Intel (NASDAQ: INTC) stock price rallied sharply in the last two months after experiencing volatility in the first half of this year. INTC shares soared close to 22% in the last two months alone.

The stock is currently trading around 52-weeks high of $57. Low valuations combined with strong growth prospects are supporting bullish case.

Analysts believe Intel stock price has further upside potential in the days to come. INTC shares are currently trading around 12 times to earnings and 3 times to sales. Its stock is also likely to receive support from improving market trends in PC and data center markets.

Analysts Boosted Intel Stock Price Target

Market pundits have raised INTC shares target following stronger than expected results for the latest quarter. Northland Capital increased the Intel price target to $69 with an Outperform rating. The firm is seeing a lower cost structure and growth in earnings in the coming days.

The firm says, “INTC’s modem business to Apple reduced operating expenses moving forward by about $450M per year, adding $0.10 in earnings.”

Morgan Stanley has set the Intel price target at $65 with Overweight ratings. MS believes that INTC has strong long-term opportunities. In addition, its process and design have returned to a much tighter level of coordination.

Nomura claims that Intel is in a position to offer cash returns to investors as it is working on the right priorities. Nomura set a price target of $65 for Intel.

INTC Shares Received Support from Outlook

The company has increased its outlook for the fourth quarter amid strengthening demand. It expects Q4 revenue in the range of $19.2B compared to the consensus estimate for $18.83B.

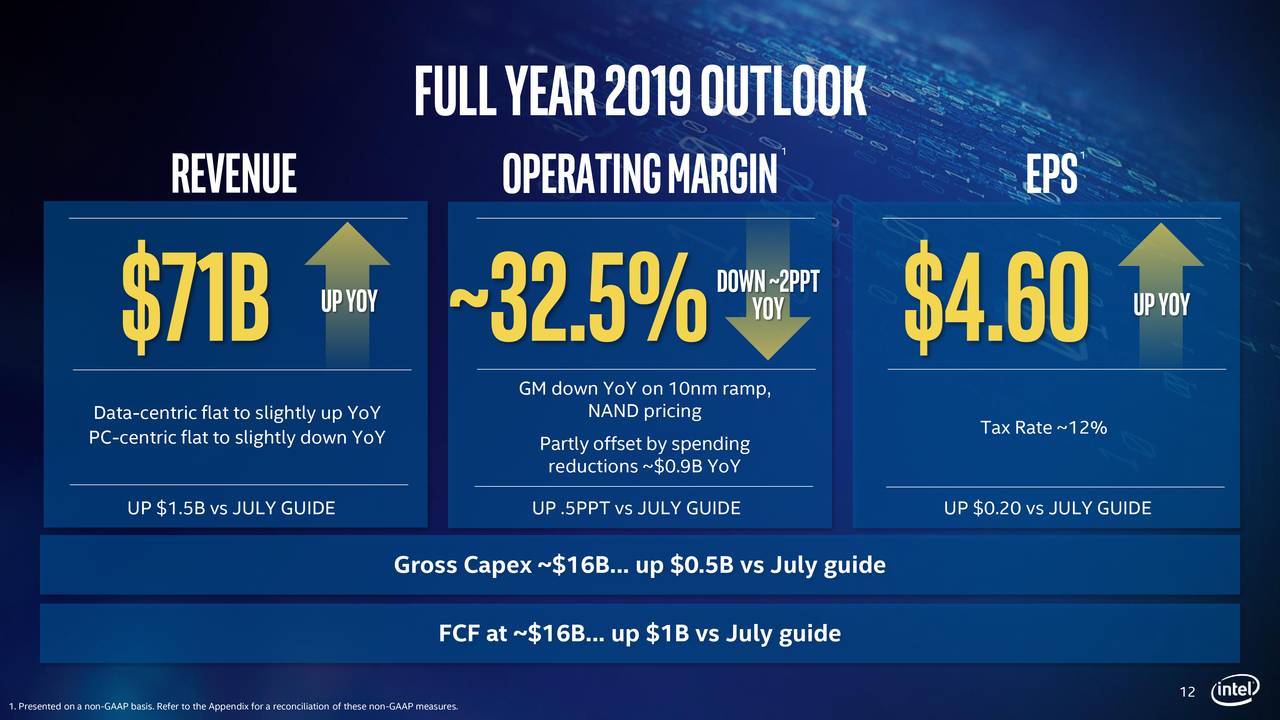

The earnings are likely to stand around $1.24 per share relative to the consensus for $1.21. Moreover, the company has also raised full-year revenue and earnings guidance to $71B and $4.60, respectively. On the whole, the analyst’s higher price targets and significant growth in financial numbers are the biggest catalysts for Intel stock price.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account