China’s Luckin Coffee (NASDAQ: LK) has fired two top bosses in the wake of a fraud scandal that has rocked the chain. The Nasdaq-listed company said on Tuesday that it has ended the contracts of executive Jenny Zhiya Qian (pictured) and chief financial officer Jian Liu, after a probe into hundreds of millions of dollars worth of fake trading.

The firm’s board of directors made the decision based on “evidence that sheds more light on the fabricated transactions”.

Six other employees who were alleged to have been involved in or known about the transactions have been suspended or put on leave.

Luckin Coffee was China’s rival to the world’s biggest coffee chain, Starbucks. Luckin increased its store count six-fold in China between June 2018 and September 2019 to 3,680 stores.

Beijing-based Luckin has been dealing with the fallout of a fraud scandal that revealed last month that the firm faked 2.2bn yuan ($310m) worth of sales in 2019.

The disclosure caused the company’s shares to sink by more than 70 per cent in the Nasdaq stock exchange in New York. Trading in Luckin shares has been suspended since 7 April.

Launched in 2017, the Chinese coffee chain made a remarkable debut on Wall Street in May 2019, raising $561m during its initial public offering (IPO). Shares soared by more than 50 per cent during initial trading.

Luckin Coffee’s downfall has had a serious impact on Chinese companies trading in the US. Chinese companies looking to raise capital through IPOs in the US are now facing close scrutiny, not just because of the Luckin Coffee massive fraud scandal, but due to growing tensions between US President Donald Trump and Chinese media over the origin of the coronavirus.

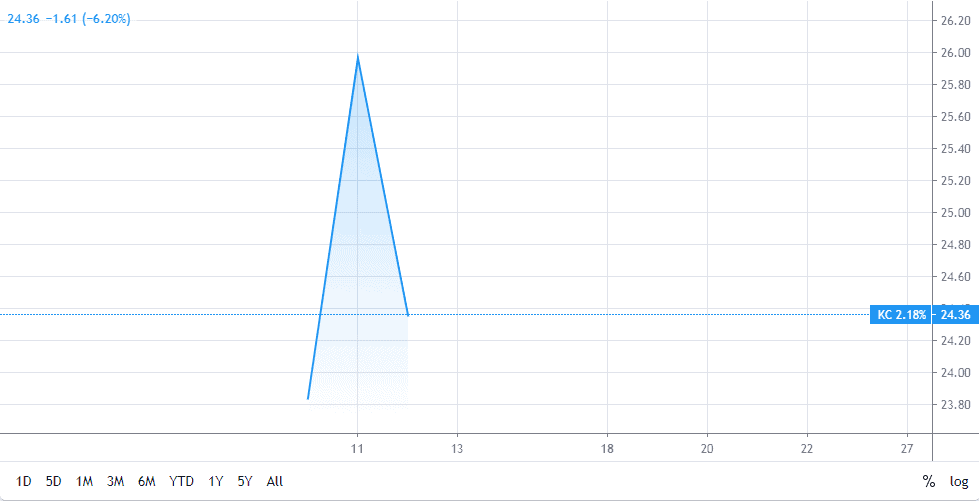

Analysts anticipated the first IPO by a Chinese company in the US since Luckin Coffee. Kingsoft Cloud Holdings began trading on Friday under the symbol ‘KC.’ Shares rose 40 per cent on its first day of trading, the first US flotation of a Chinese company in the US since the accounting scandal at Luckin Coffee.

The Beijing-based cloud computing service company raised $510m in its initial public offering, pricing its shares at the midpoint of a $16 to $18 targeted range. The shares closed at $23.84 in New York trading Friday, giving the company a market value of $4.8bn. The stock closed down 6.2 per cent at $24.36 on Tuesday.

For more shares of US-listed companies you can invest in, check a list of our list of recommended stock brokers. You can also read our guide on how to short stocks.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account