Lockheed Martin (NYSE: LMT) stock price has been rallying at a robust pace due to financial growth and strong cash returns for investors. In addition, the company’s massive backlog and new contract wins are adding to investor’s sentiments. Consequently, the market analysts are expecting the extension of upside momentum in fiscal 2020.

LMT shares soared close to 45% this year; Lockheed Martin stock price had recently hit an all-time high of $395. LMT shares are currently trading slightly below from the record level. Analysts anticipate its stock to trade above $400 mark in the coming days. The fourth-quarter results along with the outlook for 2020 could play a key role in strengthening sentiments.

Future Fundamentals Are Enhancing Confidence

The company appears in a solid position to extend the financial and share price momentum in 2020. This is because of its strong future fundamentals. The company had reported a record backlog of $137 billion at the end of the latest quarter. In addition, the new contract wins are adding to future fundamentals.

For instance, the Defense Department awarded a $7B contract modification to LMT for F-22 air vehicle sustainment. Additionally, the U.S. Navy announced a $1.96B contract to LMT for the detail design and construction of four Multi-Mission Surface Combatant ships for Saudi Arabia.

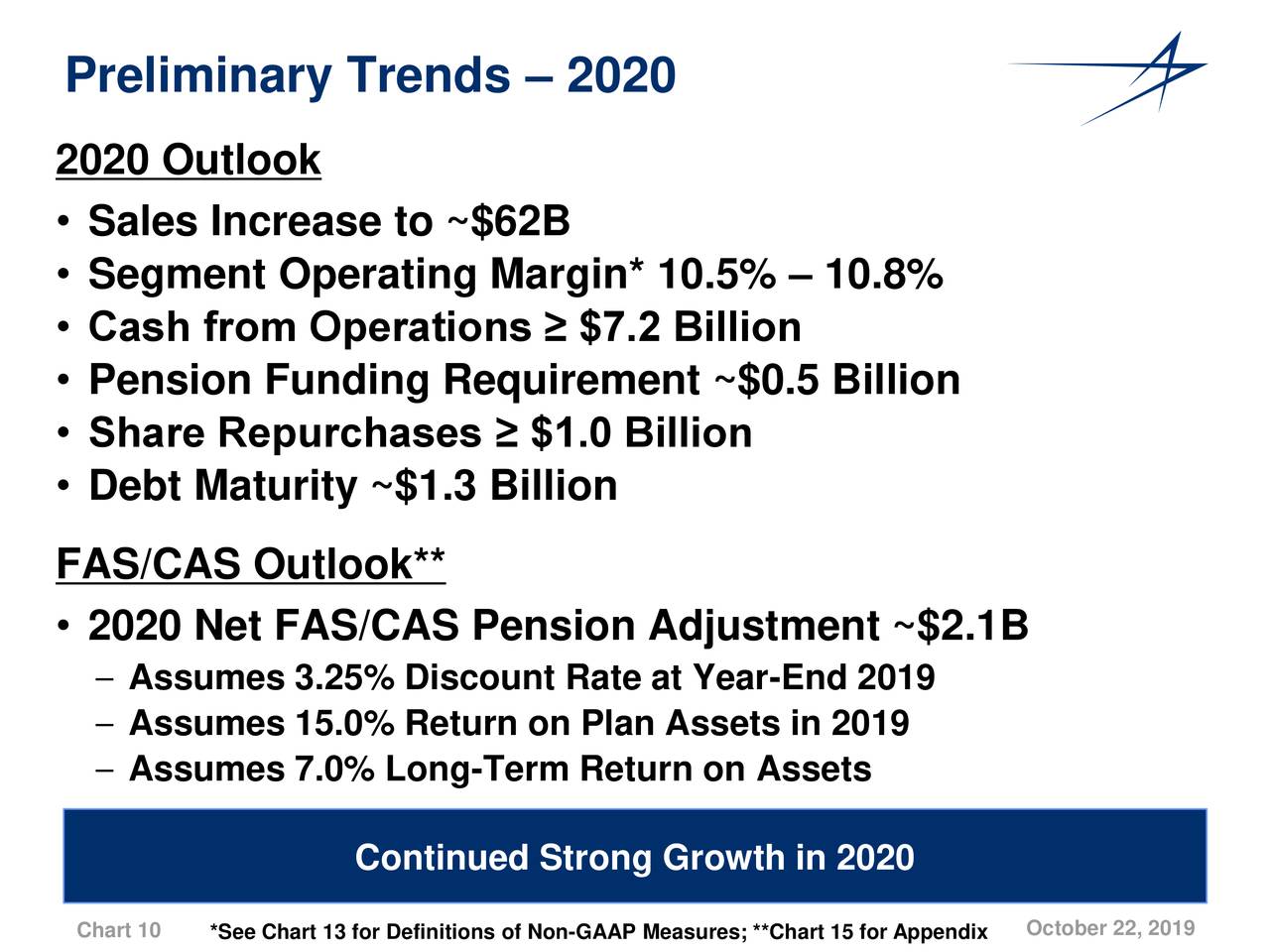

The company expects to generate high mid-single-digit growth in revenues in fiscal 2020. The earnings per share are likely to increase at a double-digit rate. The company also appears strong enough to increase cash returns for investors.

Cash Returns Could Also Support Lockheed Martin Stock Price

Lockheed Martin is among those companies that offer big cash returns to investors. Despite a sharp share price rally, the company has sustained its dividend yield of around 2.5%.

It has recently increased the quarterly dividend by 9.1%. This represents the 18th consecutive year of a dividend increase. Moreover, the company has also been returning billions of dollars in the form of share buybacks. In a nutshell, analysts consider Lockheed Martin among the best stocks for defensive investors.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account