There’s no doubt that the rise of cryptocurrency over the past decade has brought about significant changes in numerous industries. Due to the upcoming release of Lucky Block, the lottery industry looks set to be the next to undergo a significant evolution that will improve the user experience for all stakeholders.

With that in mind, let’s take a look at what Lucky Block is and explore whether it could be the best new cryptocurrency to invest in 2022.

What is Lucky Block?

By moving the lottery system to the blockchain, Lucky Block removes these problems and provides a much better user experience. Lucky Block is hosted on the Binance Smart Chain and leverages technological advances to remove geographical boundaries and improve the odds of winning for each entrant. What’s more, Lucky Block’s native token (LBLOCK) has numerous use cases, such as buying lotto tickets and as an investment asset. Finally, Lucky Block’s prize distribution model is incredibly efficient. Pay-outs to winners are made instantly, and other users receive a portion of the prize pool just for holding LBLOCK tokens!

The Story So Far

As you can see from the section above, Lucky Block’s potential is enormous. Now let’s dive in and examine the platform’s journey to get to where it is today:

- Lucky Block’s development team came up with the idea for the platform after noting various pain points associated with traditional lotteries that could be reduced (or removed) by transitioning to the blockchain.

- After developing the Lucky Block platform, an experienced smart contract and blockchain auditor (Solidproof.io) was hired to ensure the validity of the platform.

- The auditing report was returned with exceptional results, so Lucky Block’s developers proceeded to apply for a listing on Coin Gecko and launched an extensive marketing campaign throughout London and Manchester.

- The Lucky Block whitepaper was then produced, detailing the motivation behind the platform, how the LBLOCK token will work, and the developers’ roadmap for the future.

- At the time of writing, Lucky Block is currently in the ‘pre-sale’ phase, where investors can purchase LBLOCK tokens at a reduced price point. More than 14.6 billion tokens have already been sold for 0.0000002419 BNB per token – equalling a total of 3543.47 BNB. Exchanging this into GBP, we can see that over £1.25 million has been raised for Lucky Block so far!

Why Buy Lucky Block?

Like other exciting cryptos, Lucky Block has numerous elements that make it stand out from the crowd. Here are some of the top reasons to consider investing in the platform in 2022:

Exciting Future Plans

Right now, Lucky Block is only in Phase 2 of its roadmap, with two additional phases to come after this one. These phases present exciting plans for the platform, such as creating Lucky Block merchandise, online scratch cards, creating a charitable foundation, and even launching Lucky Block NFTs!

Great Tokenomics

A 12% transaction tax will be levied each time an investor sells LBLOCK, which is designed to promote the long-term holding of the token. However, this tax is used to benefit the platform further, as 4% will be added to upcoming prize pools, 4% will be added to liquidity pools, 3% will go to Lucky Block’s gaming and royalty fund, and 1% will be ‘burned’ to reduce the total supply.

Experienced Development Team

Finally, Lucky Block’s development team is clearly highlighted on the website and whitepaper, ensuring clarity on who is behind the platform. Scott Ryder, Lucky Block’s CEO, has extensive experience within the crypto space and even serves as CEO of SafeMoon – another exciting cryptocurrency that produced exceptional returns in 2021.

Lucky Block Crypto Lottery

Much like traditional lotteries, entrants will need to buy a ticket to participate in prize draws. Tickets can be purchased using LBLOCK, with winnings distributed in LBLOCK. All winning tickets are decided on using Random Number Generation (RNG), which ensures the fairness of the entire system. The great thing is that if your ticket was a winner, you can easily exchange your LBLOCK to BNB and then to FIAT currency, enabling you to spend your winnings in the real world!

As noted earlier, the tokenomics behind LBLOCK are stellar. A total of 10% of each prize pool will be distributed back to LBLOCK holders as a sort of ‘reward’ for simply holding the token. This follows a similar structure to dividend payments received for owning a company’s shares, allowing LBLOCK investors to generate a passive income whilst still having scope for capital gains too.

Lucky Block Presale

Although Lucky Block isn’t scheduled to officially launch until Q2 2022, users can still invest in LBLOCK through the pre-sale. Crypto platforms tend to utilise pre-sales to increase the ‘hype’ surrounding a project and allow early investors to purchase tokens at an attractive rate.

Investing in Lucky Block’s pre-sale is easy, as all it requires is for you to hold some BNB, which will be used to exchange for LBLOCK. The pre-sale ends on February 1st, which will mark the last time that investors can purchase tokens for a reduced price. Finally, you can even discuss the pre-sale with other investors through Lucky Block’s official Telegram group – which has over 16,400 members at the time of writing!

