Oil prices slid amid fears that early signs of a recovery in fuel demand will be snuffed out by fresh coronavirus spikes around the world.

US West Texas Intermediate (WTI) crude futures fell 42 cents, or 1% to $40.59 a barrel on Tuesday morning, while Brent crude futures fell 46 cents, or 1% to $43.69 a barrel as demand slows. Brent crude sold for $70 a barrel in January.

States across America are seeing new outbreaks of the disease, ranging from California, Texas and Ohio. White House coronavirus task force leader Dr Deborah Birx said the nation was entering a new phase with “extraordinarily widespread” cases on Sunday, although a day later President Donald Trump labelled her remarks “pathetic.”

Around the world from Manila and Melbourne to towns and cities in Germany and the UK, tighter restrictions have been imposed to battle a fresh rise in infections.

Oil demand falls

The scale of the dampening of demand since the start of the year was highlighted by UK oil major BP, which posted a record $6.7bn second-quarter loss on Tuesday, adding that outlook for oil prices and demand “remains challenging and uncertain”.

BP also cut its dividend in half for the first time since the Deepwater Horizon disaster in 2010. Its shareholder payout was 5.25 cents, compared to 10.50 cents in the first quarter.

The group, led by chief executive Bernard Looney (pictured), who started in his role in February, warned that the pandemic could weigh on the global economy for a “sustained period”.

Hargreaves Lansdown analyst Nicholas Hyett said: “The collapse in oil prices has hit BP’s profits hard. The oil major now expects oil prices to hover between $50 and $60 a barrel for the next 30 years, and that’s meant massive writedowns in the value of the group’s oilfields.”

Hyett added: “The focus is now on getting the most out of its remaining oil fields while investing in a low carbon future. Given the somewhat precarious state of the balance sheet that’s likely to mean significant asset sales in the years to come and reductions in exploration and development budgets.”

BP pledges to cut output

BP shares lifted 8% on Tuesday morning in London to 301p, investors liked that it had cut debt by $10.5bn to stand at $40.9bn.

The oil major added over the next decade it plans to boost its annual low carbon investment 10-fold, to around $5bn a year, boost renewable power generation to 50 gigawatts, while shrinking its oil and gas production by 40% compared with 2019.

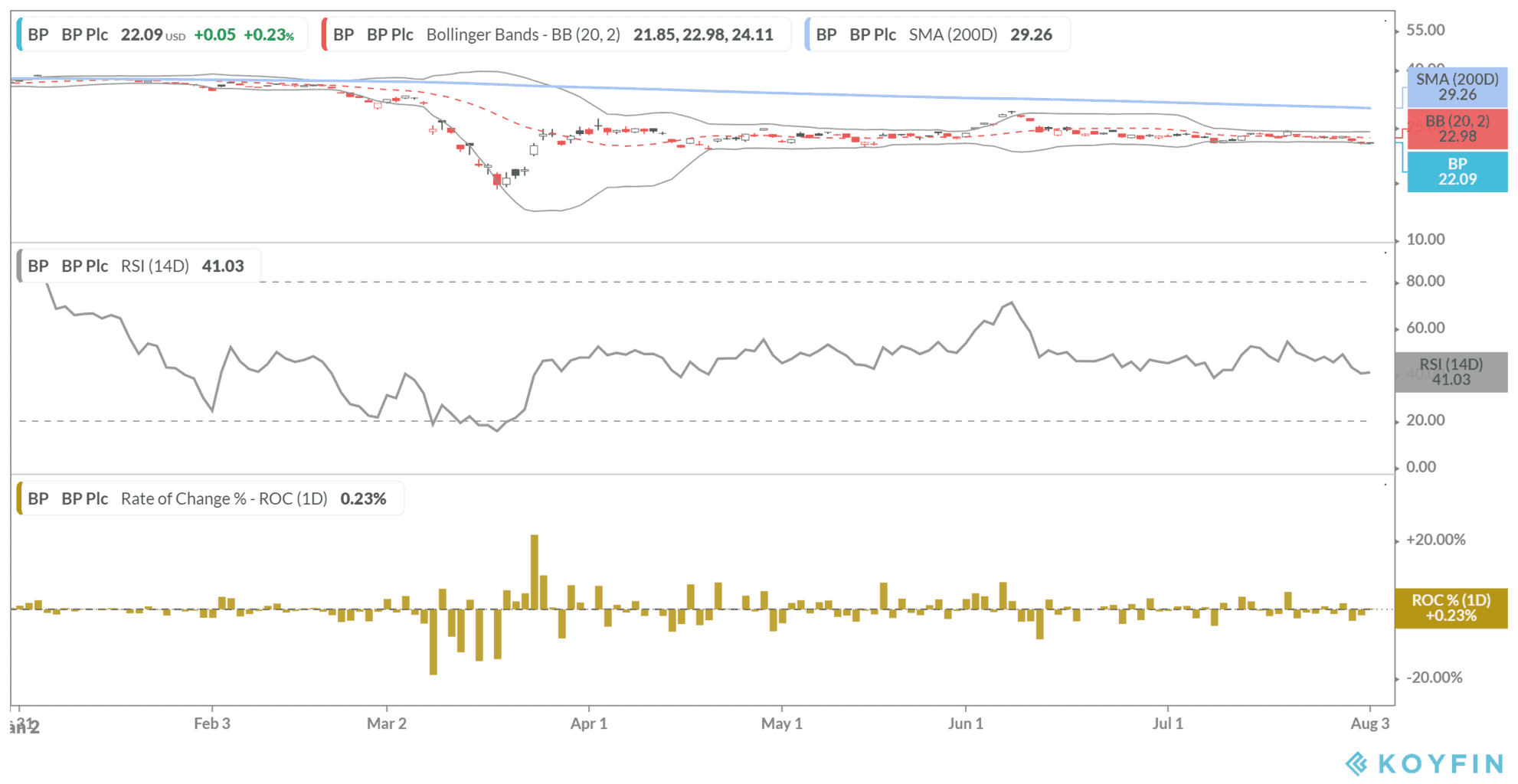

However, the low demand for oil in 2020 has seen its share price tumble 38% this year.

In a further sign of a patchy rebound in demand, American oil stockpiles are expected to rise this week when the US government releases an update on Wednesday.

US inventories of gasoline are set to rise by 600,000 barrels, according to an estimated of five analysts polled by Reuters. Distillate stockpiles, which include diesel and heating oil, are likely to have grown by 800,000 barrels, while crude stocks fell by 3.3 million barrels in the week to 31 July.

You can check out a list of recommended stock brokers if you want to invest in stocks.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account