On Monday, Netflix, Inc. reported impressive results for the second quarter, adding 5.2 million new subscribers versus 3.2 million expected by Wall Street analysts. Netflix’s shares rose more than 10% in after-hours trading on Monday, reaching an all-time high of over $178 per share. The video streaming giant reported $2.8 billion in revenue and a profit of 15 cents per share, topping analysts’ estimate of $2.76 billion in revenue and 16 cents earnings per share.

Along with the second quarter report, in an interesting move, Netflix released a new document, titled ‘Overview of Content Accounting,’ to investors to disclose information regarding its content accounting practice.

Heavy Cash Spending on Content

Netflix is betting big on original programming in a bid to attract and retain customers as the video streaming space becomes more competitive.

But the program is the video streaming service has been burning a huge amount of cash to keep creating new shows.

During the second quarter, Netflix spent over $608 million in cash on content, significantly up from $254 million in the same period a year ago. The company is expected to burn $2.0 billion to $2.5 billion in cash on programing in the full year 2017.

Netflix, Inc. intends to use debt to finance its content spending. The company completed a $1.4-billion bond offering in April.

“With our content strategy paying off in strong member, revenue, and profit growth, we think it’s wise to continue to invest,” the company said in a letter to investors.

“In continued success, we will deploy increased capital in content, particularly in owned originals, and, as we have said before, we expect to be FCF negative for many years. Since our FCF is driven by our content investment, particularly in self-produced originals, we wanted to provide some additional context on our content accounting at our investor relations website,” according to the letter.

Netflix Streaming Content Accounting

Netflix’s video library includes three type of content: originals (self-produced and licensed) and 2nd run titles licensed from ABC, Disney and others.

In its presentation, the video streaming service disclosed that it uses two accounting standards for its streaming content costs. It applies the guidance of ASC 920: Entertainment – Broadcasting and ASC 926: Entertainment – Films.

ASC 920 states that a broadcaster will account for a license agreement for program material as a purchase of rights.

Under ASC 920, the following three criteria must be met in order for the content Netflix licenses to qualify for asset recognition: (i) the cost of each title is known or reasonably determinable; (ii) the title (source file) has been received; and (iii) the title’s available for first showing, according to the presentation.

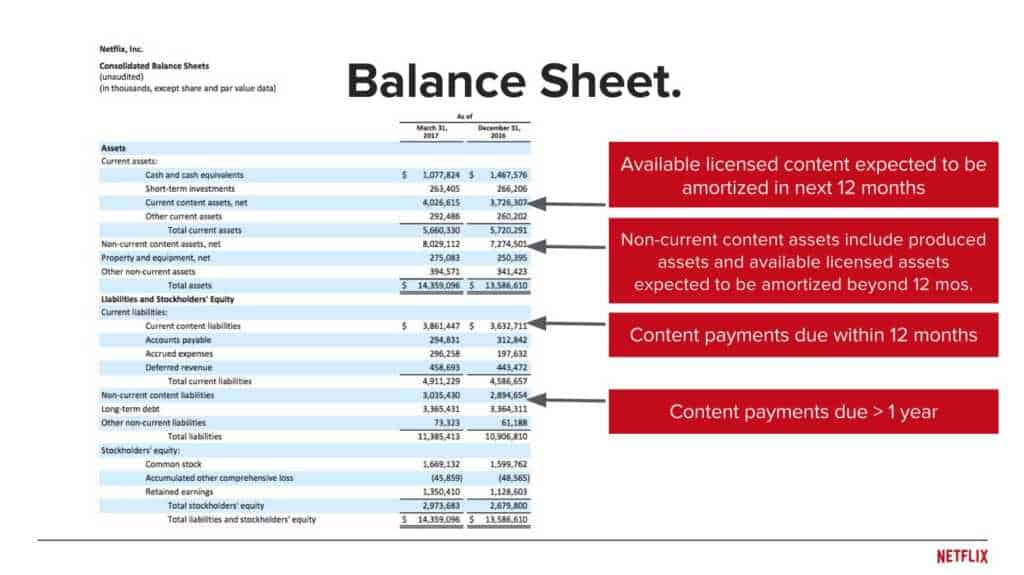

Netflix said in the presentation that it uses ASC 926 for outside produced assets. For the self-produced content, the company capitalizes the costs associated with production, including development cost direct costs and production overhead. These amounts are included in “non-current content library, net” in the company’s balance sheet, according to the company.

The presentation, which can be downloaded from the company’s Investor Relation page, includes many annotated statements, including this balance sheet:

Netflix to Reinvigorate Film Business

Meanwhile, in the letter to investors, Netflix, Inc. said that it wants to reinvent the film business like it did the TV business.

“We understand that our approach to films – debuting movies on Netflix first – is counter to Hollywood’s century-old windowing tradition. But just as we changed and reinvented the TV business by putting consumers first and making access to content more convenient, we believe internet TV can similarly reinvigorate the film business (as distinct from the theatrical business).”

Earlier this year, Netflix, Inc. hired veteran film producer Scott Stuber to lead the acquisition, development, and production of film properties at the streaming service.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account