Microsoft (NYSE: MSFT) stock price breached several records in fiscal 2019 on the back of substantial financial growth. In addition, traders are considering it one of the best stocks for 2020. This is because of its strong future fundamentals and increasing market share in cloud markets.

Its financial numbers grew at a double-digit rate in 2019; the company is likely to sustain the trend in 2020.

MSFT shares outperformed its peers by generating a 55% growth in fiscal 2019. Microsoft stock price is currently trading around the highest level in history. Moreover, MSFT appears like the best stock for retirees and defensive investors.

Microsoft Stock is a Solid Pick for Defensive Investors

Along with the share price appreciation, MSFT offers a strong dividend yield to investors. The company has increased dividends in the last 16 successive years. It currently offers a quarterly dividend of $0.51 per share.

The largest tech company with a market capitalization of over $1 trillion is well set to increase its quarterly dividend in fiscal 2020.

It returned $7.9 billion in the first quarter of the fiscal year 2020 through dividends and share buybacks. This indicates an increase of 28% year over year. Its dividend payout ratio based on the income of 37% offers room for more dividend increases.

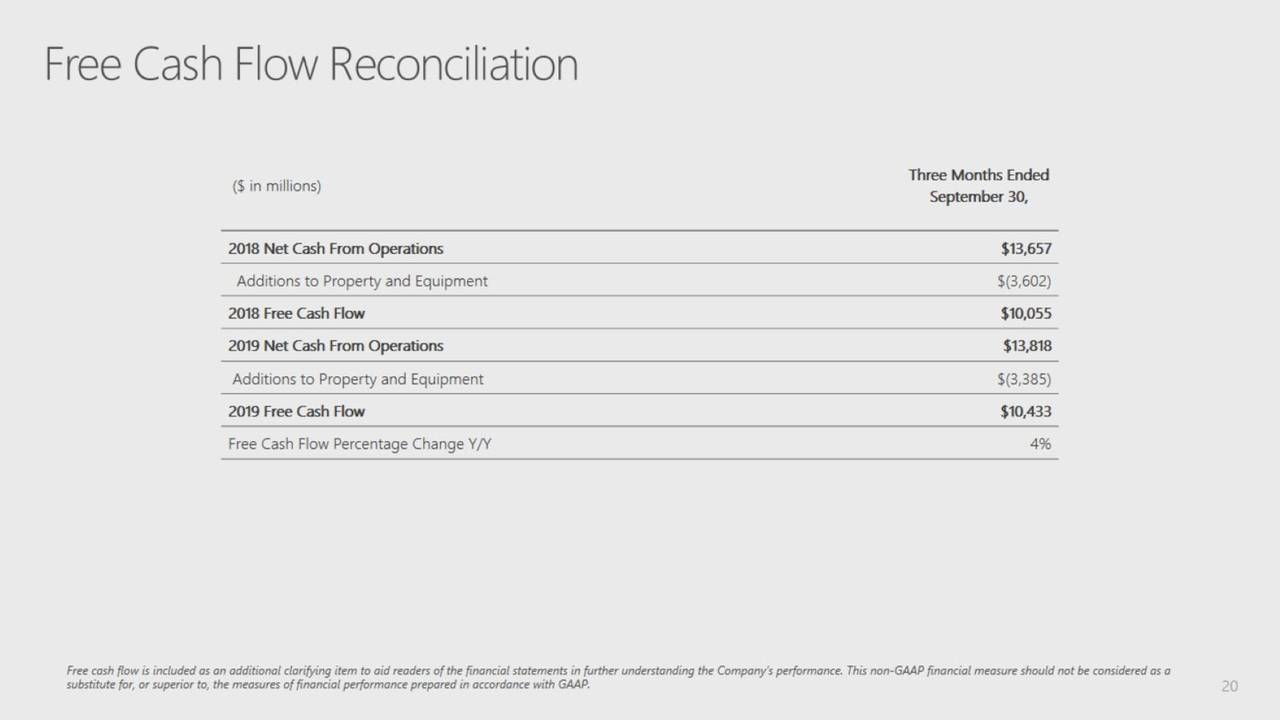

Moreover, the company’s cash flows are also strong enough to support dividend growth. The company had generated $13 billion in operating cash flows in the latest quarter, which is more than enough to cover cash returns.

