Microsoft (NASDAQ: MSFT) stock soared to the highest level in history amid analyst’s confidence in durable growth trends. The company’s latest financial results along with the outlook for the full year added to investors and analysts confidence. The company easily topped second-quarter revenue and earnings estimates, driven by solid growth from cloud-related products.

Microsoft stock price notches a record level of $185 after a second-quarter beat. MSFT share price is up 15 per cent since the beginning of this year, extending the twelve-month rally to 71 per cent. The market pundits are expecting a further upside in the coming days.

Analysts are Bullish on Microsoft Stock

The majority of analysts have raised MSFT share price targets after second-quarter results. RBC provided a $200 price target compared to the prior target of $180. “We see durable growth as the world increasingly moves to the cloud with MSFT uniquely positioned to take an increasingly large percentage of corporate IT budgets in a hybrid world,” analyst Alex Zukin said.

The BMO sticks to an Outperform rating with the price target of $200, saying the strong margin improvement will support earnings.

High Double-Digit Growth is Impressing Analysts

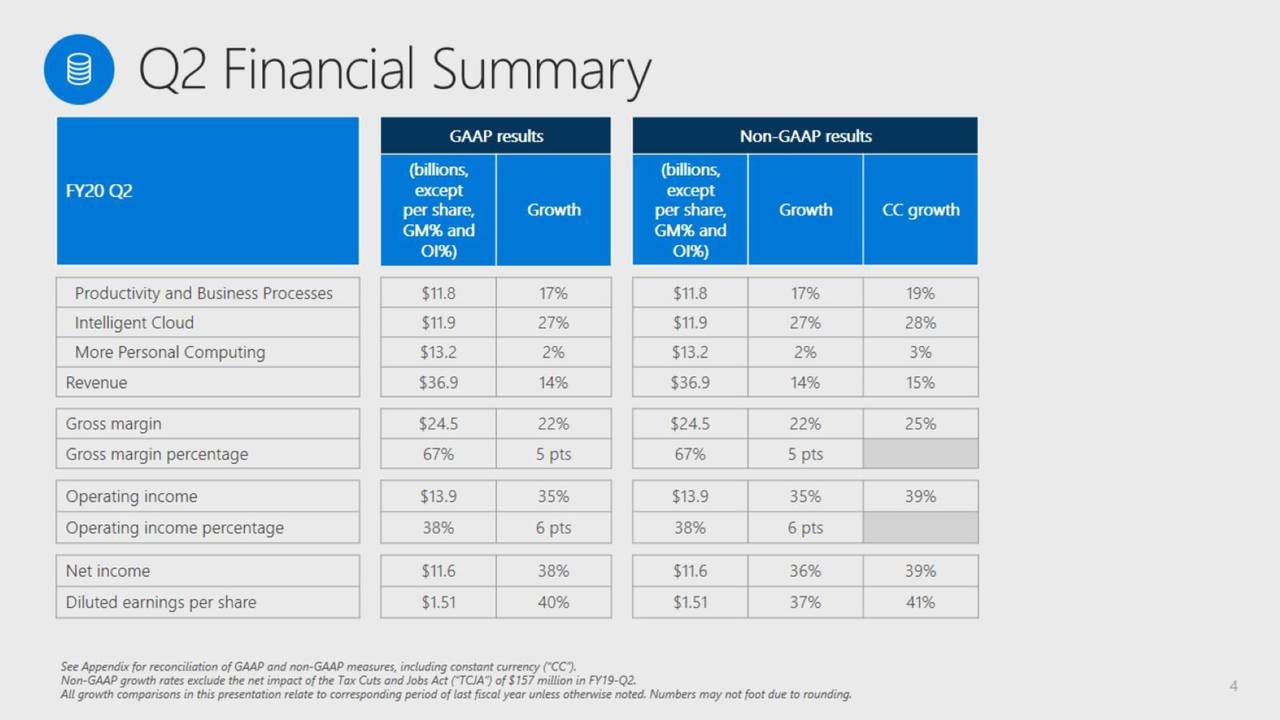

The company’s second-quarter revenue of $36.9bn increased by 14 per cent from the past year period. The company has turned double-digit revenue growth into big profits. Its net income of $11bn grew 35 per cent from the past year period. MSFT also reported a similar growth in cash flows – which would allow it to increase cash returns for investors. It returned $8.5bn to shareholders in the form of share repurchases and dividends.

Microsoft expects third-quarter revenue in the range of $34.9bn, up from the $34.15bn consensus. For the full year, MSFT anticipates double-digit revenue growth and operating margin increase of roughly 2 points Y/Y. The robust financial performance is likely to get support from revenue growth from cloud businesses along with office products. The potential acquisition could add to its revenue growth trends in the following quarters.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account