NVIDIA (NASDAQ: NVDA) stock price rallied sharply following higher than expected results for the second quarter fiscal 2020. Its shares jumped from $148 at the beginning of this week to $170 a share at present. Before this rally, NVIDIA share price remained volatile since the beginning of this year. The stock had lost half of its value during the final quarter of last year.

Traders are questioning whether the rally is a dead cat bounce or the stock is set to extend the upside momentum.

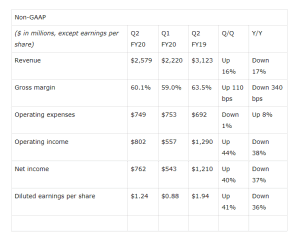

It has beaten revenue estimates by $30 million and topped analysts’ consensus earnings estimate by $0.09 per share. Its revenue of $2.58 billion increased 16% from the previous quarter but declined 17% from the year-ago period. Similarly, the company’s gross margin and operating income improved from the previous quarter. Its earnings per share of $0.90 jumped 41% from the first quarter this year.

“We achieved sequential growth across our platforms,” said Jensen Huang, founder, and CEO of NVIDIA. “Real-time ray tracing is the most important graphics innovation in a decade. Adoption has reached a tipping point, with NVIDIA RTX leading the way.”

The company has been investing heavily in growth opportunities to expand its revenue base. It is investing in conversational AI along with autonomous systems. It is also actively working on the acquisition of Mellanox – which is a leading supplier of end-to-end Ethernet and InfiniBand intelligent interconnect solutions and services.

NVIDIA expects further improvement in financial numbers in the following quarters. It expects Q3 revenue to stand in the range of $2.9 billion, higher from second-quarter revenue of $2.58 billion. The guidance for diluted earnings per share for Q3 is $1.24 per share.

The company appears in a strong cash position to back the potential investments. Cash, cash equivalents and marketable securities at the end of Q2 were $8.47 billion, high from $7.80 billion in the previous quarter. On the whole, NVIDIA stock price rally is not a dead cat bounce. It is supported by improving financial numbers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account