US medical device giant Medtronic said it will buy Medicrea, a French maker of implant technology tools, to strengthen its spinal surgery business.

Medtronic, which is based in Dublin for tax purposes but has its operational headquarters in Minnesota, said in an agreed deal it will offer Medicrea shareholders €7 per share, which represents a 22% premium over Medicrea’s 14 July closing stock price, valuing the company at about $154m.

“Combining Medtronic’s innovative portfolio of spine implants, robotics, navigation, and 3D imaging technology with Medicrea’s capabilities and solutions in data analytics, artificial intelligence and personalized implants, would enhance Medtronic’s fully-integrated procedural solution for surgical planning and delivery,” said Jacob Paul, president of the spinal technologies unit for Medtronic in a joint press release.

“We are thrilled to be joining forces with Medtronic because we share a similar mission to restore the long-term quality of life for [spine surgery] patients”, added Medicrea founder and chief executive Denys Sournac (pictured).

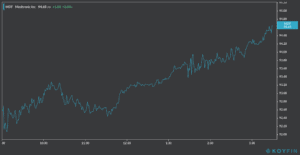

Shares of Medtronic went up 2% yesterday to close the day at $94.65 prior to the announcement while the are also gaining 0.4% in today’s premarket stock trading activity. Meanwhile, Medicrea shares are up 20% in Paris since the announcement was released and are currently trading at €6.94 per share.

Medtronic said it has secured a total of 44.4% of the outstanding shares of Medicrea so far and must reach a total of 66.67% of the company’s voting rights to complete the acquisition successfully, based on French financial markets regulations.

The transaction still has to be approved by the French Markets Authority (AMF) and must also be cleared in the US. Medtronic expects to be able to file the tender offer by September 2020, after both regulators have cleared the deal.

Medtronic is an American medical device supplier with offices in more than 150 countries and more than 100,000 employees. Medicrea is a French medical technology company that has provided world-leading surgery implant solutions in more than 175,000 spinal surgeries to date, employing nearly 200 people worldwide.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account