Goldman Sachs saw its quarterly earnings almost halve as its set aside cash to cover expected defaults due to the coronavirus pandemic and suffered losses at its asset management unit.

The New York-based investment bank said net profit fell by 46% to $1.12bn in the first quarter ended March 31, from $2.18bn a year earlier. Earnings per share tumbled to $3.11 from $5.71.

Goldman revenues remained largely unchanged, ending the quarter at $8.7bn compared to $8.8bn for the same period, while operating expenses increased by 10% as a result of higher costs across the board with a special emphasis on brokerage, clearing, exchange and distribution fees which jumped by 28% as a result of “an increase in activity levels”.

It also ramped up its provision for credit losses by 318% during this quarter, moving from $224m last year to $937m, anticipating an increase in defaults derived from a deteriorating economic environment sparked by the health emergency.

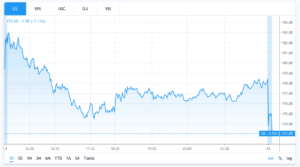

Goldman shares slipped 3.6% on morning trading, and have lost around a quarter of its value this year, as investors fear banks will suffer loan defaults as the world seems set for a recession caused by stalled economic activity.

Goldman Sachs’ chief executive, David Solomon (pictured) said: “Our quarterly profitability was inevitably affected by the economic dislocation. As public policy measures to stem the pandemic take root, I am firmly convinced that our firm will emerge well-positioned to help our clients and communities recover.”

Goldman’s quarterly report shows poor results from its asset management unit, which lost $96m compared to the $1.8bn it earned last year as a result of “significant net losses in lending and debt investments and net losses in equity investments”.

Revenue at the group’s trading division, its single biggest business, surged 28% to $5.16bn as the bank’s traders took advantage of higher market volatility and client activity. Fixed-income trading revenue came in at $2.97bn, the division’s best results in five years. Equities revenues totaled $2.19bn, the second-best quarter in five years.

Goldman Sachs, which as more than a 150 years old, is a pillar in the global investment banking, providing a wide range of financial services including investment banking, financial advisory, asset and wealth management, and clearing services. The bank employs around 38,000 employees and manages approximately $2trn in assets for its clients.

The group’s tier 1 capital ratio, a key measure of a lender’s strength stood at 12.5%, down 0.8% compared to the same quarter last year and the bank currently sits on $106bn in cash and equivalents. The board approved a quarterly dividend of $1.25 per share, to be paid on June 29, 2020.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account