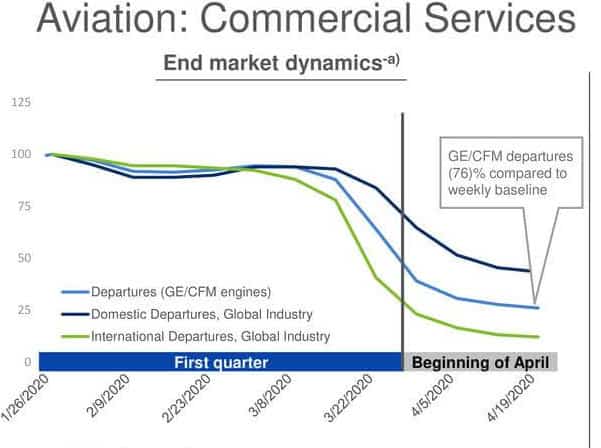

General Electric (NYSE: GE), which has already been struggling for years due to debt loads and cash generation problems, has been dealt a further blow as lockdown restrictions have seen flights plummet, with forecasts for demand to drop 33%-40% from earlier estimates.

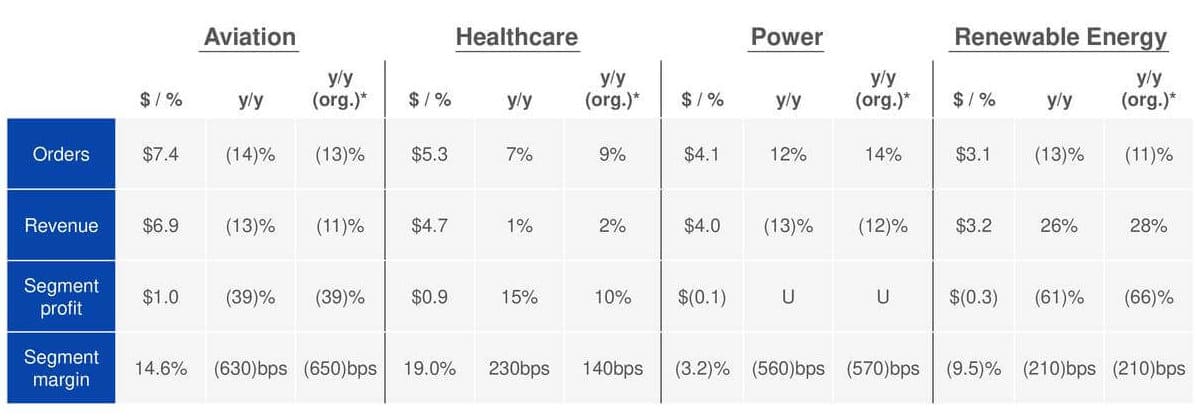

GE Aviation is General Electric’s largest revenue contributor and the most profitable business segment, with first-quarter revenue of $6.9bn and a profit of $1bn.

Investors have reacted strongly to slowing airline industry demand and bleak forecasts. Boeing chief executive David Calhoun said that the airline industry will take several years to completely recover, in a TV interview on Tuesday.

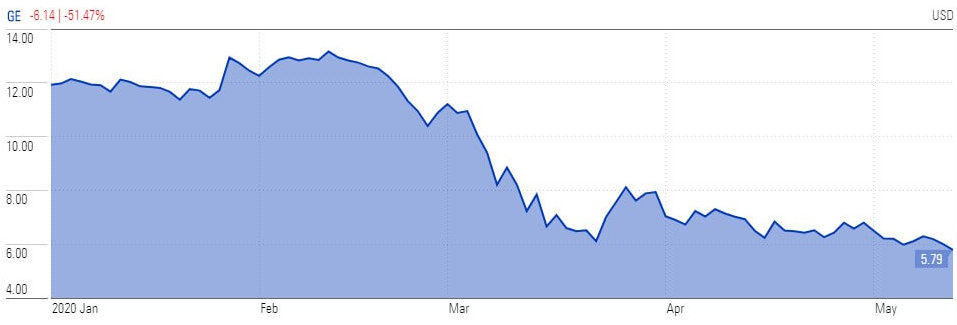

General Electric stock fell to its to the lowest level in three decades on Wednesday hitting $5.59 as a report from International Air Transport Association that says air travel will not recover from the pandemic for another five years. The firm hit its lowest level since 1991, before closing down 21 cents, or 3.5%, to $5.79.

Shares in General Electric have fallen almost 55% in stock trading this year.

The company has already slashed close to 13,000 workers from its jet-engine unit, about 25% of the division’s workforce.

“The deep contraction of commercial aviation is unprecedented … Unfortunately, more [cost-cutting] is required as we scale the business to [reality],” GE Aviation chief executive David Joyce said.

GE chief executive Larry Culp said the group is planning to save $2bn in cost-saving measures, with much of that coming from the aerospace business.

Air travel sentiment has been hit by Warren Buffett’s sale of its entire stake in airline companies last month. The legendary investor said air travel problems will linger for years to come as virus has significantly changed outlook. Buffett also commented on General Electric, saying a surplus of airplanes around the world will shrink demand for GE’s aviation business.

If you plan to invest in stocks, you can review our featured stock brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account