Match Group (NASDAQ: MTCH) stock price outperformed top-rated companies in fiscal 2019. It stands among the best performers in internet stocks. MTCH share price grew 91% in the last year, driven by its sharp growth rate.

The company has been growing at a strong pace over the past couple of years. It has achieved several milestones in the last year.

Match Group stock price is currently trading around $80, down slightly from an all-time high of $95 that it had hit at the end of last year. The company is planning to spinoff IAC to fully focus on long-term growth strategies.

Growth Trends are Strong

Match Group is working on the business model of providing dating products through a portfolio of brands such as Tinder, Match, PlentyOfFish, Meetic, OkCupid, OurTime, Pairs, and Hinge, along with other brands. The company offers these products via its App and website in more than 40 languages.

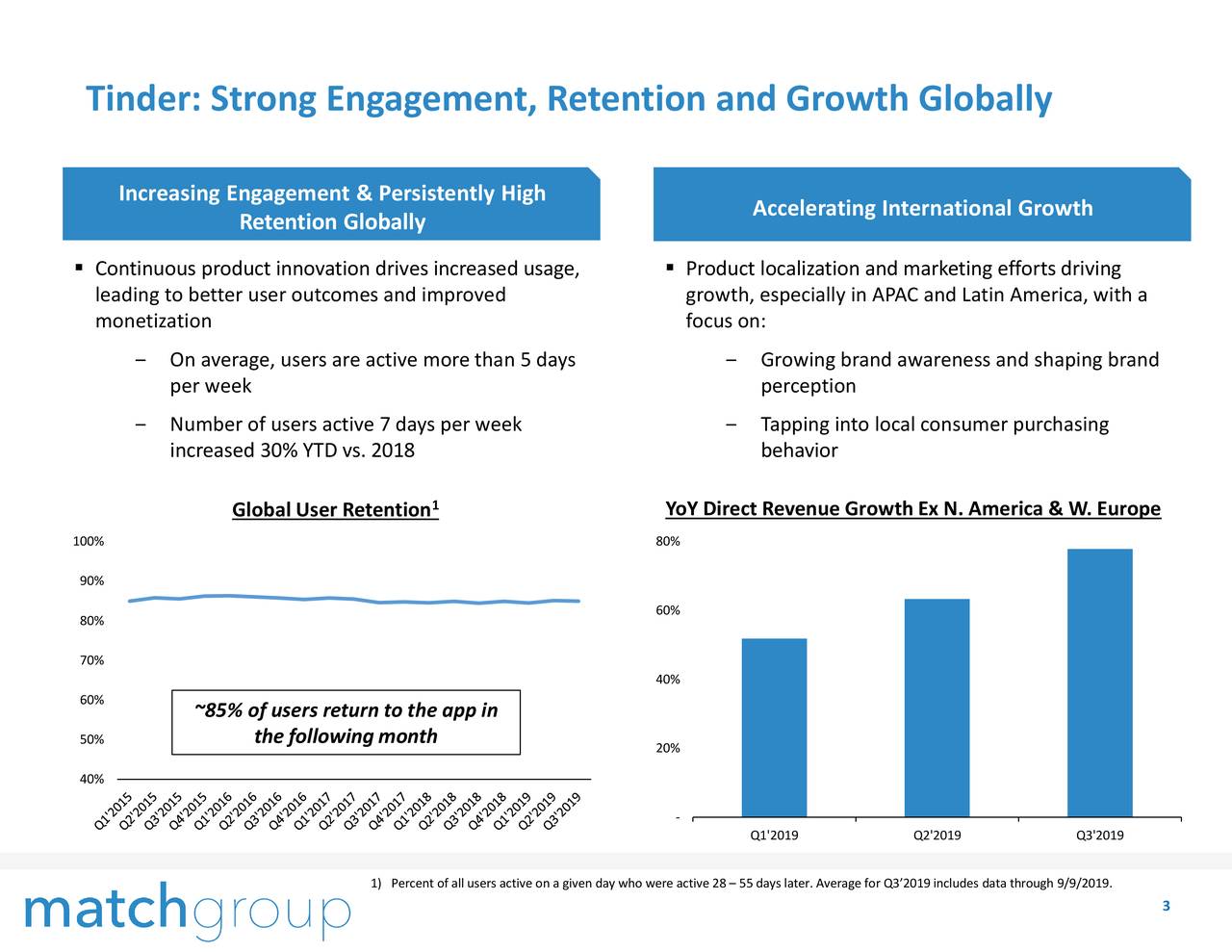

Its revenue growth trends indicate that the company has been successfully attracting users across the world. Its revenue grew 22% to $541 million in the latest quarter.

