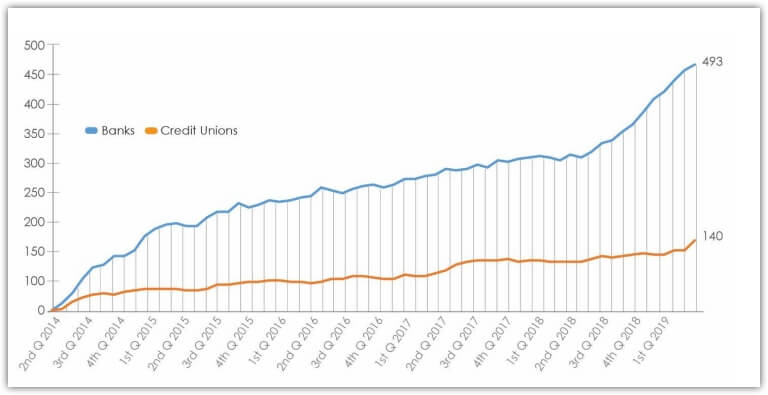

New data released by the Financial Crimes Enforcement Network (FinCEN) of the US Treasury shows that the number of banking entities providing services to cannabis firms is growing. Numbers suggest that banks and credit unions providing services to cannabis-related business has grown from 400 at the beginning of 2018 to 633 in at the end of the first quarter of 2019.

Is the data misleading?

According to Tyler Beuerlein, the picture painted by FinCEN is rosier than reality. The executive vice president for business development at Hypur said that the actual number of business being served by the industry is much lower. Hypur is a Scottsdale, Arizona-based technology provider that brings depository institutions in highly regulated industries.

Beuerlein said that FinCEN numbers are based on the Suspicious Activity Report (SAR) filings because of which their data isn’t accurate. These reports are filed when an account is suspected of being associated with a cannabis business. Sometimes, such accounts are closed. This indicates that a SAR is not the right indicator between open, transparent relationships between a cannabis company and a bank.

How to get the right numbers?

Beuerlein is also the vice chair of the Banking Access Committee of the National Cannabis Business Association. He suggests that all estimates should be based on factors that can define a clear relationship between banks and cannabis companies and shows that depository institutions actually want to serve these businesses.

The suggested that data should be based on three factors:

- The bank is offering banking services to 10 or more plant-touching cannabis-related businesses.

- The bank has marijuana-related business programs

- The bank is engaged in bringing more marijuana-related businesses to its client list.

According to his data, the number of banks and credit unions that fit this description is less than 40, a far cry from the number suggested by FinCEN. However, he notes that the number of banks and credit unions in this industry is increasing. More plant-touching marijuana businesses now have access to banking. The Pacific Northwest has the highest concentration of actively banked marijuana business. The greatest growth is in California, which is also the largest cannabis market.

Beuerlein also notes that more banks are actively working with cannabis business than credit unions. However, credit unions have a higher volume of cannabis clients. The 2019 Marijuana Business Factbook suggests that while only 76% of plant-touching businesses have banking access, about 90% of ancillary service providers get banking services.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account