How to Buy Lucky Block

Here’s a quick and easy video tutorial on how to buy Lucky Block right now.

For those who prefer written guides, simply keep scrolling down.

If you’d like to invest in Lucky Block, you’ll be glad to know that the process is incredibly straightforward. By following the four quick steps below, you’ll be able to buy LBLOCK from your smartphone, tablet, or computer – all in a matter of minutes.

Step 1 – Buy BNB

Step 2 – Proceed to the Lucky Block Pre-Sale Page

Head over to the official Lucky Block website and click ‘Buy Now’. Alternatively, you can CLICK HERE to be taken straight to the Lucky Block pre-sale page.

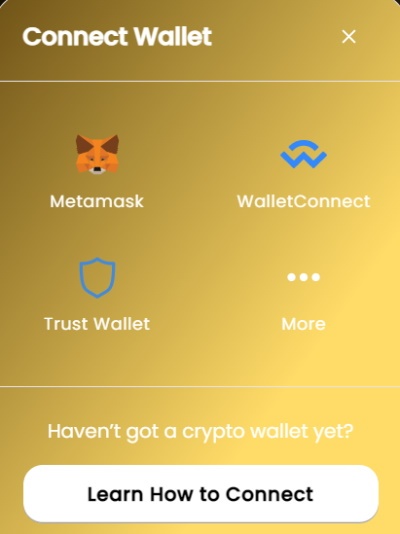

Step 3 – Link your Crypto Wallet

Click ‘Connect Wallet’ in the top right of your screen and choose the wallet provider that stores your BNB. After this, follow the on-screen instructions to connect your crypto wallet to the Lucky Block pre-sale.

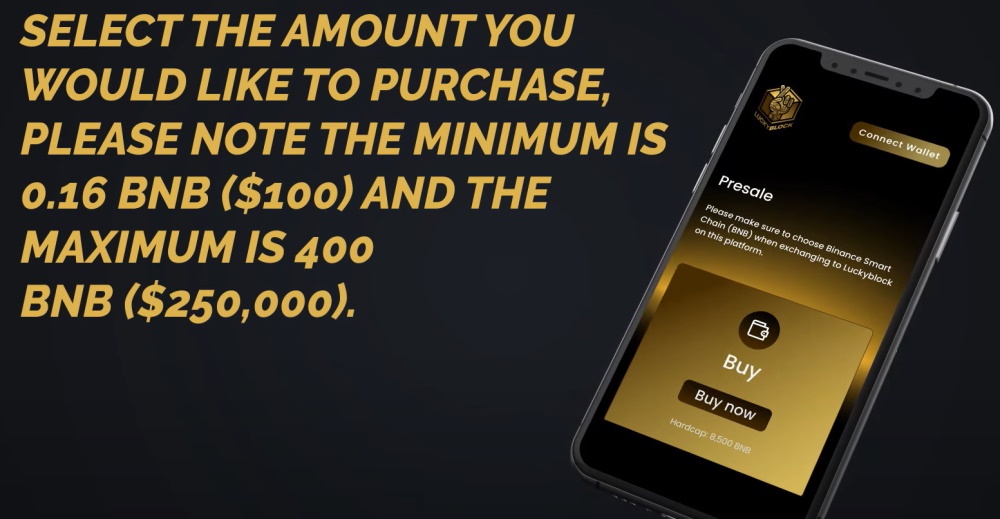

Step 4 – Buy LBLOCK

Your capital is at risk. Lucky Block is not affiliated with Lucky Block Network (LBN).

Enter the amount you’d like to invest in Lucky Block, which will be denominated in BNB. The minimum investment is only 0.16 BNB, equating to around £56. Once you’ve confirmed your position, the number of LBLOCK tokens that your investment equates to will automatically be transferred to your crypto wallet.

Where Has Lucky Block Been Featured?

Finally, Lucky Block has already been making waves in the media, with numerous mainstream outlets noting the buzz around the platform. Interestingly, a recent article published by The Herald placed Lucky Block in the number one spot on their list of the best cryptocurrencies to invest in for 2022. Furthermore, Lucky Block has also been mentioned on Yahoo Finance, BeInCrypto, and even The Economic Times of India. Ultimately, these outlets deciding to create content around Lucky Block helps improve the platform’s credibility and increase the ‘hype’ surrounding it.

Corporate launch partners are Finixio Ltd and The Manc Group.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account