Microsoft (NYSE: MSFT) stock price bounced sharply after topping revenue and earnings estimates for the second quarter. The strong demand for the cloud has been driving double-digit revenue growth for the world’s largest software and technology company over the past couple of quarters. MSFT share price soared more than 60% in the past twelve months on the back of sustainable growth in financial numbers.

It has also increased the third-quarter revenue outlook due to strengthening demand for the cloud. The better than expected performance of Productivity and More Personal Computing segments are helping in generating solid financial numbers. Microsoft stock is currently trading slightly shy from the highest level of $172 a share.

Second Quarter Beat Added to Microsoft Stock Price

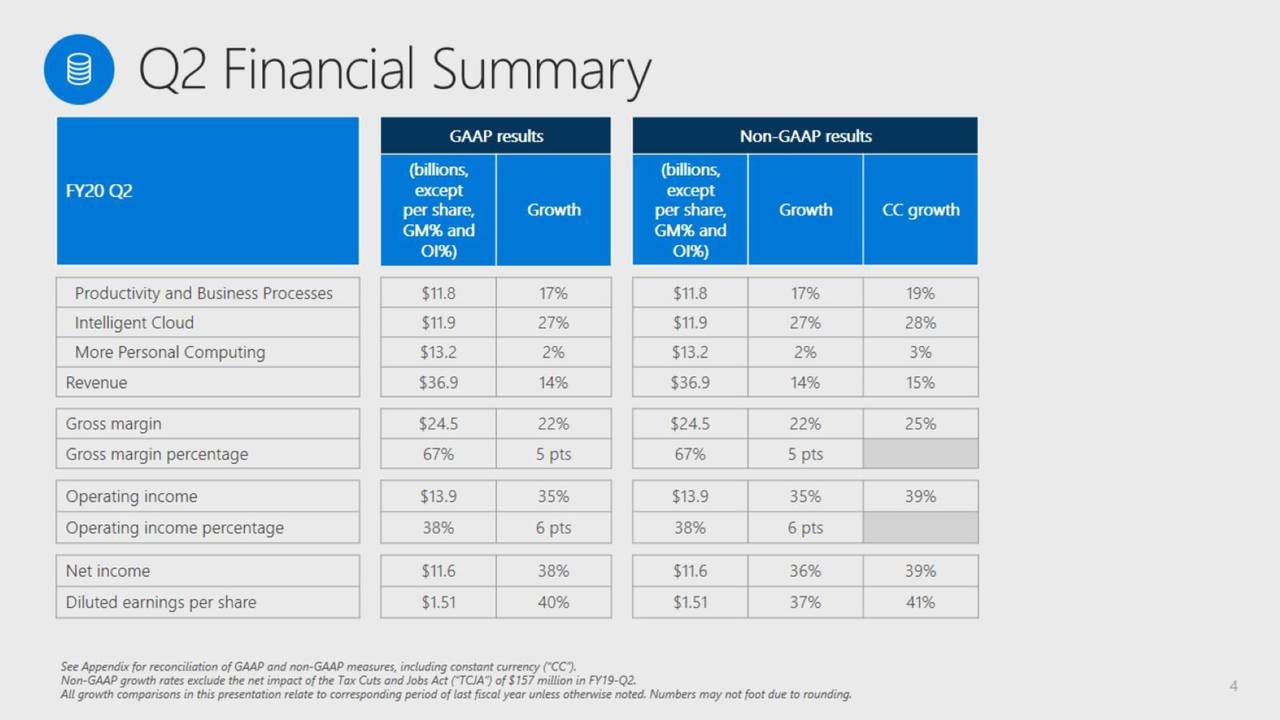

Microsoft reported second-quarter revenue of $36.9bn. This represents a growth of 13.6 per cent from the past year period. Its commercial cloud revenue surged by 39 per cent year over year to $12.5bn. The revenue from the Productivity and Business Processes segment stood around $11.8bn in the second quarter, up 17% from the year-ago period.

“We are innovating across every layer of our differentiated technology stack and leading in key secular areas that are critical to our customers’ success,” said Satya Nadella, chief executive officer of Microsoft. “Along with our expanding opportunity, we are working to ensure the technology we build is inclusive, trusted and creates a more sustainable world, so every person and every organization can benefit.”

MSFT continues to show its potential of turning the double-digit revenue growth into big profits. Its second-quarter operating income of $13.9 billion grew 35% from the past year period.

Cloud Strength Is Adding to Revenue Growth

The company increased its outlook for the third quarter due to strong demand for cloud products. It now expects third-quarter revenue to stand around $35bn compared to the consensus estimate for $34.1bn. It plans to return more than $8bn to investors through dividends and share buybacks. Microsoft stock is likely to extend the upside momentum, according to market pundits. For instance, Raymond James set a Strong Buy rating with the price target of $192.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account