Netflix (NASDAQ: NFLX) stock price has been struggling to generate sustainable growth amid trader’s concerns over increasing market competition. The impact of market competition has started impacting NFLX subscriber growth and financial numbers.

The streaming company missed fourth-quarter subs growth by a wide margin. Traders are blaming the entry of Disney and Apple in the streaming market for lower than expected growth in U.S. subscribers.

Netflix stock is trading around $338 at present. Although NFLX share price bounced in the past couple of months, the market analysts are seeing limited upside ahead. This is because of market competition from several new players.

Netflix Stock Plunged after Subscriber Growth Miss

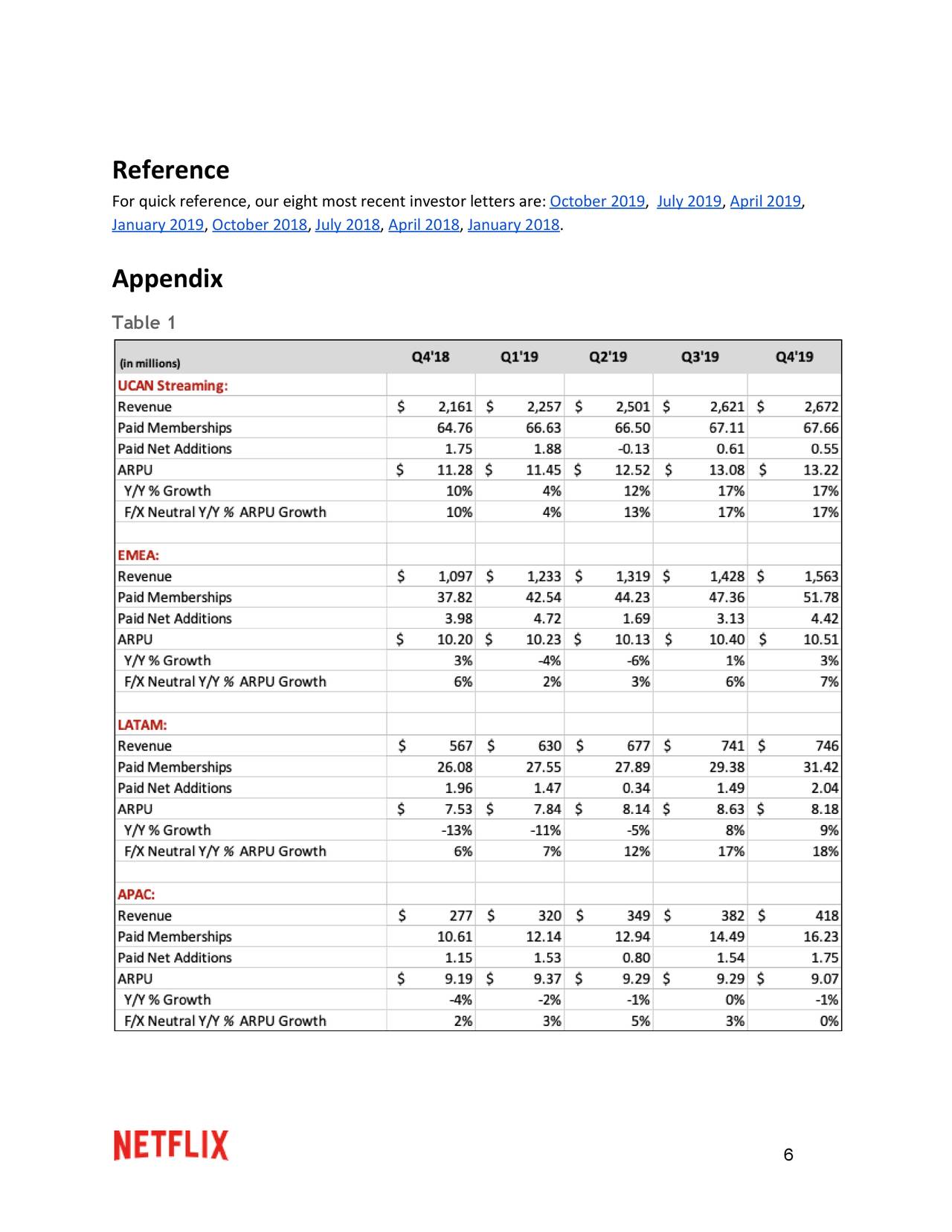

Its Q4 U.S. and Canada streaming additions stood around 550K, down from the consensus estimate of 611K and guidance for 589K. The U.S. net adds came in at 420K in the final quarter.

On the positive side, the company generated robust growth in International streaming additions during the fourth quarter. The International streaming additions jumped 8.33M in Q4 compared to guidance for 7.0 million. In addition, its Q4 U.S. streaming margin rose to 39.3% while the international margin was standing around 17.1%.

Greenlight Capital looks bearish about Netflix’s future growth potential. The firm said, “We believe this narrative is finally coming to an end. NFLX is no longer the only value-priced streaming VOD provider. There are now a half-dozen subscription services and in the coming year there will be additional credible entrants with deep content libraries.”

Financial Numbers are Still Improving

The company has been generating robust financial growth over the years. Its fourth-quarter revenue grew 27% from the year-ago period. Moreover, it expects revenue growth in the range of 26% for the first quarter of 2020. NFLX has also generated a huge increase in earnings. Its full-year operating income surged by 62% year over year to $2.6 billion. On the negative side, the company provided lower than expected subscriber additions for 2020.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account