Hilton Hotels (NYSE: HLT) is among the most beaten-down stocks in the coronavirus selloff, but investors are eyeing it to ride the recovery and outperform its rivals on its wider margins. Higher margins would permit Hilton to offer bigger discounts to customers once business travel resumes after the pandemic.

The chain, which runs almost 6,000 hotels in 117 countries, is just over 7% up in afternoon trading today at $77.50, and is 25% up over the last five days. However, the group is 30% down in the year-to-date, reflecting the impact travel restrictions caused by the pandemic has had on the travel industry.

However, Billionaire investor Bill Ackman has bought “around $2bn worth of equities” in the last ten days, backing sound firms to take market share from rivals when they come out of the health emergency. The chief executive of New York hedge fund Pershing Square has hoovered up shares in a host of firms such as Starbucks, Berkshire Hathaway and Hilton.

“We’re very bullish, and we do think there are certain companies obviously, we like more than others,”Ackman told Yahoo Finance on Monday. “You’ve got to have a strong balance sheet to withstand the current environment.”

The fundamentals of Hotels stocks strengthened after a stimulus package of $500bn for troubled corporations to cope with the fallout of the coronavirus outbreak – these companies would have easy access to cash through loans from Fed against the equity stake to cover wages, salaries, and benefits of its employees.

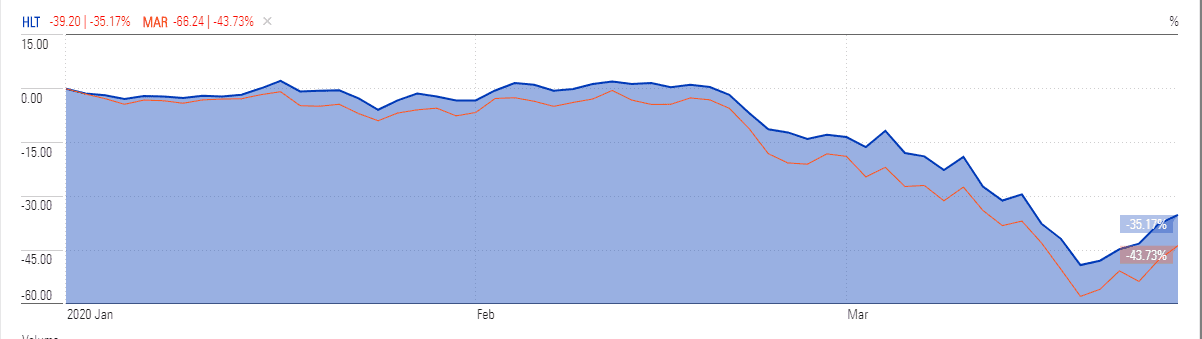

Gina Sanchez, chief executive of money manager Chantico Global, said she was confident in the recovery of hotel stocks, prefers Hilton stock over Marriott (NASDAQ: MAR) to ride the recovery following the share price selloff over the last month.

Hilton is outperforming Marriott due to its strong margin in Gina Sanchez’s view. “The hotel stock that I think has the best quality is going to be something like Hilton. Hilton has very, very high operating margins, meaning that they can cut into those quite a bit. Marriott was a lot more leveraged in that regard. So I think that Hilton, of all of these, they look good on several levels,” she said.

Nomura provides Buy ratings for Hilton stock, citing strong cash position and fee-based business model a key weapon to survive from most economic stresses. Its analyst Harry Curtis is bullish about both Marriot and Hilton. “Both companies have ample cash on hand and in revolvers to weather this downturn for at least 24 months, and they have sources of incremental liquidity if needed,” Harry Curtis said.

However, Bill Baruch, president of investment firm Blue Line Capital, is down on the hotel sector overall. “I just don’t think this is a space that you need to be in right now. Here’s the thing, hotels, overall, they’re overbuilt. There’s simply too many of them already. Now you’re removing travel, you’re taking away discretionary spending,” Baruch told CNBC on Wednesday. “There’s still too much uncertainty in the States right now.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account