Gilead Sciences (NASDAQ: GILD) stock price slashed to 52-weeks low amid investors’ concerns over slower revenue and earnings growth. Its shares are trading around $62, down significantly from a 52-weeks high of $77 a share. Gilead shares are down 18% in the last twelve months.

Although its dividends are safe, the dividend growth is limited. This is due to the sluggish top and bottom-line financial performance – which has been impacting its cash generation potential.

Soft Financials Hinders Gilead Sciences Stock Price

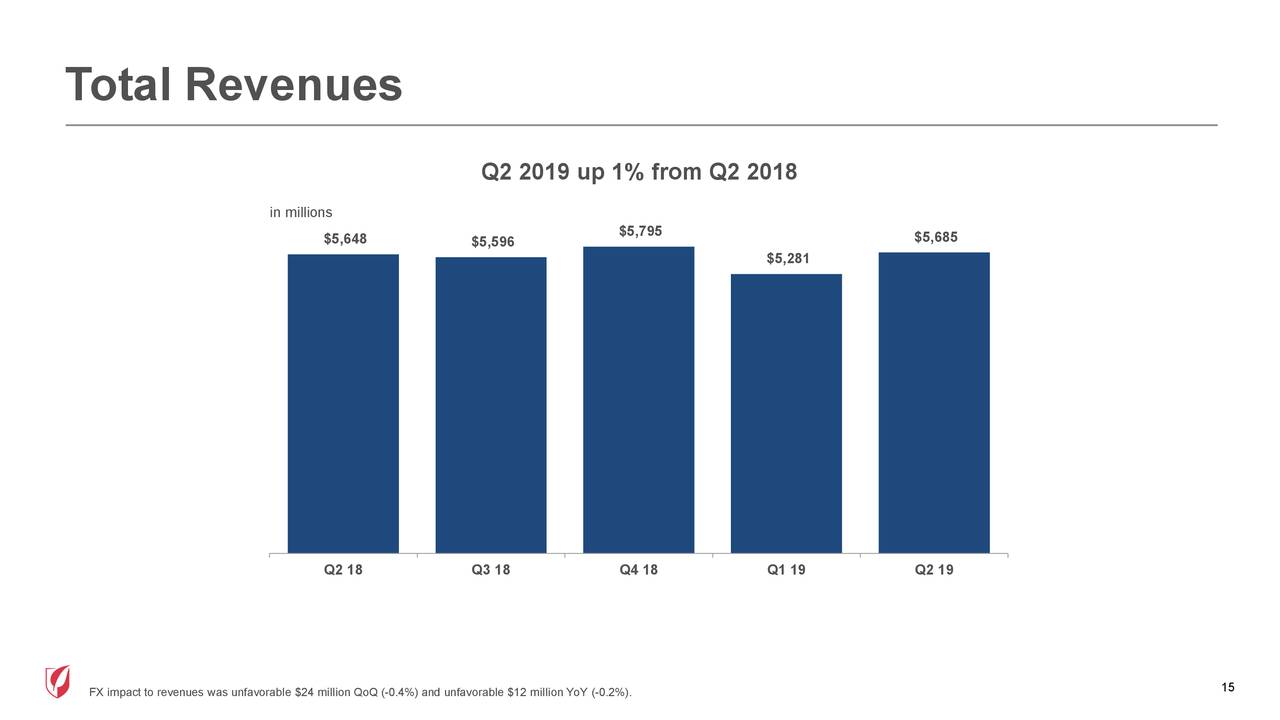

The financial numbers have been impacting Gilead Sciences’ stock price performance over the years. The company’s revenue declined in the past three consecutive years. It has generated revenue of $22 billion in fiscal 2018, down from $26 billion in 2017 and $30 billion in fiscal 2016.

Gilead has generated revenue of $5.6 billion in the second quarter, up only 0.66% from the year-ago period. Its net income improved slightly amid cost cuttings and lower operating expenses. Its Q2 net income stood at $1.9 billion, up from $1.8 billion in the year-ago period.