The dating company also experienced a double-digit increase in subscribers. Its average subscribers grew 19% to 9.6 million. On the other hand, its operating income rose 26% to $177 million from the year-ago period.

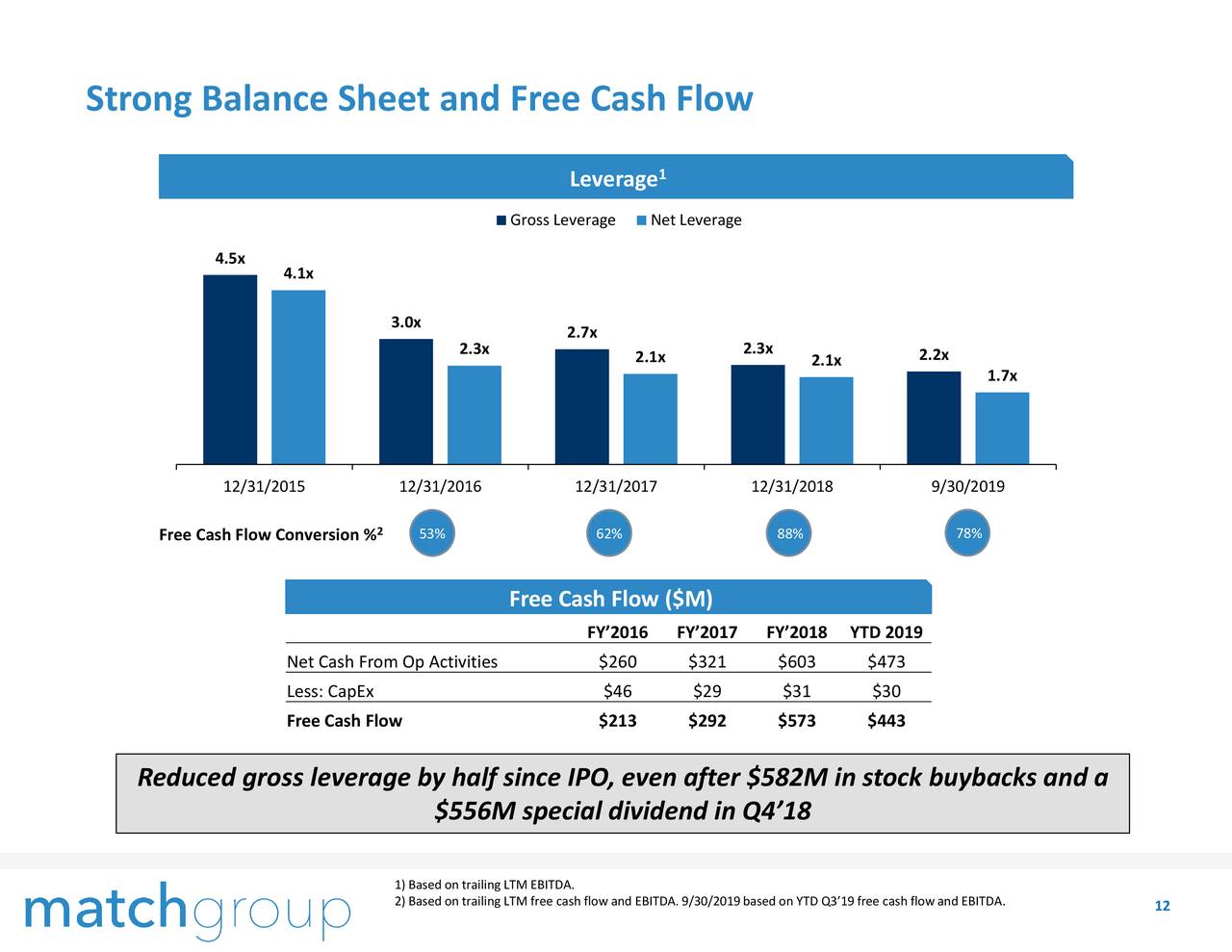

The company has also reported strong cash flows in the past couple of quarters. Its operating cash flow of $450 million in the past three quarters offers a lot of room for investment in growth opportunities.

Analysts Are Bullish on Match Group Stock Price

Analysts expect MTCH share price to cross $100 level in the coming days. Jefferies has set a buy rating with a $105 price target despite showing concerns over technical pressure on the stock. Cowen, on the other hand, provided a price target of $104. The company expects to generate $555 million in fourth quarter revenue. Overall, prospects are looking bright for further upside potential.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account