Netflix (NASDAQ: NFLX) stock price started recovering the losses that it had made during past couple of months. Some bullish reports are helping in healing the sentiments. The threat of increasing competition already priced into the stock. Investors believe NFLX shares bottomed around $250 few months ago.

The shares regained momentum in the last two months. The stock price is currently trading slightly above $300 mark.

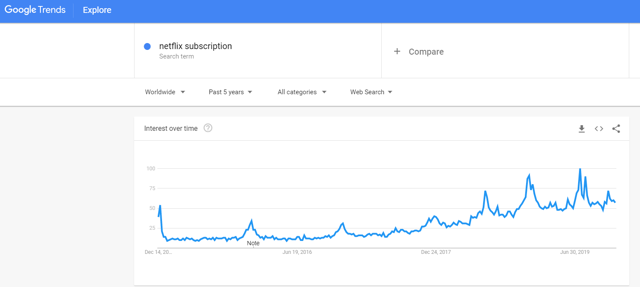

The impact of competition is not visible yet. Google trends and several other factors indicate a sustainable traffic for the streaming company. In addition, the company has been experiencing a boom in Asia-Pacific region.

Bullish Indicators Could Accelerate Netflix Stock Price

The internet data and Apptopia reports are showing positive trend for Netflix. Moreover, Google also suggests that subscription growth remains strong for Netflix. According to Apptopia’s report, NFLX app downloads remain steady despite a massive success of Disney in the streaming business. Google searches increased for Netflix during the past month.

On the other hand, the streaming company has been experiencing a significant growth from Asia-Pacific region. The reports are suggesting that NFLX Asia-Pacific business soared 153% in the last two years and membership jumped 148%.

The company is planning to enhance its advertising campaigns in Asia to capitalize on demand. Asia Pacific could turn out to be the second largest revenue contributing region for NFLX.

The company is witnessing strong demand from India, which is one of the largest markets for entertainment companies. Consequently, Netflix is testing heavily discounted multi-month subscriptions in India.

The Big Share Price Rally Is Unlikely

Although the prospects for steady share price gains are bright, the substantial upside momentum is unlikely in the short-term. This is due to the sluggish growth in revenue and subscriber growth compared to the previous years. The stock is also trading at higher valuations compared to the industry average; the shares are trading around 90 times to earnings.

Click here to learn more about stock brokers and stock trading.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account