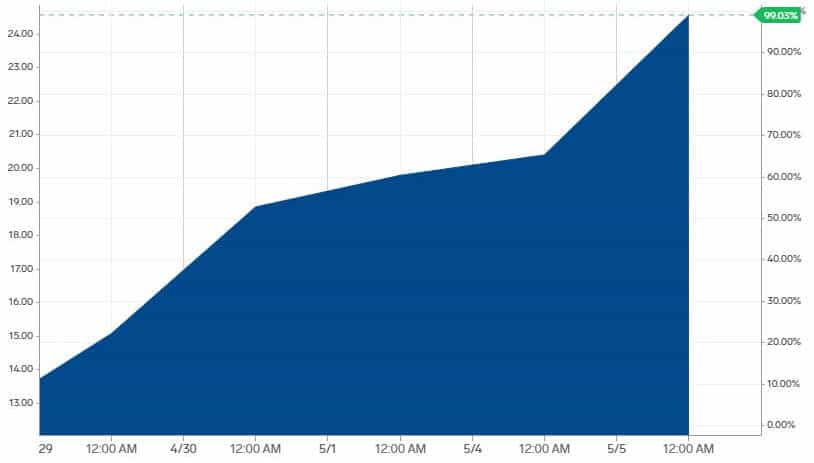

Oil prices, that last month fell below zero, have rebounded over the past five days on prospects of growing demand after months of lockdowns as several countries, from China to parts of the US, begin to ease restrictions.

Opec’s strategy of slashing 9.7 million barrels of oil production along with lower capital spending from US oil producers has helped boost investor sentiment.

Brent crude oil, the international benchmark, surged to $31 a barrel, almost double from 21-year low it had hit last month. West Texas Intermediate crude futures soared to $25 level after plunging as low as -$42 last month.

“The reopening of economies has injected a degree of cautious optimism back into an oil market that plunged to historic lows only weeks ago,” RBC analyst Michael Tran said in a client note.

The oil trading rebound reflects investor optimism over the improving demand as several countries including Spain, Italy, the US, Nigeria, India, and the largest oil consumer China started permitting people to go back to their jobs.

Meanwhile, announcements of a massive drop in capital spending from US oil players hinted lower production levels this year.

Price pressure has forced ConocoPhillips (NYSE: COP), Occidental Petroleum (NYSE: OXY), and several other US players to slash spending by around 30% from the previous estimates, a move that will add to Opec’s 9.7 million barrels a day production cut.

Big oil majors like Exxon (NYSE: XOM), Chevron (NYSE: CVX), and BP (NYSE: BP) have also announced billions of dollars of cuts in 2020 spending.

But a supply glut is likely to persist over the coming months as demand will take time to return to 2019 levels. “We’re talking about normalization of supply and demand but we’ve got a long way to go,” said Lachlan Shaw, National Australia Bank’s head of commodity strategy.

If you plan to trade commodities, you can check out of featured commodity brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account