Morgan Stanley (NYSE: MS) stock price rallied to the highest level in the past two years on the back of stronger than expected financial performance in 2019. MS shares are also trading close to an all-time high of $58 that it had marked two years ago. In addition, the high double-digit growth in financial numbers is offering support to cash returns.

The company currently offers a dividend yield of 2.5%; it has raised dividends in the past six years. Along with the potential dividend increase, the prospects are also strong for Morgan Stanley’s stock price upside in 2020. This is because the big bank has raised its outlook for the next two years.

Morgan Stanley Stock is Poised for Further Rally

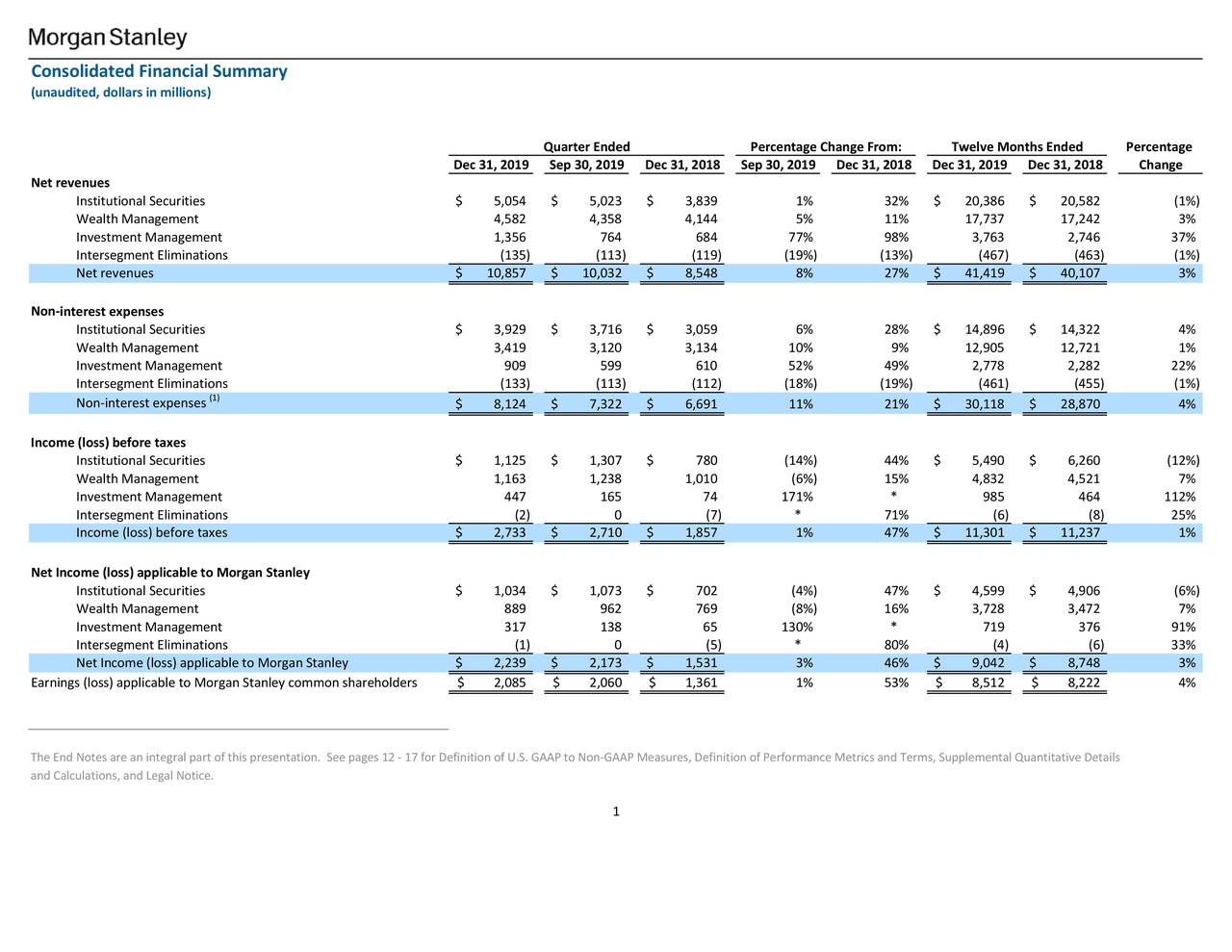

Although MS share price soared 25% in the past three months, the shares are likely to extend momentum. Its Q4 beat and better than expected outlook for 2020 is helping in strengthening investor’s sentiments. The company generated 27% year over year revenue growth in the latest quarter.

2019 was a record-breaking year for MS. It reported record full-year revenue of $41.4 billion, up from $40.1 billion a year ago. Moreover, its earnings also increased significantly from the year-ago period. The bank’s net income came in at $9.0 billion for 2019 compared to net income of $8.7 billion a year ago.

James P. Gorman, Chairman, and Chief Executive Officer said, “Firmwide revenues were over $10 billion for the fourth consecutive quarter, resulting in record full-year revenues and net income. This consistent performance met all of our stated performance targets.”

Expectations are High for 2020

MS increased the return on tangible common equity goal to 13%-15% for the next two years. This is up from the previous target of 11%-14.5%. The company plans to achieve a return on tangible common equity goal of 15%-17% in the long term. It raised a two-year target of efficiency ratio to 70%-72%. Overall, Morgan Stanley appears in a position to offer solid returns to investors in 2020.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account