Netflix (NASDAQ: NFLX) stock is set for growth say some Wall Street analysts as the firm adds subscribers amid stay-at-home policies around the world, which could also see the world’s largest streaming service to hike prices in the coming next year.

Its leading position in streaming video with a library of thousands of programs, ranging from Queer Eye to Orange is the New Black (pictured), offers it an edge over new entrants like Disney Plus (NYSE: DIS) and Apple Plus (NASDAQ: AAPL). Its global net subscriber additions could rise to 9.9 million in the first quarter of the year, according to Cowen analyst John Blackledge. The company, which reports its results next week, has previously said it would add around 7 million paid subscribers in the period.

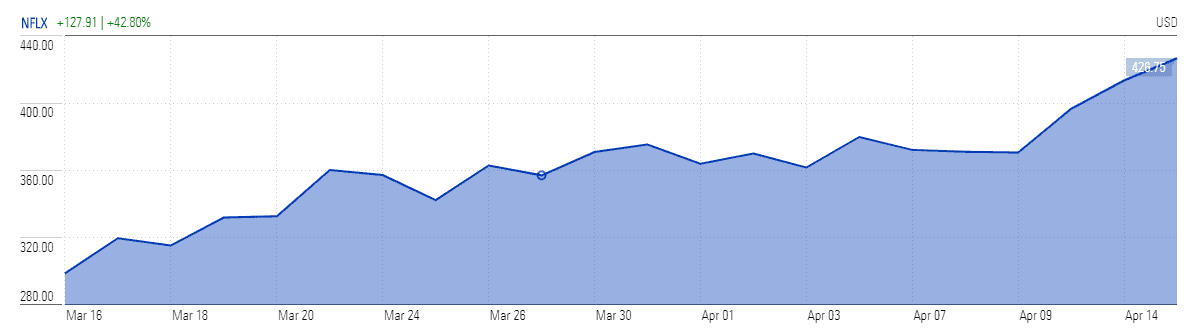

While the share price of the company rallied 42% in the last month alone, it hit an all-time high of $426 on Wednesday. Some Wall Street analysts expect Netflix stock to edge close to $500.

Brokers at Bernstein give a target of $487 with a buy rating. They said: “The increased engagement and appreciation from users this year could make it that much easier for Netflix to successfully pass through pricing increases in 2021.”

Expectations for robust first-quarter results, on 21 April, have added to investor’s optimism as subscriber additions are key for its revenue and earnings growth potential.

During the fourth-quarter earnings call, management guided that its first-quarter revenue to lift by 17% year-on-year to $5.73bn. The outlook for net income is around $750m with a near-record operating margin of 18%. The expectations are also high for the rest of the year as analysts expect the benefit of higher subscriber growth to follow through into subsequent quarters.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account