Hasbro (NASDAQ: HAS) stock price jumped 12.5% as the world’s largest toymaker said it has strong demand for toys its products during the coronavirus pandemic and that its plants in China has restarted production. The stock closed Monday at $51.87.

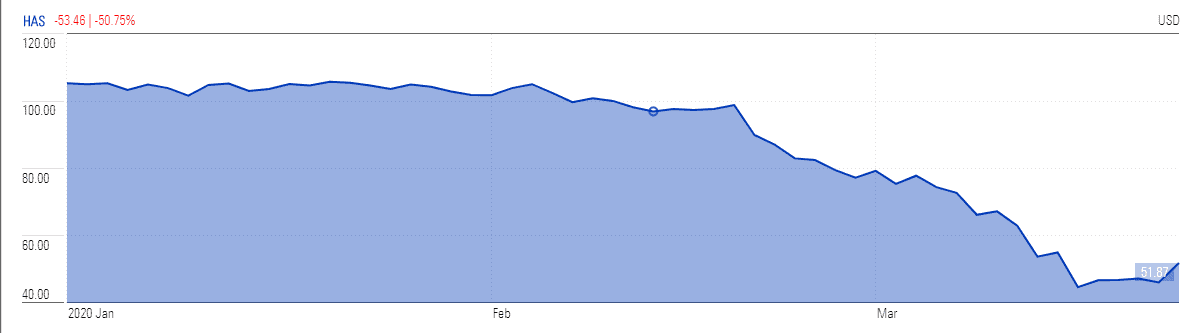

Hasbro – which makes Monopoly, Marvel superhero figures and My Little Pony – plunged more than 50% from February high of $105 a share due to trader’s concerns over growing uncertainty about the consequences of the coronavirus. Hasbro shares hit a seven-year low of $41 a share last week.

The company said it will provide further details later this week on the launch of its new Bring Home the Fun campaign, which encourages families to connect during a time of social distancing.

“Our first quarter has been quite good,” the chief executive Brian Goldner (pictured, left) told CNBC on Monday. “We may miss some shipments as we’re catching up, as production is catching up. We believe that by April our production will be fully caught up.”

Hasbro’s net revenue of $4.7bn in fiscal 2019 increased by 3% from a year ago.

The group completed £4bn acquisition of Canadian film and TV Studio Entertainment One, which owns the Peppa Pig and PJ Maska children’s series, furthering Hasbro’s growth in the infant and preschool categories.

Hasbro’s dividends also appear safe following Goldner’s confidence in supply and demand. The company has increased dividends for ten years in a row. It currently offers a quarterly dividend of $0.68 a share, yielding around 5.24%. The company had generated $400m in operating cash flows while dividend payments stood around $336m. It ended the latest quarter with cash and cash equivalents of $4.58bn, including $3.4 billion of Entertainment On acquisition financing.

UBS has set Hasbro stock price target at $117 with a buy rating, citing a lot of room for margin expansion in the coming quarters.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account