Prices of gold and bitcoin have surged this year as small investors buy alternative assets amid the chaos of the pandemic, but these choices reveal a generational divide.

This year is among the most turbulent year for investors. US stock markets fell sharply between February and March. However, they recovered from their lows and have closed in the green every month since then and the Nasdaq 100 Index is now up almost 27% for the year.

Amid the market turmoil investors have searched for alternative assets as stores of value.

JP Morgan analysts said that older investors still prefer gold, while the millennials prefer cryptocurrencies like bitcoin. “The two cohorts show divergence in their preference for ‘alternate currencies,” said JP Morgan analysts. They added: “The older cohorts prefer gold while the younger cohorts prefer bitcoin.”

Bitcoin: Millennials’ new gold

Bitcoin is up almost 64% this year. It has rallied 3.5% this month while the S&P 500 has risen 2.7%. Like equity markets, bitcoin also tumbled in March amid global risk-off sentiments.

Generally, stock markets and alternate assets have a negative correlation. However, over the last four months, we have seen a rally in alternate assets like gold and bitcoin as well. The correlation between bitcoin and traditional asset classes like equities has risen this year.

“Simultaneous flow support has caused a change in the correlation pattern between bitcoin and other asset classes, with a more positive correlation between bitcoin and gold but also between bitcoin and the dollar as US millennials see bitcoin as an ‘alternative’ to the dollar,” a team of JP Morgan analysts led by Nikolaos Panigirtzoglou said in a note.

Gold prices are also up

Gold prices have also risen this year, topping the $2,000 per ounce level and making a new all-time high. The yellow metal has gained 36% over the last year.

Inflows into gold ETFs have surged to record highs as old investors have preferred gold amid the volatility in equity markets. Frank Holmes, chief executive at investment firm US Global Investors expects gold prices to rise to $4,000 per ounce.

Apart from gold, older investors have put money into bond funds. JP Morgan analysts pointed that in June and July, older investors poured their excess liquidity into bond funds.

They, however, said, “younger cohorts of US retail investors show little interest in bond funds.” According to JP Morgan analysts, young US investors have also avoided equity funds. Instead, “preferring to invest in equities directly by buying individual stocks, especially tech stocks.”

Tech stocks

Millennials buying into tech stocks has lifted the valuation of US tech stocks to astronomical levels. The opinion is very divided on the valuation for US tech stocks. Tesla is a perfect example here. Millennials see it as a tech company while many older investors see it as an automotive company.

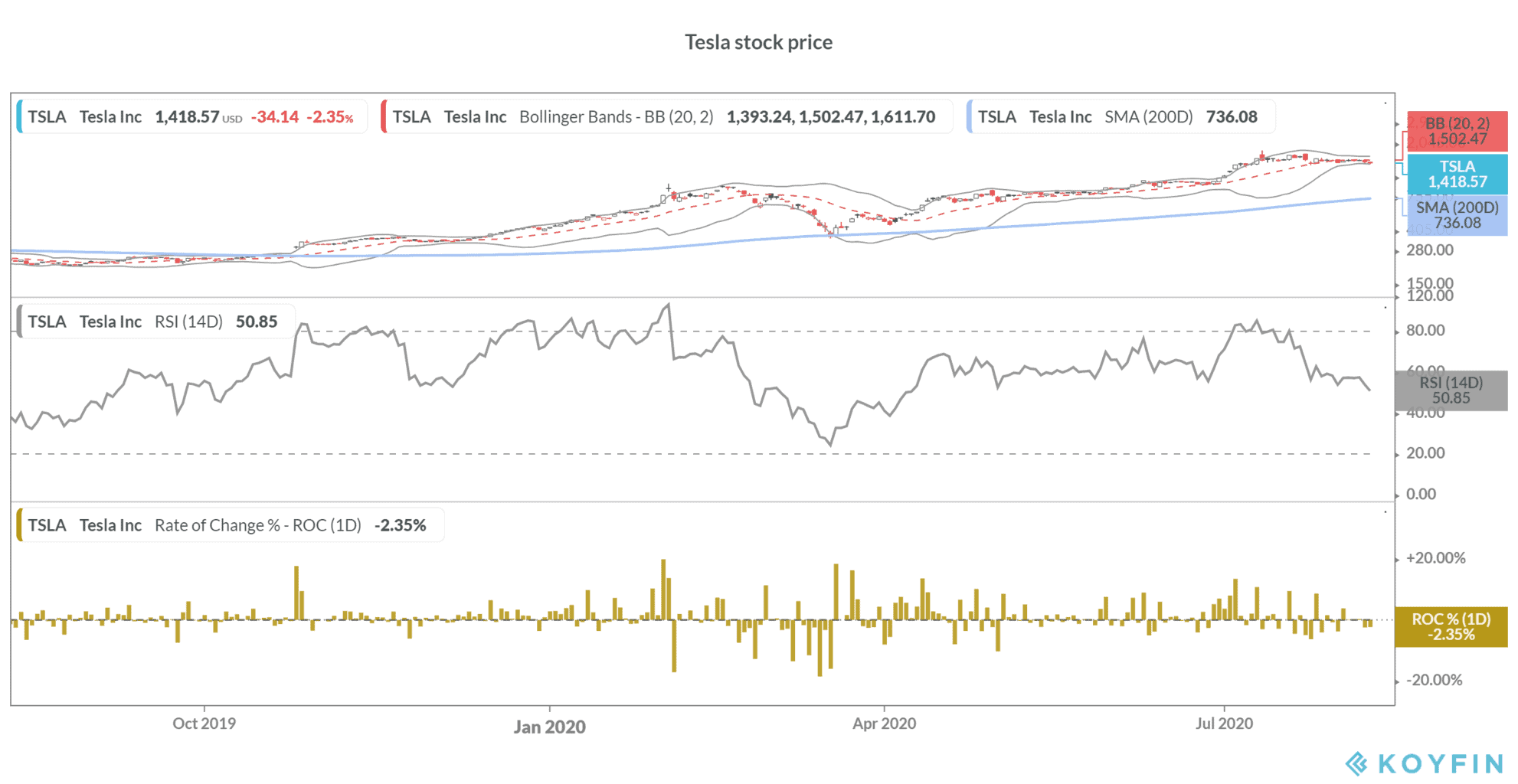

Tesla stock has rallied 239% for the year and is currently quoted at $1,418 per share. Tesla’s market capitalization soared above $300 billion last month, commanding a valuation more than Toyota Motors that sold almost 30 times more vehicles last year.

Ashwath Damodaran, popularly known as the ‘Dean of Valuation’ said in an interview, that to justify its valuation Tesla would need to make revenues similar to Volkswagen with margins like Apple and make investments in manufacturing “like no other manufacturing company has before.”

However, millennials have a different yardstick for Tesla and so far, they seem to be winning the battle as is visible in the stock’s price action.

You can buy trade in Tesla through any of the best online stockbrokers. Alternatively, you can trade in cryptocurrencies like bitcoin through any of the reputed brokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account