Gun stocks edged higher after another night of civil unrest in the US with violent incidents continuing in New York City, Los Angeles, Buffalo, Las Vegas and St. Louis.

As gun demand “remains strong as civil unrest increases with the George Floyd [who died while being detained by police officers] protests, near-term firearms demand probably also would be “bolstered” if the election prospects for Democratic presidential nominee Joe Biden strengthen, given the party’s “more restrictive stance on gun control,” said Cowen’s guns and ammunition analyst Cai Von Rumohr.

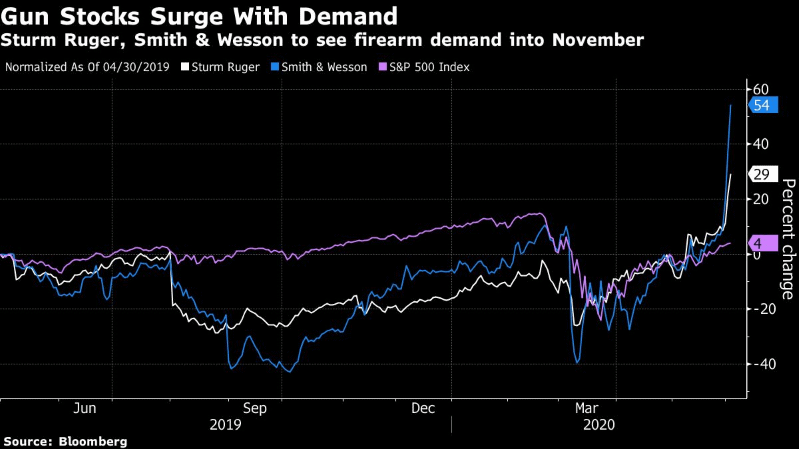

Shares of gun makers Sturm Ruger & Co. Inc. and Smith & Wesson Brands Inc. soared 14% and 25%, respectively, over the past two days. They’ve also outperformed the broader market over the past 13 months, with a strong surge coming since mid-March.

That correlates with meaningful year-over-year gains in adjusted background checks of 80% in March, 69% in April and 75% in May. That’s a significant jump from the adjusted gains of 19% and 17% in January and February respectively.

Gun stocks have typically been volatile in response to political and regulatory changes and pressures. AGF investments chief US policy strategist Greg Valliere said on Monday that, “we think — as of now — that the Democrats are within sight of controlling the House, the Senate and the White House.” This will drive “continued demand in June and through the fall,” Lake Street analyst Mark Smith wrote in a note on Tuesday.

As gun stocks are soaring after a weekend of civil unrest in the US investors are using the best free apps for Android or iOS or buying shares of gun and ammo companies through the best stock brokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account