Warren Buffet, one of the largest and most prominent stock market investor, has constantly been showing confidence in Amazon’s (NASDAQ:AMZN) share price upside potential. Warren Buffett’s Berkshire Hathaway has raised their stake in Amazon by 11% in Q2. They now hold 537K shares worth close to $1B.

Amazon share price rose sharply in the past five years; AMZN stock price jumped from $300 level to an all-time high of $2000 mark. Its shares are currently trading around $1800.

Amazon’s future fundamentals are supporting the upside momentum. The company has been aggressively working on expanding its revenue growth by taking innovative moves. For instance, the company experienced strong customer’s response to its one-day delivery. It also offers free one-day delivery to Prime members on almost ten million items.

Amazon sales grew to $63.4 billion in the second quarter, up 20% from $52.9 billion in the same period last year. The company expects sales growth to stand in the range of 24% in the third quarter of this year. It has successfully converted significant sales growth into big profits. The company has generated earnings per share of $5.22 compared to $5.05 per share in the past year period.

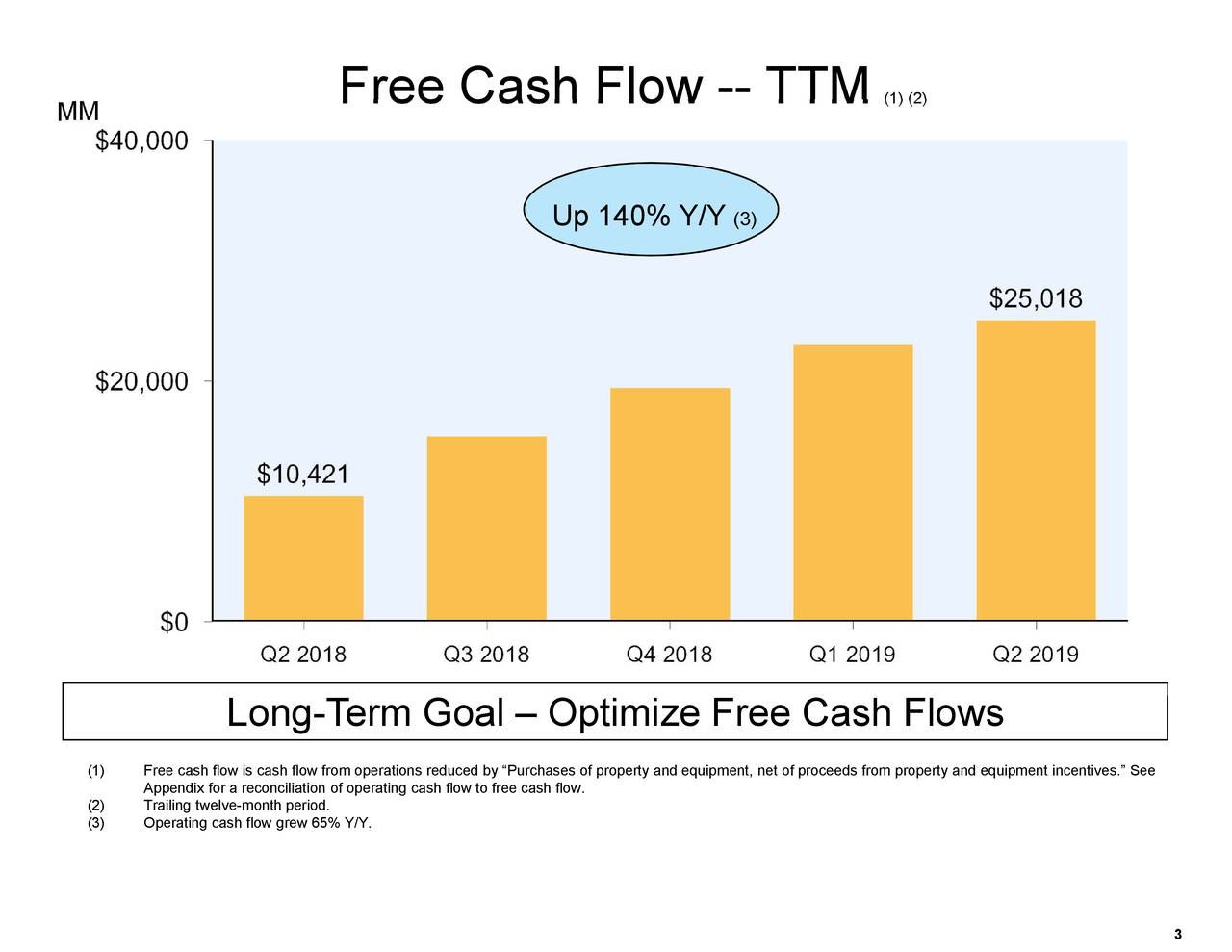

On top, its cash generation remains robust. Its free cash flows grew to an all-time high of $36 billion in the trailing twelve months, up 65% from the same period last year. The significant growth in cash flows indicates its investment potential in growth opportunities. The company also seeks to use cash flows for share buybacks – which always create a positive impact on share price performance.

Market pundits are bullish about Amazons share price upside potential. For instance, Goldman Sachs says, “With revenue growth accelerating, we continue to believe AMZN represents one of the best risk/rewards on the Internet and remain Buy-rated with a 12-month price target of $2,400.” Stifel, JPMorgan, and Evercore ISI analysts are also bullish on AMZN share price upside.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account