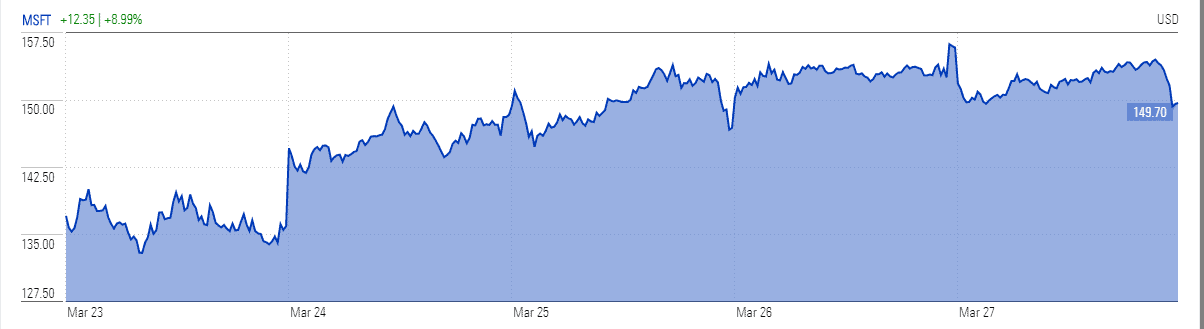

Microsoft ‘s (NASDAQ: MSFT) stock price selloff has created an attractive buying opportunity, with analysts’ calling it an outperformer of the bear market and a leader in the next stock market rally. The whopping 775% demand growth for cloud services last week, reported by the traded firm is the main reason behind the optimism. Is commercial cloud revenue stood around $12.5bn in the second quarter.

The company said it is seeing robust usage increases in services that include Microsoft Teams, Windows Virtual Desktop, and Power BI – with most of the demand coming from regions that have enforced social distancing or lockdowns. It’s Windows Virtual Desktop usage surged close to threefold last week.

“We have seen a very significant spike in Teams usage, and now have more than 44 million daily users. Those users generated over 900 million meeting and calling minutes on Teams daily in a single week,” Microsoft says.

Besides the demand side, Microsoft has a cash pile of $136.6bn with a free cash flow generation potential of $7bn. Dividends also appear safe considering its cash generation potential and growth in demand. The company currently offers a quarterly dividend of $0.51 per share, yielding around 2%. It has increased dividends over the past 16 consecutive years. Its revenue stood around $36bn in the latest quarter while the company generated earnings per share of $1.51 per share

The latest acquisition of 5G software maker Affirmed Networks for $1.4bn hints Microsoft’s confidence in its cash generation and future fundamentals.

While Microsoft stock price is down significantly from its all-time high of $190 a share, Wedbush analyst Daniel Ives says the selloff is an attractive buying opportunity and sets a price target of $210. “Even a 10%-plus ‘haircut’ to the cloud and enterprise drivers leaves what we value as a $900bn to $1trn valuation cloud franchise,” Ives said.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account