General Electric (NYSE: GE) stock price jumped to the highest level in the last fifteen months amid the substantial improvement in financial numbers. GE share price also received support from the analyst’s positive commentary and price target hikes. The company reported better than expected growth in free cash flows for fiscal 2019; GE expects significant improvement in free cash flows for 2020.

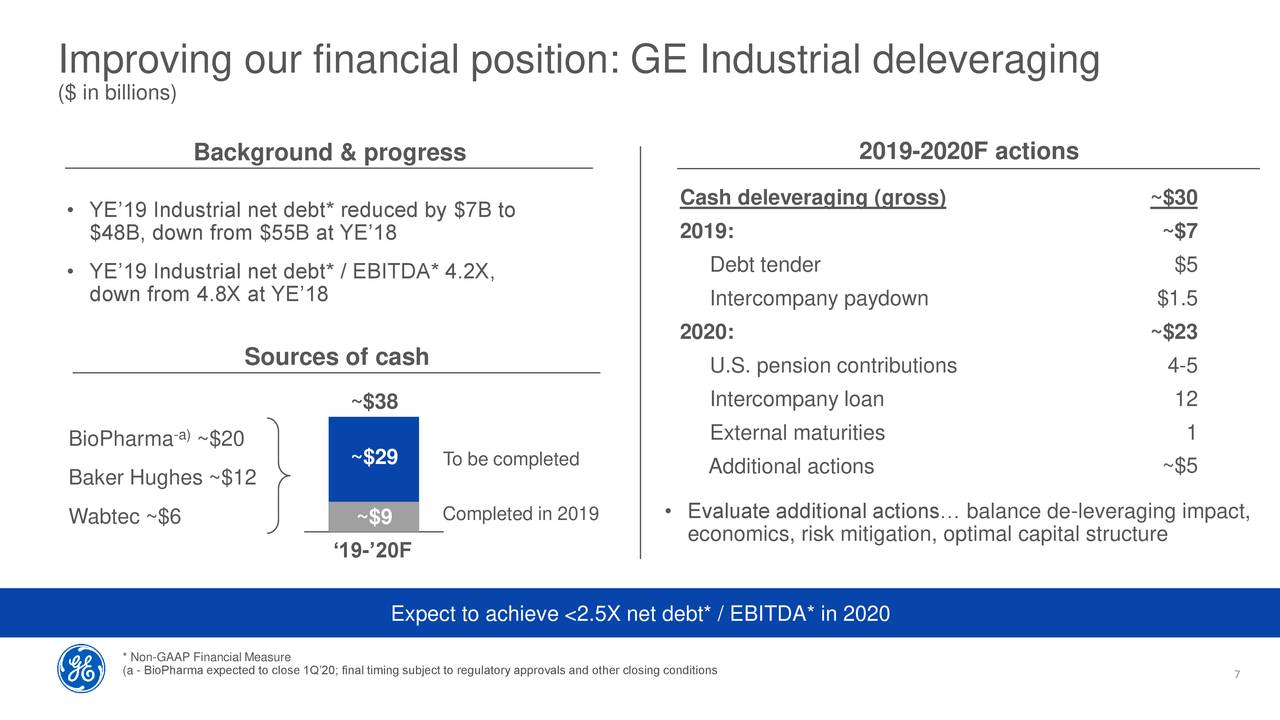

General Electric share price soared close to 25% in the last twelve months. The company’s strategy of selling billions of dollars of assets along with investments in industrial and power businesses is enhancing future fundamentals. It has also reduced billions of dollars of debt in the past couple of quarters.

Free Cash Flow Expansion Boosted General Electric Stock Price

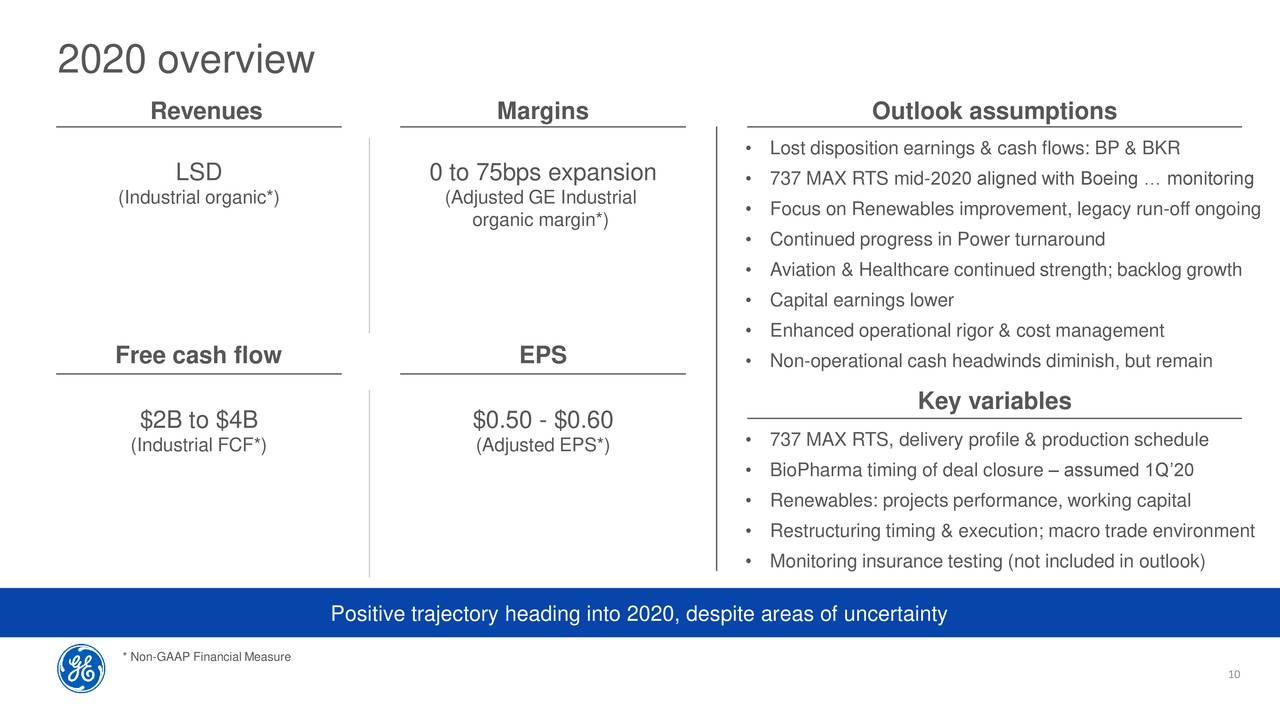

General Electric announced that its manufacturing cash flows are likely to hit $4bn in 2020 compared to the Wall Street expectations of $2.2bn this year. This is up from $2.32bn in the last year. The company praises its Baker Hughes and Wabtec divestitures along with a strong performance from its Healthcare and Aviation segment’s for a robust cash position.

It has also been reducing the debt at faster than expected pace, thanks to cash generation potential. In the last quarter alone, GE reduced consolidated debt by $7B, reducing leverage to 4.2x EBITDA from 4.8x in the previous years. Its adjusted earnings per share of $0.21 enlarged 50% from the year-ago period. GE expects to generate 2020 earnings per share in the range of $0.50 to $0.60.

Analysts See Strong Upside

Although GE share price rallied more than 25% in the past twelve months, the market pundits are anticipating further upside in the coming days. Citi raised the GE price target to $16, citing improving cash generation and declining debt position. “With an initial 2020 outlook indicating an expectation of further progress in its operational and financial turnaround, the shares “could be poised for further upside as GE executes,” Citi analyst Kaplowitz contends.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account