HP (NYSE: HPQ) stock Price has been extending the bearish trend over the last twelve months. The market analysts expect the extension of the downtrend in the coming days. Lower than expected earnings outlook contributes to bearish sentiments.

Traders are showing concerns over the bleak outlook for the printers market. The company has missed printing revenue estimates by a wide margin in the latest quarter.

HP stock price is currently trading around 52-weeks low of $18. The shares slid 10% year to date. The stock had hit 52-weeks high of $27 a share during the final quarter last year.

Analysts Downgraded HP Stock Price

Analysts have lowered their price targets and stock price rating for HP. UBS has dropped its price target to $20 from $26 with a Neutral rating.

Bernstein has downgraded HP stock to Market Perform from Outperform with a price target of $5 from $20. Bernstein analyst Toni Sacconaghi believes the potential for greater structural headwinds for printing due to the shift to digital.

The analyst also predicts that the growth in the PC business is unsustainable. Higher valuations and lack of catalysts would also impact share price performance.

Lower Outlook Could also Impact Stock Price

HP has reduced its outlook for the full year due to restructuring actions. It guides FY 2020 earnings per share in the range of $1.98-$2.10. This is significantly below from the $2.18 analyst consensus estimate.

The company believes restructuring actions will create a negative impact in the short-term. The restructuring efforts would help in saving $1 billion in the long-term.

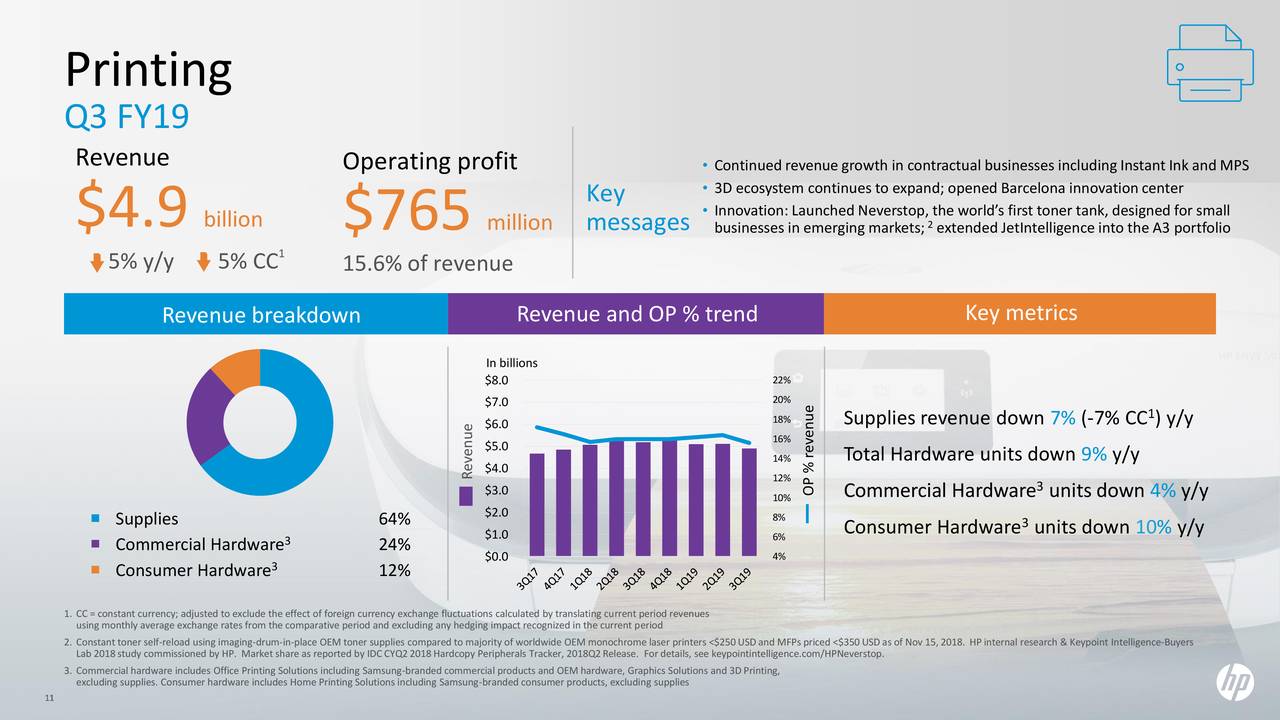

Lower revenue from the printing segment is another headwind. Its printing revenue of $4.91 billion in Q4 declined considerably from the consensus estimate for $5.07B.

Overall, HP stock price is likely to remain under pressure in the short-term. This is mostly due to lower demand for printing and macroeconomic headwinds for the PC segment. Therefore, the dip in its share price isn’t a buying opportunity.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account