Microsoft (NASDAQ: MSFT) stock price is likely to add $10 in the coming days, according to market analysts. MSFT shares rallied 40% year to date and it is up 135% in the past three years. The share price is currently standing around an all-time high of $140.

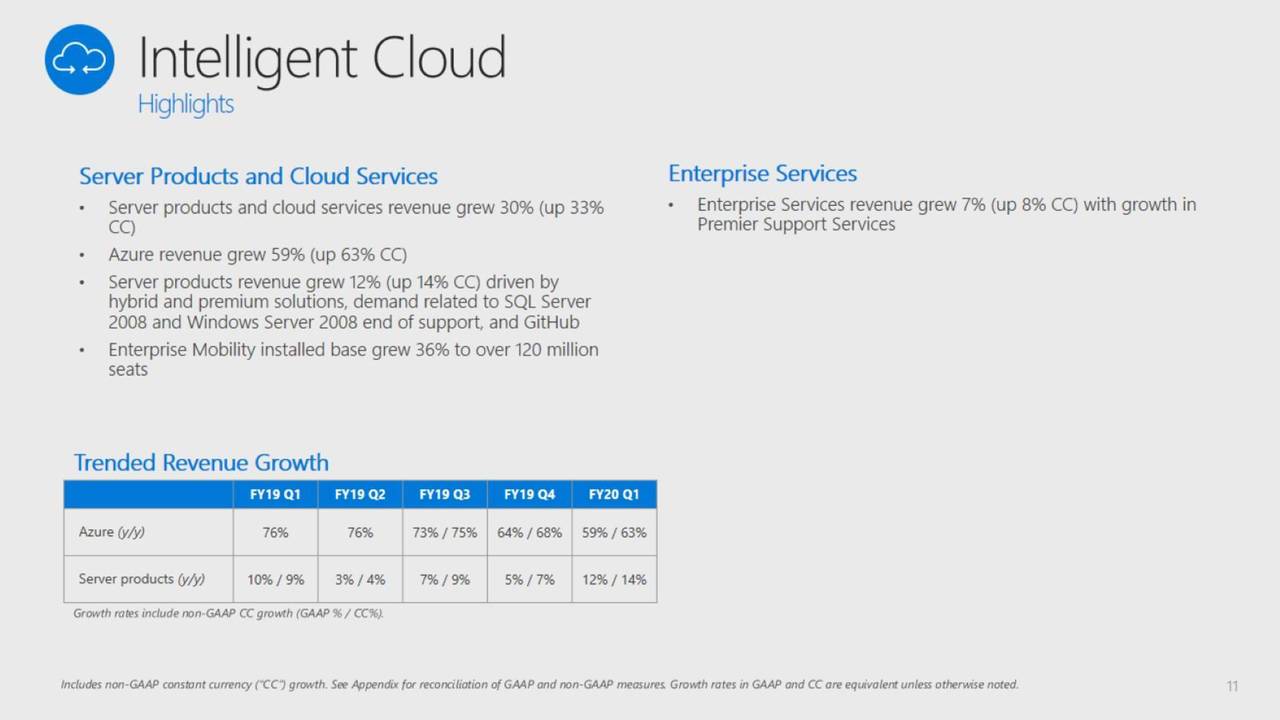

Analysts believe the tech giant’s acceleration in cloud markets is among the biggest catalyst for upside momentum. The company has generated a cloud revenue growth of 36% year over year in the latest quarter. The latest Pentagon’s JEDI contract win could turn out to be a game-changer for the tech giant, analyst says.

Pentagon’s JEDI Deal Could Add $10 to Microsoft Stock Price

Microsoft recently wins the Pentagon’s JEDI cloud computing contract. The contract is valued at $10 billion. Wedbush calls it a game-changer for Microsoft. The firm believes the contract could increase the cloud business out of Redmond for years.

The firm says, “We believe this deal adds at least $10 per share to Microsoft’s stock and could have significant positive financial implications to the model over the coming years that the Street will be digesting over the coming months.”

Q1 Results and Strong Guidance Supports MSFT Shares

Microsoft has generated double-digit growth in revenues and earnings in the first quarter. Its Q1 revenue of $33.1 billion rose 14% from the year-ago period. The revenue increase is supported by strong growth in cloud revenues. In addition, the company has been turning double-digit revenue growth into big profits.

Its operating income grew 27% year over year in the first quarter. Diluted earnings per share came in at $1.38 in Q1, up 21% year over year.

On the other hand, the tech giant has also been returning significant cash to investors in the form of dividends and share buybacks.

It has returned $7.9 billion in Q1 to investors in the form of share repurchases and dividends. This represents an increase of 28% from the same period last year. Overall, analysts believe Microsoft stock price is well set to extend the bullish trend.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account