Microsoft (NYSE: MSFT) stock price has been extending the upside momentum on the back of robust demand for cloud, software and other office and business products. MSFT share price had outperformed the broader market index last year. The rating agencies and market indicators are suggesting further share price rally in 2020. Evercore has provided a street high price target amid strong growth prospects.

Microsoft stock price grew 73 per cent in the past twelve months and up 183 per cent in the last three years. MSFT share price is currently trading around the highest level of $185. The shares are trading around 32 times to earnings and 10 times to sales ratio.

Evercore and Other Analysts Suggest to Hold Microsoft Stock

Evercore increased MSFT share price target to $212 from the previous target of $190, saying Microsoft still has “plenty of gas in the tank when taking a multi-year view.” Its analyst Kirk Materne thinks the company has a competitive advantage due to Azure’s focus towards the hybrid cloud portfolio, non-conflicted business model, and enterprise footprint. Materne is showing confidence in demand from business applications and gaming.

RBC and BMO analysts also expect MSFT shares to cross the $200 mark in the coming days. They are optimistic about future fundamentals. They believe MSFT is well-positioned to take a benefit from increasing corporate IT budgets in a hybrid world.

Microsoft’s Financial Growth Indicates Robust Demand and Solid Execution

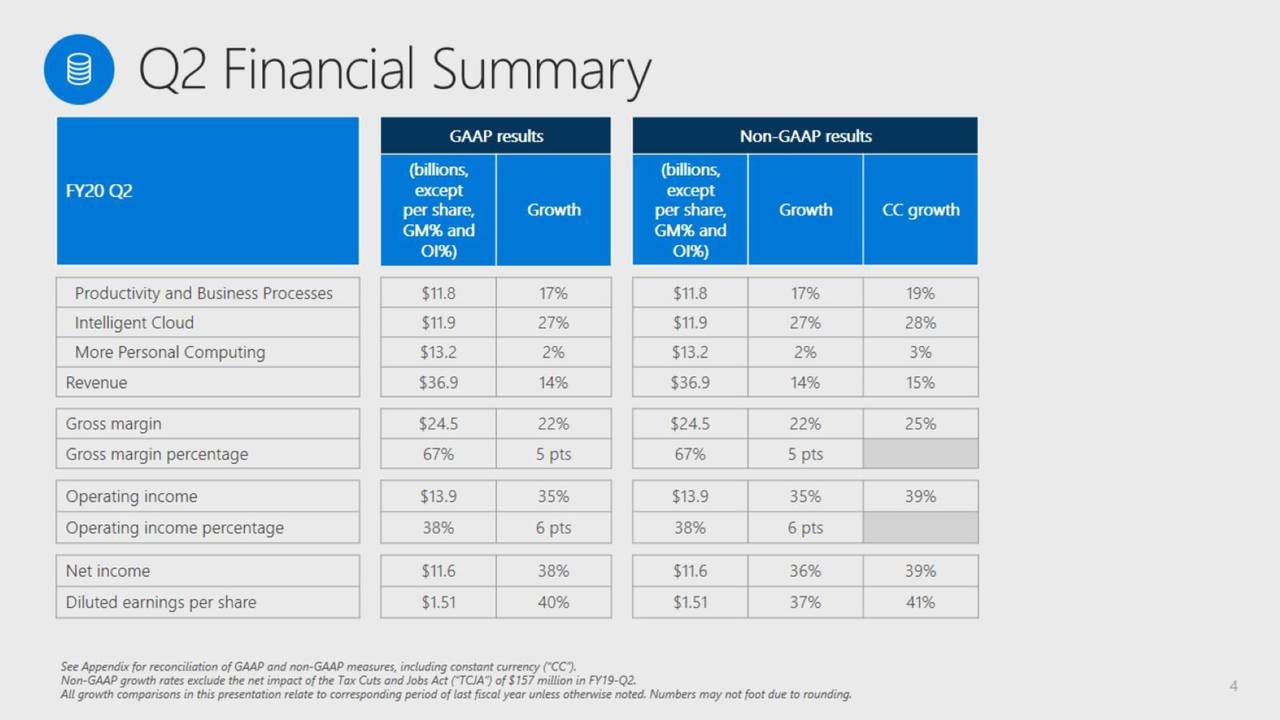

The trillion-dollar company generated year over year revenue growth of 13.5 per cent to $36.9bn in the second quarter of 2020. The revenue growth is driven by 39 per cent year over year growth from the commercial cloud. The commercial cloud revenue came in at $12.5bn in the latest quarter. On top, its second-quarter earnings grew 40 per cent from the past year period. The company also plans to returns massive cash to investors in the form of dividends and cash returns. It returned $8.5bn to shareholders in the second quarter.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account