Greece is still in the midst of talks with the Euro group in order to find a long term solution to its current issues, but even as the country slides further and further toward an exit from the Euro, it seems that its debt is still guarded by the implicit guarantee of the money union.

Over at MarketWatch today, Brett Arends did the math and found that Greek long term bonds are a much better bet for traders than those of Germany even if the country refuses to pay the majority of the debt that it owes. Mr. Arends found that Greece could default on 70% of its debt and still leave those holding bonds with a better deal than the German Bund.

Greece benefits from Euro halo

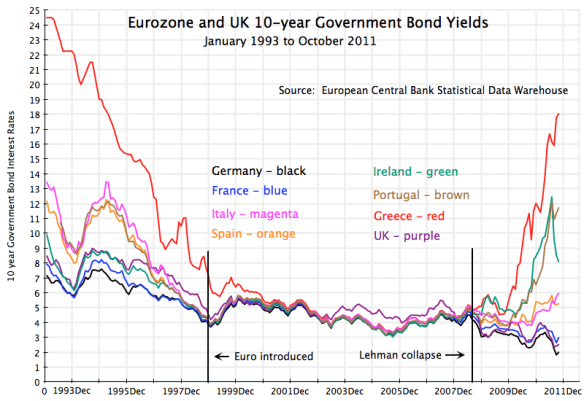

In the years leading up to the launch of the Euro and the years after it came to be, bonds in riskier countries in southern Europe became more expensive, and yields shrank. This was the implicit guarantee of being a member of the Euro. Cheap borrowing, allowed by that aligning of bond yields, was one of the many factors that lead to today’s euro crisis.

That move can clearly be seen in the chart above.

With Greece headed for an exit from the Euro zone and bond yields well above where they were before the crisis hit, one might assume that the promise of the Euro that shielded Greece from high rates is gone. That may not be true in the long term.

30 year bonds in Greece have a yield of around 13.5 percent on today’s market. With German yields at 1.4 percent for the same length, it’s clear that the market is pricing risks into Greece’s long term debt. That risk may be softened, however, by a market belief that Greece will stay in the Euro, or that it might be back again.

Betting on Greek debt

Investing in Greek debt may seem a bad idea with a haircut around the corner, but according to the math done by Mr. Arends, if you buy an equal amount in Greek bonds and German bonds on this morning’s market, you will end up with the same return if Greece does a 73% haircut on that debt.

The implicit guarantee that boosted the price of Greek bonds by so much in the late 1990s and early 2000s may still be priced into debt in the country in the years ahead.

That doesn’t mean there are no risks to money put into long term Greek bonds, nor does it mean that its an ideal way to bet on the future of the country. It’s simply a metric of what the bond markets seem to think about the future of the country.

If talks fail Greece may seek to do much more than a 70 percent cut on outstanding debt, and the country may default again and again over the coming years.

There are also many different ways to interpret the same numbers, especially those from a bond market in the midst of a crisis. Mr. Arends says that German bonds could be riskier than those from Greece over a 30 year period.

It may be, however, that the market is giving Greek bonds the “Euro halo” it had before some years down the road, making yields lower than they would be otherwise.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account