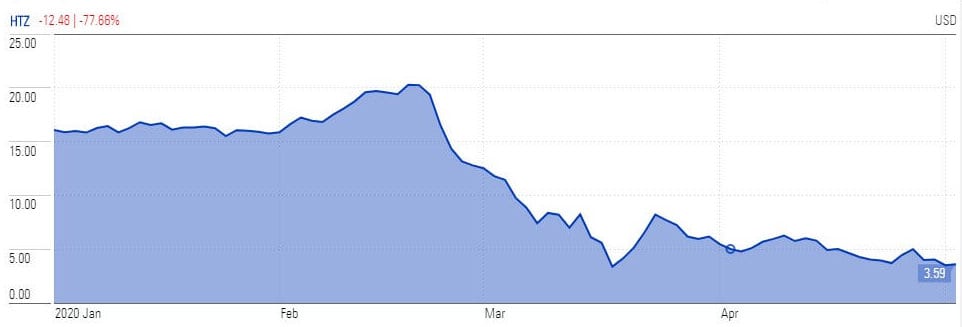

Hertz (NYSE: HTZ) stock plunged 23% below $3 in after-hours trading for the first time in history after reports that the company has hired an additional adviser for chapter 11 bankruptcy preparations if it fails to get a grace period on a missed debt payment.

Hertz, which missed lease payments last week, has hired FTI Consulting, which specializes in restructuring and bankruptcy cases, to help restructure its $17bn in debt.

The Florida-based car rental company is burning close to $200m a month due to coronavirus stay-at-home restrictions, according to reports in the Wall Street Journal.

The rising competition from Uber (NYSE: UBER) and Lyft (NYSE: LYFT) has been forcing Hertz to spend more on growth activities and marketing efforts, which is resulting in big losses over the past few quarters. Its cash flow generation also remained negative in past quarters due to losses and higher investments in growth opportunities. Its net debt rose to $17.1bn in the latest quarter from $16.32bn in the year-ago period.

In March, the group furloughed almost 10,000 workers and cut executive pay. The business has around 38,000 employees worldwide, with about 29,000 of those in the US.

Hertz stock trading reflected the difficult market conditions for the car rental company. Its shares plummeted from the 52-week high of $21 in late February to below $3 at present with expectations that it could stand among the penny stocks if the business environment remains negative for the short-term.

Hertz operates from 12,400 locations worldwide and provides both airport and off-airport vehicle rental and leasing services, with close to 567,600 vehicles in the US and almost 204,000 vehicles in international operations.

If you plan to invest in stocks or you want to short Hertz stock, you can check out featured stock brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account