Digital payments giant Paypal may face a pullback, as its stock has risen too high and too fast, according to an analyst.

Matt Maley, from trading firm Miller Tabak, said Paypal shares, currently trading at $192.5, may have overreacted to the firm’s recent quarterly earnings report, during an interview with CNBC’s Trading Nation. The report showed that Paypal, led by chief executive Dan Schulman (pictured), made an 80% jump in profitability as a result of higher digital payments volumes amid pandemic lockdowns.

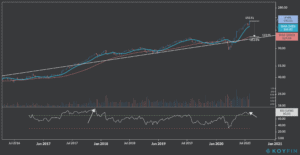

The analyst pointed that the weekly relative strength index (RSI), which is a technical indicator of how price action has fluctuated compared to historical patterns, is showing an overbought situation currently at 80, ten points above the higher threshold of 70 used to identify when the market is getting ahead of itself.

Why is this important?

Maley highlighted that this is the second time in Paypal’s history that the stock has traded at those weekly RSI levels, with the last time being late 2017, after which the stock saw a 6% pullback during the next five to six months.

“We have to remember that stocks, even stocks of the best companies, can get way ahead of themselves sometimes. I mean, let’s face it, look what Amazon has done over the past 20 years — it’s changed the world — but it’s had many, many big declines after it got too far”, said Maley.

Wednesday’s positive earnings report sent the stock up roughly 9%, as investors piled into the stock, even as they went 35% above their 200-day moving average. Over the long term, stocks tend to revert to their long-term mean, which could be another factor weighing on Paypal shares in the next few weeks when investors’ sentiment cools off.

How can investors hedge in case of a pullback?

Maley said if Paypal does weaken after this buying frenzy, the stock of other payment processing companies such as Visa may start to shine and, therefore, investors could effectively hedge their Paypal position by taking on some shares of its rivals in anticipation of this shift.

“Visa is still a great company. It may not have the long-term potential that PayPal has, but if it can break above $200 and break above the sideways range it has been in for a while, it’s going to be a better performer”, said Maley.

Visa, currently trading at $194 per share, seems to be caught on a falling wedge, a technical pattern that could lead to a break above the upper trend line, even though it still needs some positive momentum in its favor that leads to a push above this line.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account