Netflix (NASDAQ: NFLX) stock price surged sharply after reporting substantial growth in revenue and earnings. The strong financial growth has helped in mitigating the impact of lower than expected growth in subscribers.

Netflix stock price currently trades around $286, down significantly from a 52-weeks high of $380 a share.

The pressure on its share price in the past couple of months was due to traders’ concerns over increasing market competition from Apple (NASDAQ: AAPL) and Disney (NYSE: DIS). NFLX management, however, appears less worried about streaming services from new players.

Strong Results Supports Netflix Stock Price

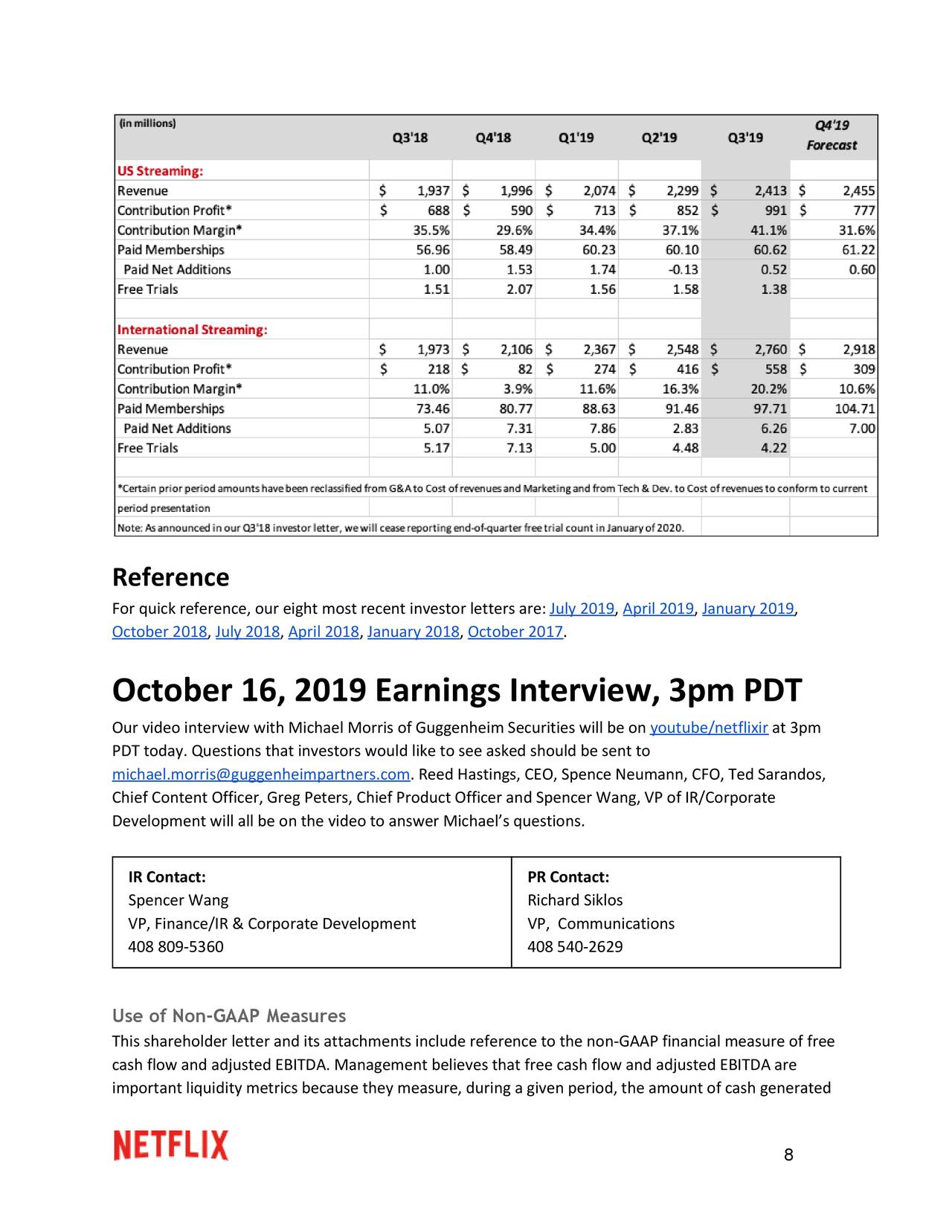

The company generated third-quarter revenue of $5.25 billion. This represents a growth of 31% from the past year period.

Its revenue grew 35% excluding the negative impact of currency conversions. The revenue growth is driven by 22% growth in average streaming paid memberships and a 9% increase in ARPU year over year.

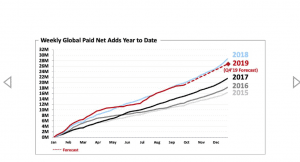

On the negative side, the company missed subscriber growth targets. Its global streaming paid net adds stood around 6.77M compared to the forecast of 7M subs.

The company believes they are on the right path for diversity, revenue growth, customer engagement, and profitability.

On top, its earnings doubled compared to the earlier year period, thanks to growth in operating margin.

The operating margin grew to 18% from 12% in the year-ago period. Netflix earnings per share stood around $1.47 in the third quarter, up significantly from $0.89 in the same period last year.

The Company Sees Low Competition from Apple and Disney

Netflix stock price plunged sharply amid traders’ concerns over upcoming competition from Apple and Disney.

Fortunately, NFLX management doesn’t give much importance to streaming launches from two new players. The CEO said, “Many are focused on the ‘streaming wars,’ but we’ve been competing with streamers (Amazon, YouTube, Hulu) as well as a linear TV for over a decade.”

Overall, positive financial results would support the NFLX share price in the coming days. The company expects to generate similar results in the final quarter. Some analysts say lower subscriber growth could hinder the upside momentum.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account