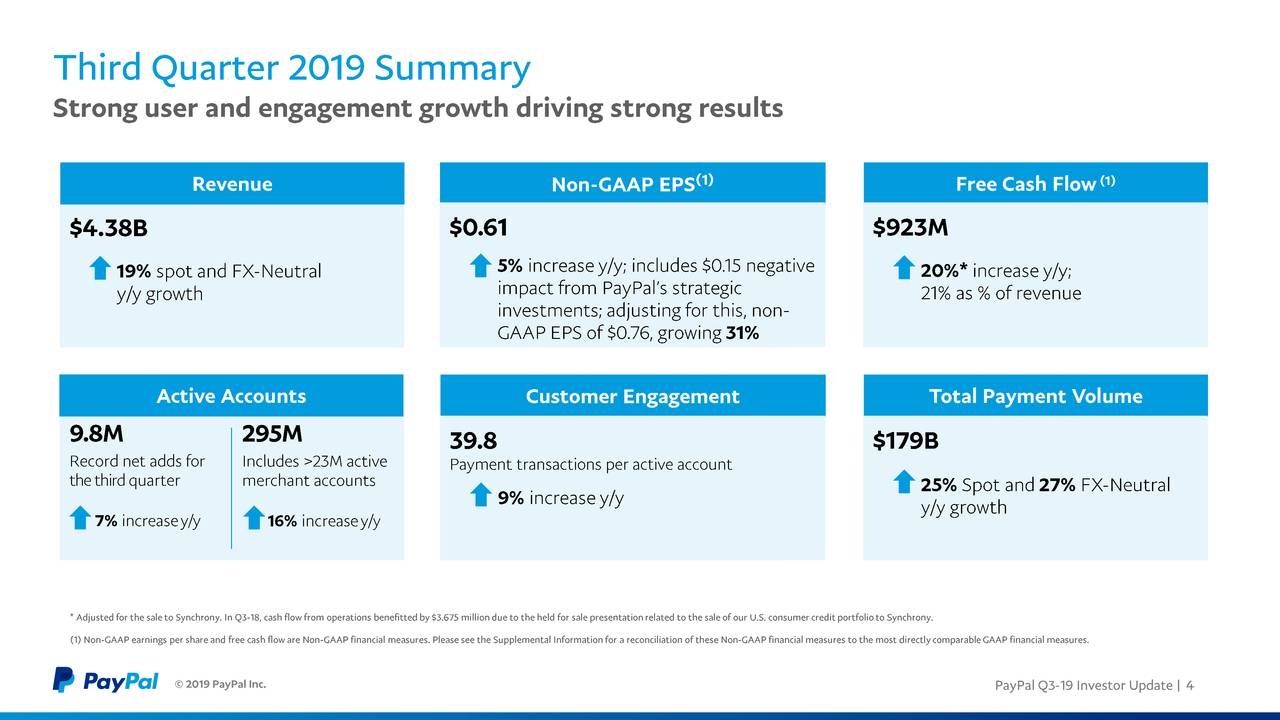

PayPal has generated third-quarter revenue of $4.38 billion, up 19% from the previous year period. The digital payment company experienced a considerable increase in margins. Its adjusted earnings per share grew 48% from the previous year period.

It added 9.8 million net new active accounts in the latest quarter. The total active accounts stood around 295 million, representing a growth of 16% year over year.

The company is actively working on expanding its presence in international markets. The CEO said, “This quarter we also announced that we will be the first foreign payments platform to be licensed to provide online payment services in China, a very significant development that has the potential to meaningfully expand our addressable market.”

It is On Hunt for Acquisitions

The company plans to make $1 to $3 billion in acquisitions each year to boost its market share and revenues. It seeks $1B-$3B of transactions in 2020. The CEO said, “There’s a lot of opportunities to acquire companies inorganically.”

PayPal closed a 70% equity stake in GoPay Information in China last week. It also announced to acquire Honey Science for $4B. It appears that PayPal stock price is likely to receive support from growth strategies despite the trader’s concerns over lofty valuations.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account