Microsoft (NYSE: MSFT) stock price rallied 35% year to date as several catalysts are supporting the upside momentum. The stock price is currently hovering around an all-time high of $141.

Fortunately, its future fundamentals along with the strategy of offering substantial cash returns are supporting the gains.

The company has announced a dividend increase of 11% for the following four quarters. The new quarterly dividend stands at $0.51 per share.

In addition to dividend increase, MSFT has also announced a share buyback plan of $40 billion. This represents almost 4% of the total company value.

The significant share buyback plan would enhance its share price, dividends and earnings per share. The buyback plan represents that shares are undervalued in Microsoft’s view.

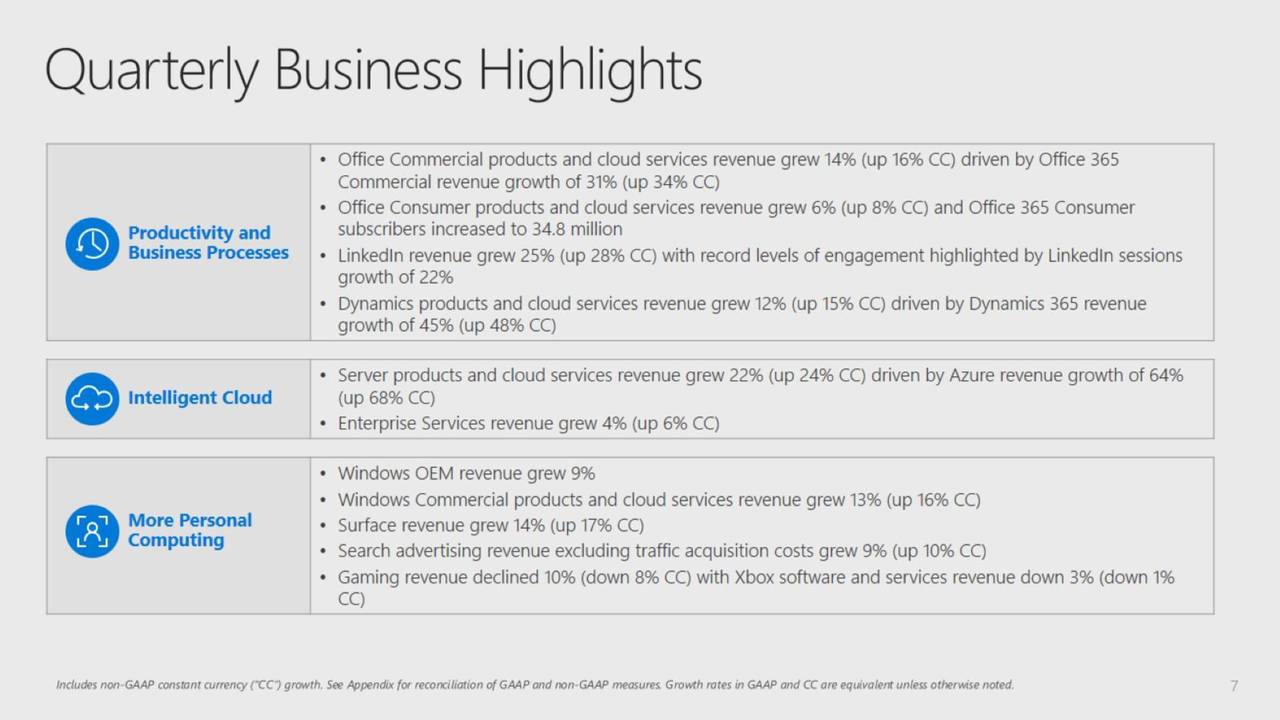

The company’s confidence in its future fundamentals and financial numbers allowed raising dividends. Its fourth quarter and fiscal 2019 revenue increased at a double-digit rate. The revenue growth is driven by an increase in cloud revenue.

“It was a record fiscal year for Microsoft, a result of our deep partnerships with leading companies in every industry,” said Satya Nadella, chief executive officer of Microsoft. The commitment to our customers’ success is resulting in larger, multi-year commercial cloud agreements and growing momentum across every layer of our technology stack.”

Microsoft’s strategy of reducing outstanding shares and investment in high margin areas is permitting it to convert revenue growth into big profits and gigantic free cash flows.

It has generated $52 billion in operating cash flows in fiscal 2019. The company invested $15 billion in growth opportunities. Thus, it was left with $38 billion in free cash flows – which was more than enough to cover dividend payments and share buybacks.

Its dividend payments and share buybacks were standing around $33 billion in 2019. The gap in cash returns and free cash flows offered the room for the latest dividend increase. Overall, its strategy of offering big cash returns are likely to add to the bullish trend.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account