General Electric (NYSE: GE) stock price continues to face big swings since the beginning of 2017. Bearish sentiments regarding lower than expected financial performance had helped in erasing more than 70% of GE stock price value.

General Electric stock price regained some momentum early this year amid new business direction from recently appointed CEO Larry Culp. The CEO has started focusing on power, aviation, and industrial businesses while he is reducing the focus on GE Capital and other businesses. The company is working on the sale of Biopharma business – which is likely to generate $20 billion in proceeds. GE has also sold $2 billion of GE Capital assets.

The company is seeking to use asset sale proceeds for the reduction of its debt along with investments in growth opportunities.

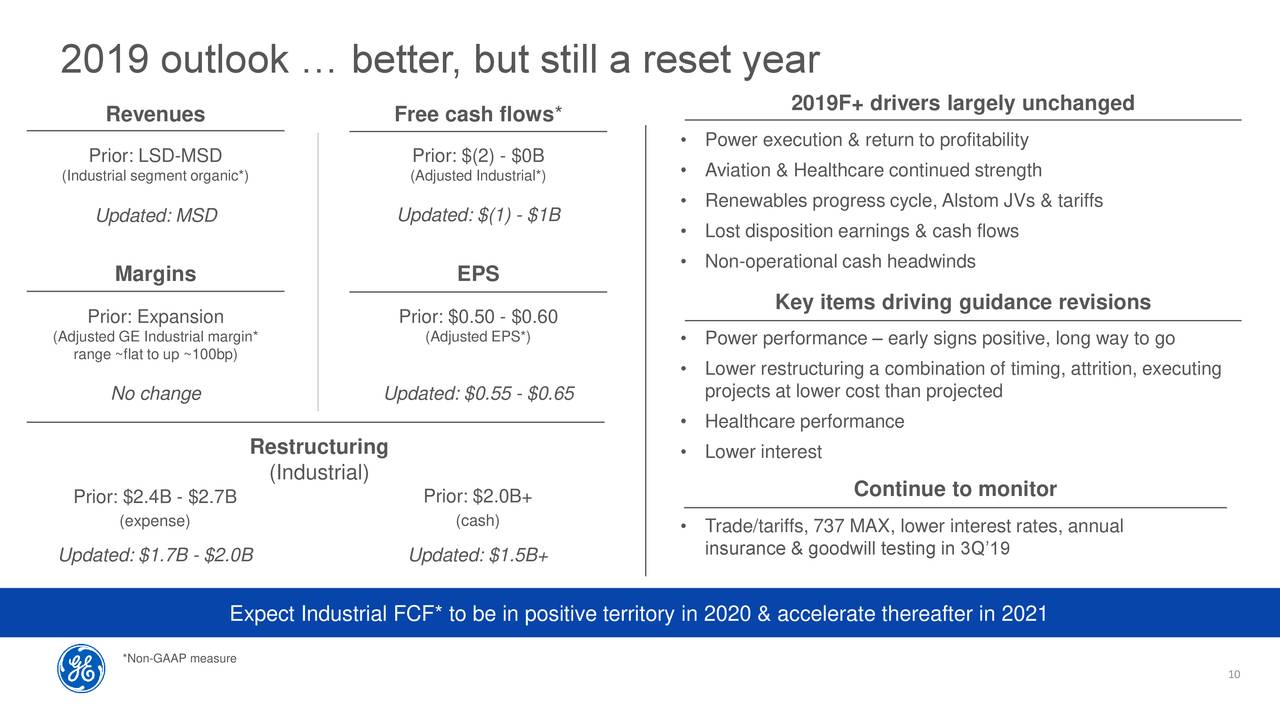

General Electric has generated a revenue decline of 1% in the second quarter while its EPS declined 6% from the year-ago period. However, it expects improvement in earnings per share in the second half of the year. The company anticipates earnings per share in the range of $0.55-$0.65 for 2019, higher from previous earnings outlook for $0.50-$0.60.

Despite all these changes, analysts and investors believe GE needs a longer time for stabilization. For instance, Gordon Haskett analyst John Inch says “The $0.05 EPS increase is less than this quarter’s $0.06 tax benefit” and the cash flow increase “appears to be heavily driven by… reduced cash restructuring drag.”

It true the expected improvement in earnings guidance is mostly due to the potential decline in restructuring expenses. The company now expects the expenses for 2019 at $1.7B-$2B vs. $2.4B-$2.7B.

On the negative side, the unexpected cost of $1.4 billion related to the grounding of 737 MAX continues to hurt investor’s sentiments over the last two weeks. General Electric stock price lost 16% of value following the news of potential loss of $1.4 billion.

GE stock is significantly responsive to bullish and bearish market reports. CEO Larry says the transformation is multi-years. Therefore, General Electric stock price is likely to extend volatile moves until complete stabilization.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account