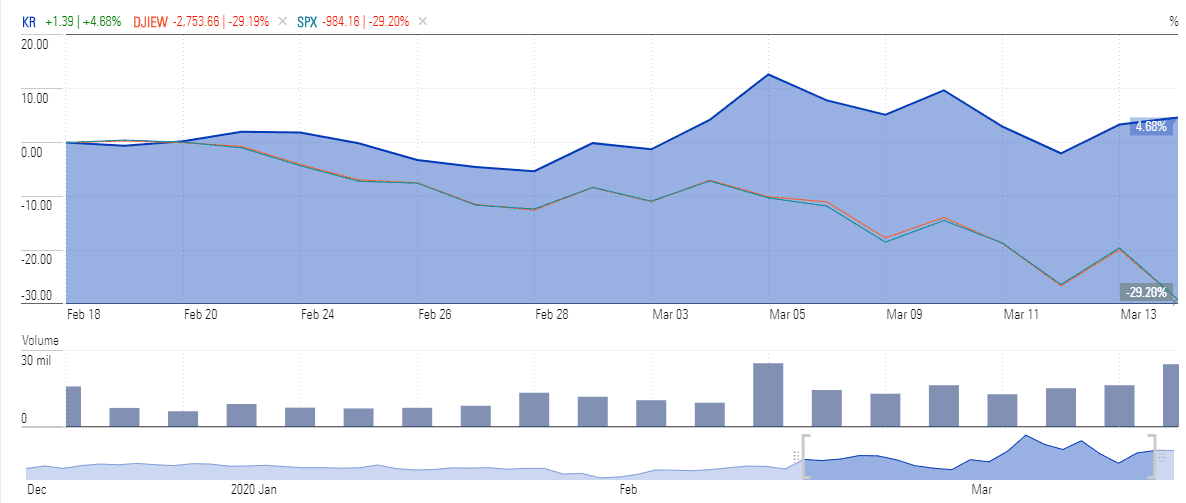

Kroger’s (NYSE: KR) stock has been outperforming the worst market selloff in three decades as people across the US queue to get into stores to buy face masks and tinned food as a result of coronavirus.

Kroger, America’s largest traditional supermarket, is among the only 29 stocks in the S&P 500 index that have generated gains over the past month; the majority of these companies experienced a massive jump in demand in the wake of the outbreak. S&P 500 and Dow Jones plunged close to 30% in the last month due to trader’s concerns over slowing economic growth and the risk of recession.

Kroger stock price rose more than 4% in the last month and the stock is up 8% since the beginning of this year. Its shares are currently trading at slightly below from 52-weeks high of $33. Kroger stock price is likely to enjoy more gains in analyst view on the back of increasing threat of lockdown across the US.

Kroger, which runs over 2,750 stores across 35 states, said it would hire more employees to meet the customer’s needs, analysts also expect demand to increase over the coming days and weeks.

“Grocery stores become the center of the community,” said Doug Baker, vice president of industry relations at food retail trade group FMI. “It’s the lifeline during a time of disaster. They are on the front lines.”

Kroger has generated identical sales growth of 2% year over year in the fourth quarter; its digital sales grew 22% from the same period a year ago. The company could easily surpass its previous targets for this year considering the robust growth in demand. Previously, Kroger guided adjusted earnings per share in the range of $2.30 to $2.40.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account