General Electric (NYSE: GE) stock price received support from its strategy of aggressively working on the deleveraging plan. The company is looking to reduce the debt burden to improve its credit ratings and liquidity position.

The stock price is trading around $8 over the last two months. General Electric stock price is struggling to achieve a double-digit figure. Bulls believe the strategy of selling noncore assets to improve the balance sheet would boost GE shares in the coming days.

Deleveraging Plan Could Boost General Electric Stock Price

The company has been aggressively working on the deleveraging plan over the last year. This time, the company announced to freeze pension plans of about 20,000 U.S. employees with salaried benefits. This action is likely to decrease GE’s pension deficit around $5B-$8B and net debt by $4B to $6B.

On the other hand, GE CEO Larry Culp recently announced asset sales of $38B in cash this year to trim its large debt load. The company also announced to pay $5 billion of debt through a tender offer.

“We want to be optimistic, we want to be positive, but we want to be grounded,” Culp said, adding there is “plenty of wood to chop” in power, renewable energy and in the corporate organization.”

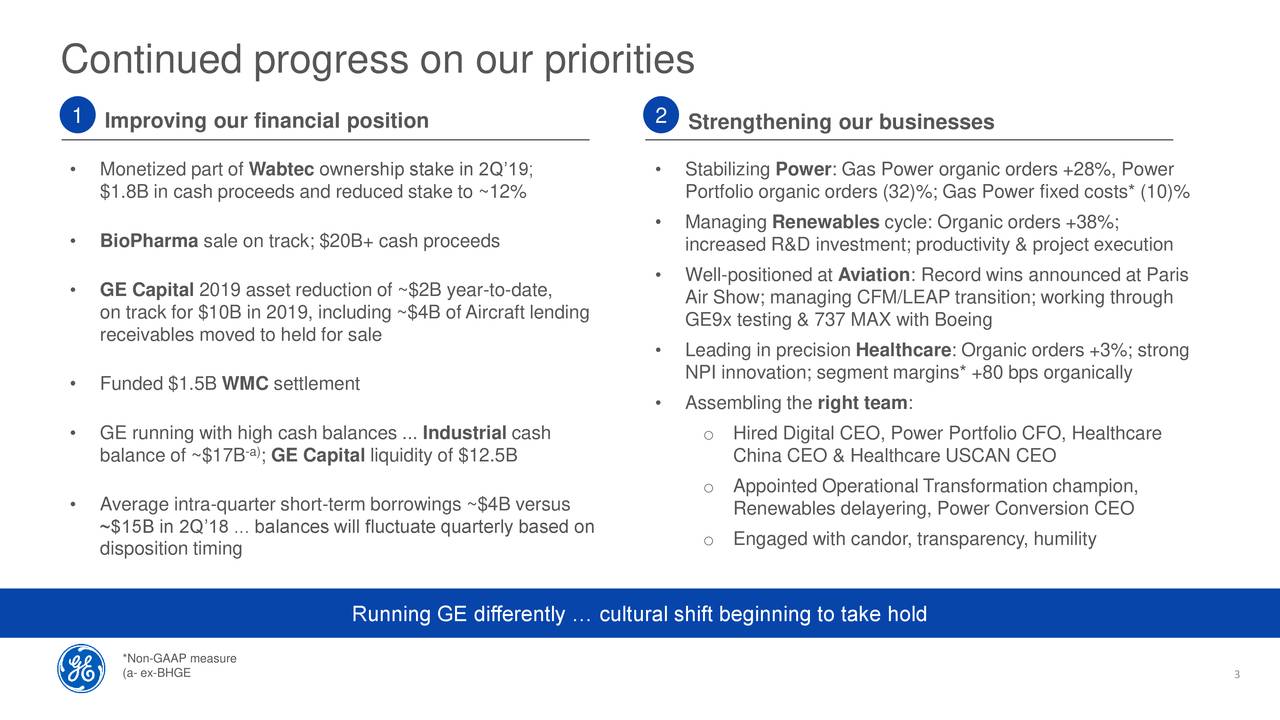

Portfolio Changes are Adding to Growth Potential

The company’s strategy of simplifying the business model is working. GE is focusing on power and industrial business while reducing the concentration on financial and other businesses.

The CEO recently announced that the power segment continues to see stronger than expected demand – which is likely to extend into the next year. In addition, industrial businesses are also showing improvements despite macroeconomic concerns.

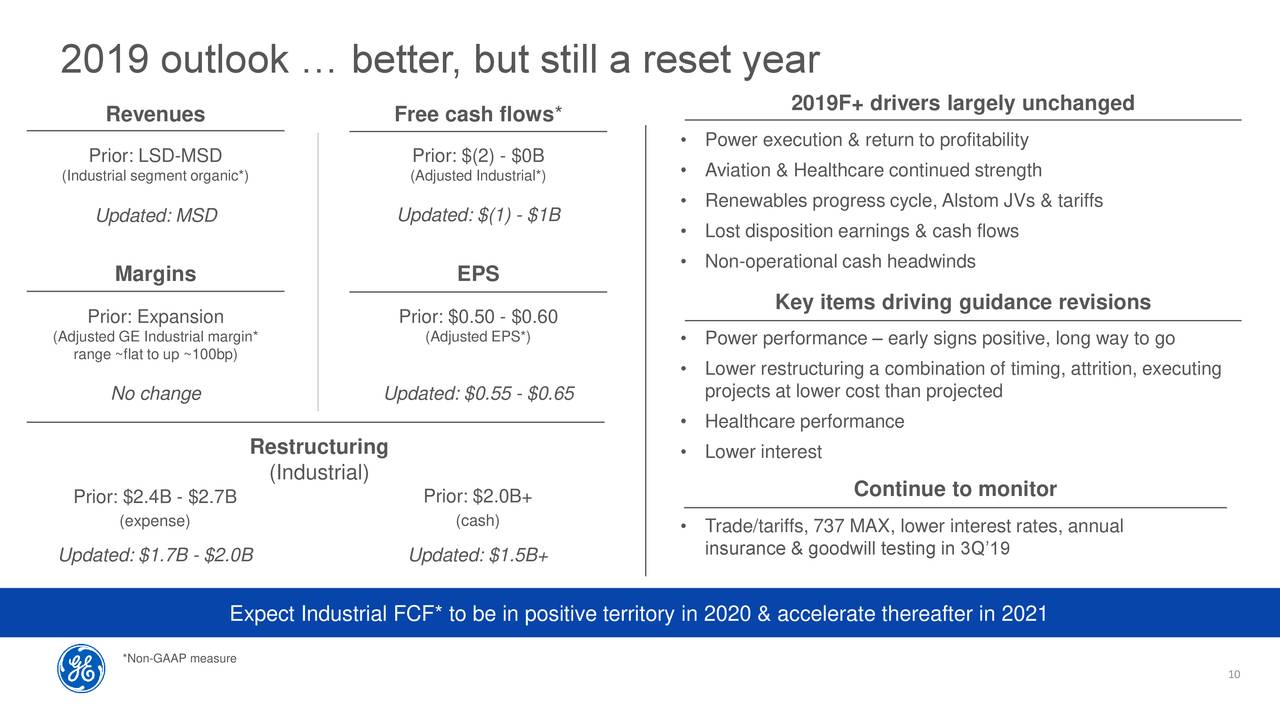

The company expects full-year adjusted earnings per share in the range of $0.55-$0.65, up from previous guidance for $0.50-$0.60. The adjusted industrial FCF is anticipated to stand around $1B. Overall, General Electric stock price is likely to receive support from its restructuring actions.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account