The bullish trend for Microsoft (NYSE: MSFT) stock price is likely to extend the momentum. The sustainable growth in financial numbers is among the biggest catalyst for share price performance. Its share price rallied 37% since the start of this year.

Although the stock has recently hit an all-time high of $140 a share, the market pundits expect an extension of the bullish trend. Mizuho has set the Microsoft stock price target at $152 with a Buy rating. The firm believes Microsoft continues to outperform other software companies despite macro uncertainties.

KeyBanc analyst Brent Bracelin says the recent contract of $7.6B with Pentagon to provide office software shows the strength of Azure. The analyst said, “We view some of these broader government modernization plans and cloud initiatives as another growth vector for Microsoft’s commercial cloud segment.”

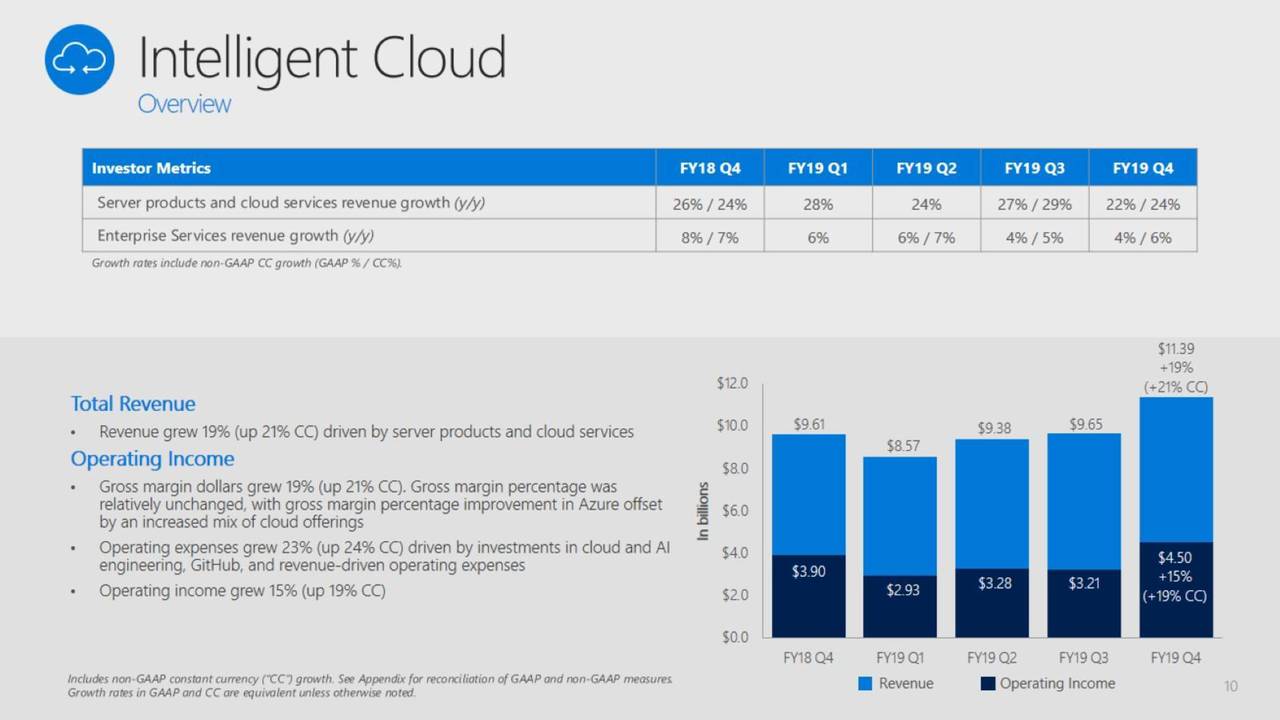

Microsoft has recently announced a rosy outlook for 2020 along with strong results for fiscal 2019. It’s fiscal 2019 record revenue of $125.8 billion rose 14% year over year. The growth is mostly attributed to Intelligent Cloud and Business Processes segments. In addition, the company’s operating income stood around $43.0 billion, up 23% from the previous year.

“It was a record fiscal year for Microsoft, a result of our deep partnerships with leading companies in every industry,” said Satya Nadella, chief executive officer of Microsoft. “The commitment to our customers’ success is resulting in larger, multi-year commercial cloud agreements and growing momentum across every layer of our technology stack.”

Microsoft returned close to $33 billion to investors during fiscal 2019 in the form of dividends and share buybacks. It currently offers a quarterly dividend of $0.46 per share, yielding around 1.32%.

Its dividend growth is safe because the company expects further acceleration in financial numbers. MSFT expects Q1 total revenue in the range of $32.4B compared to the consensus estimate for $31.99 billion. Overall, financial numbers and other key metrics are supporting the extension of the bullish trend.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account