The company claims that upcoming products are likely to enhance their revenue growth.

“I am also very excited about the progress we are making to strengthen our pipeline, including the recently announced Galapagos collaboration, to bring forward our next generation of products,” said Daniel O’Day, Chairman, and Chief Executive Officer, Gilead Sciences.

The company expects to generate annual revenue in the range of $22 billion. This reflects a decline from $22.13 billion in the past year.

Dividend Growth is Limited

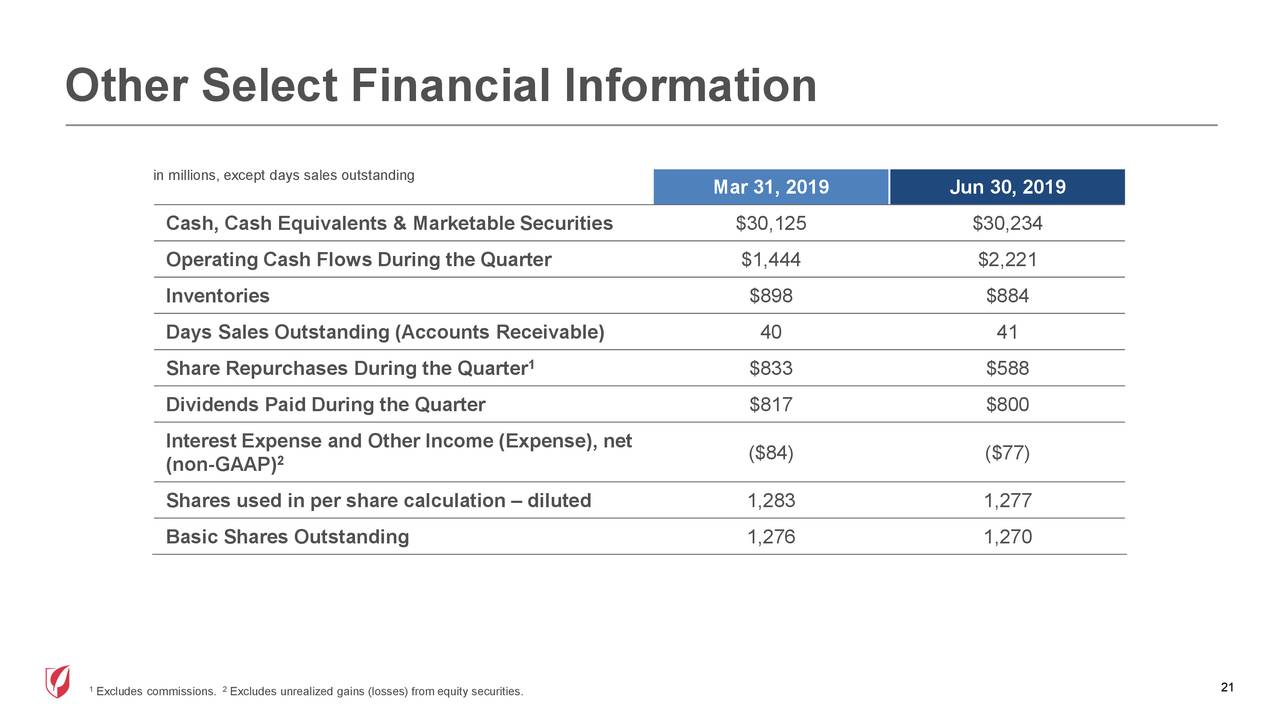

Gilead generated $2.2 billion in operating cash flow in the second quarter. It repaid $500 million of debt. The dividend payments stood around $800 million. It repurchased $588 million of outstanding stock during the second quarter.

Thus, the company has limited potential to make a double-digit increase in dividends. Moreover, its future cash flows are unlikely to increase. Overall, Gilead Sciences stock price has limited upside potential. Its dividend growth is also unsafe.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account