New-York based investment bank Goldman Sachs recently revised its 2020 GDP estimates for the US economy, as coronavirus cases in the country reach all-time highs and lockdown fears loom in the backdrop.

The bank’s team of economists, led by Jan Hatzius (pictured), is now forecasting a deeper contraction during the third quarter of the year, anticipating a 33% drop in the country’s gross domestic product, worst than the 25% they initially estimated.

As a result, Goldman Sachs said in a private note sent to clients over the weekend, America’s GDP could now see a 4.6% annualized drop by the end of 2020, up from the 4.2% contraction the bank initially forecasted.

“Over the last few weeks, the Covid situation in the U.S. has worsened significantly to the point where the U.S. is now a notable outlier among advanced economies”, Goldman economists said.

However, the bank still believes a swift economic recovery in 2021 is likely, forecasting a 5.8% jump in the country’s GDP by the end of next year, while it also revised down its unemployment rate forecast for 2020 to 9%, lower than 9.5% the team estimated initially.

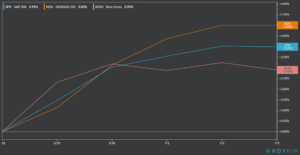

Gloomier economic forecasts and a spike in virus cases in the US appear to go unnoticed by the stock market, as reflected by last week’s performance of the three major US stock indexes, with the NASDAQ leading the charge, posting a 5% gain since 29 June after a 5-day rally.

Meanwhile, the S&P 500 and the Dow Jones Industrial gained 4% and 2.9% during the same period respectively and they appear to be pointing to a higher opening this Monday, rising by 1.6% and 1.9% on pre-market stock trading.

Goldman’s most recent economic forecasts comes as virus cases in the North American country continue their way up, with states like Florida, Texas, California, and Arizona reporting record-high daily case counts while the country as a whole saw an all-time high of 57,000 new cases in a single day on Thursday, only a day before the 4th of July independence day holiday.

The markets seem to be appeased by the fact that the number of deaths resulting from this surge in cases seems to be significantly lower, even though experts have warned that there’s a natural lag between both indicators.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account