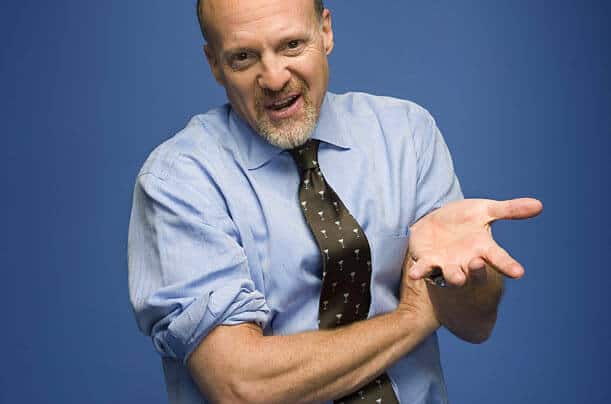

Jim Cramer considers General Electric Company , Dow Chemical Co and RR Donnelley & Sons Co , as three solid stocks that got mindlessly beaten down on Monday. Market sell-offs create panic in the minds of investors. Nothing can escape from the downward spiral. But the hysteria eventually evaporates and reason returns. It is then that investors realize they have offloaded otherwise good stocks, whose fundamentals remains intact.

“It is as if the whole cohort of decent stocks with good yields and some economic risk has to be banished from portfolios wherever they might be found,” Jim Cramer said.

Jim Cramer Believes in General Electric Company ’s Turnaround

General Electric has a 3.5 percent yield, with one of the fastest organic growth rates among the major industrials. The return to roots is successfully playing out, as the firm becomes more and more industrially focused. Finance, which used to be a big part of the business, currently accounts for only 10 percent.

Of course, sceptics might point out that it derives 6 percent of its revenues from the trouble-ridden China, and 13 percent from the crumbling oil and gas space. But Jim Cramer argues that the remaining 81 percent of the firm is growing nicely. So don’t be surprised if hefty dividend hikes and more share buyback happen.

Dow Chemical Co

Dow with a yield of close to 4 percent is a fantastic stock, considering that the 10-year Treasury offers slightly more than 2 percent.

Dow Chemical has proven to be among the most consistent performers in the market. Growth is not its forte; but with competitive advantage, and steady gains on the bottom line, earnings will likely be strong in the next few quarters. Why would anyone want to sell such a stable stock during such a volatile market?

RR Donnelley & Sons Co

Wall Street has for long undervalued this firm. The commercial printing giant has a huge cash flow, and Cramer is flummoxed as to why anyone would want to part with a firm that is paying investors a 6.6 percent yield to wait for its breakup into three separate firms that will potentially unlock further value.

Tom Quinlin, president and CEO of RR Donnelley & Sons Co , believes that each of these new entities – a printing firm, a financial data services firmand a multi-channel communications firm- will be instant leaders in their industries.

Shares of General Electric Company were hammered a massive 21 percent on Monday. It was the biggest one-day drop since 1987’s Black Monday. Dow Chemical Co is down 12 percent in the past 5 trading sessions, and closed Tuesday at $39.39.

According to Jim Cramer, “Declines like we have seen in these three stocks have become endemic in this market.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account