Macy’s (NYSE: M) has suspended its dividend and drawn down all of its $1.5bn credit facility to boost the cash position, as the department chain bolsters itself against a slowing economy brought about by the coronavirus.

The New York-based business, that runs over 775 stores, said it had “increased its borrowings under the revolving credit facility as a proactive measure to increase its cash position and preserve financial flexibility in light of current uncertainty in the global markets resulting from the COVID-19 outbreak,” in a Securities and Exchange Commission filing earlier this week.

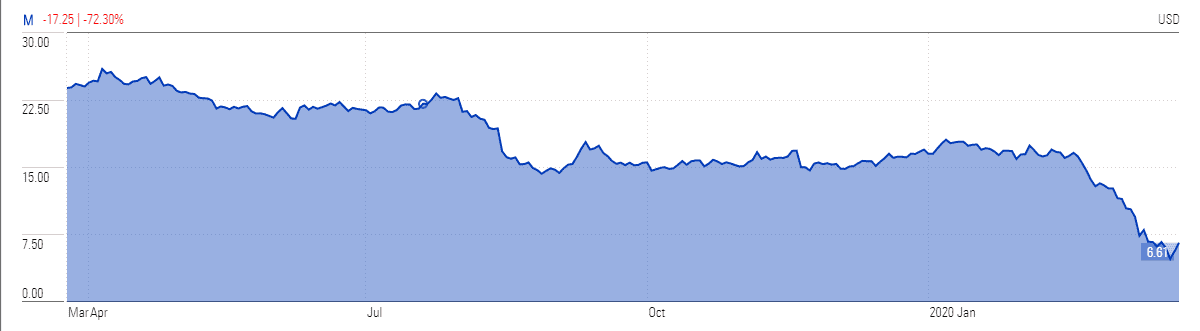

Macy’s stock is up 17% at $6.61 in morning trading on Thursday, but its stock price is down more than 70% in the last twelve months and it plunged almost 90% in the last five years.

Using debt to counter challenges is only the viable solution in management’s view despite the fact that it was already standing among the most high-debt leveraged retailers in the specialty softlines category.

The company had reduced its debt by $3.5bn over the past four years and all of the debt repayment was predominantly voluntary, but credit agency S&P responded negatively to debt declining strategy and lowered its debt to junk status last month. The new debt along with cash burn due to shut down and slow demand could hurt its strategy of lowering debt to EBITDA ratio to 2.5 times to 2.8 times.

Macy’s stock price is hit harder by the coronavirus backed selloff because investors believe the temporary closure of all stores will further accelerate its revenue downtrend. The company has generated negative or flat revenue growth in the past four years while operating income shirked from $2bn in 2016 to $1.19bn last year.

“We will continue to take the necessary actions to ensure that Macy’s and our brands – Macy’s, Bloomingdale’s and Bluemercury – emerge from the other side of this crisis ready to serve our customers and welcome back our colleagues,” said chairman and chief executive officer Jeff Gennette.

The retailer is also working on measures like cost cuttings and lower spending to improve financial flexibility. The chief executive officer said he is not receiving any compensation from the company due to the coronavirus pandemic. The latest dividend cut would help it in saving $450m annually. Jeff Gennette said “we frozen hiring and deferred capital spend along with extending its payment terms among other measures.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account