Double-Digit Growth is Likely to Enhance Returns and Sentiments

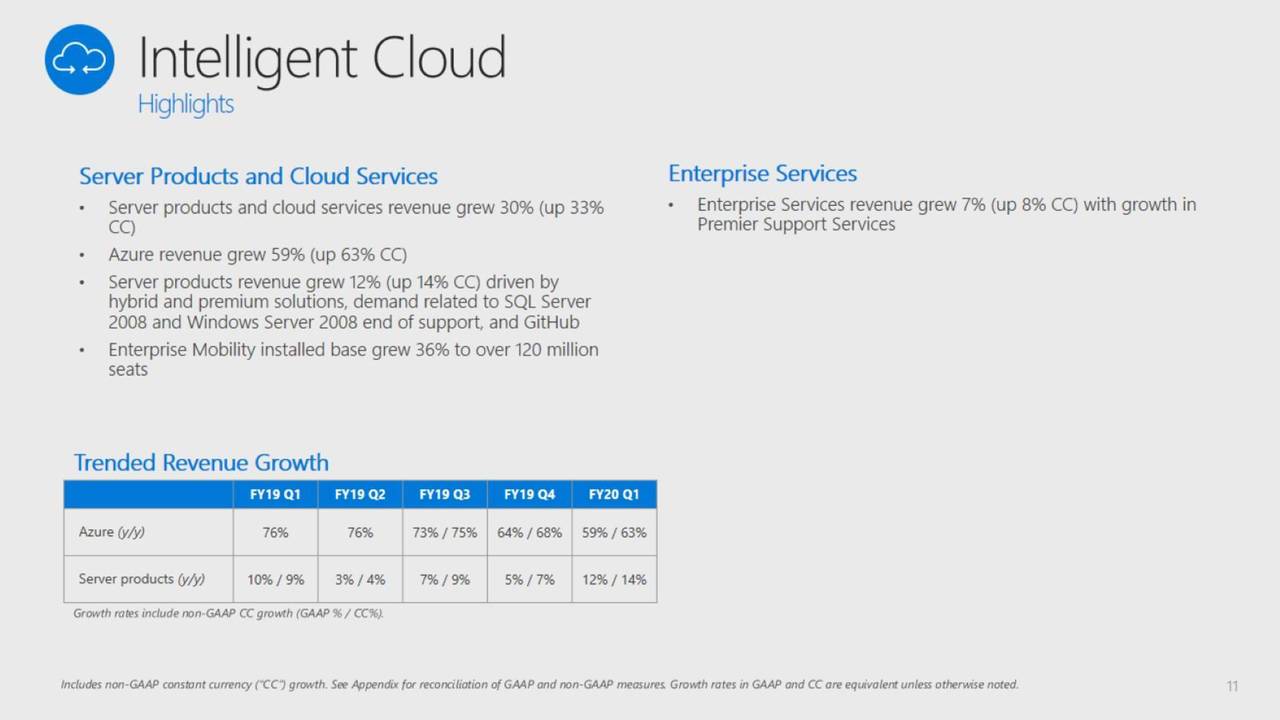

The company expects to generate double-digit growth in revenues and earnings in fiscal 2020. The robust revenue growth is likely to be driven by cloud business. Its cloud revenue jumped 36% year over year in the latest quarter. MSFT anticipates similar growth from cloud business in the following quarters.

“The world’s leading companies are choosing our cloud to build their digital capability,” said Satya Nadella, chief executive officer of Microsoft.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account