General Dynamics (NYSE: GD) shares retreated after reaching a record level of $190 three months ago. The selloff in the share price of aerospace and defense companies is due to industry-related headwinds.

General Dynamics’ new contract win of $22.2 billion would help in strengthening sentiments. Some investors believe GD shares are presenting an attractive entry point for new investors.

Along with the share price appreciation, the company has been awarding investors with big cash returns in the form of dividends and share buybacks. It offers a dividend yield of 2.22%; the company has raised dividends in the past 25 consecutive years.

Future Fundamentals are Strong for General Dynamics

The company has strong future fundamentals. This is evident from the new contract win combined with a massive backlog of $67.4B. The company signed a new $22.2 billion with the U.S. Navy for construction of nine Virginia-class submarines with Virginia Payload Module.

Previously, the company signed a contract of $1.3 billion with the Canadian government for armored combat support vehicles.

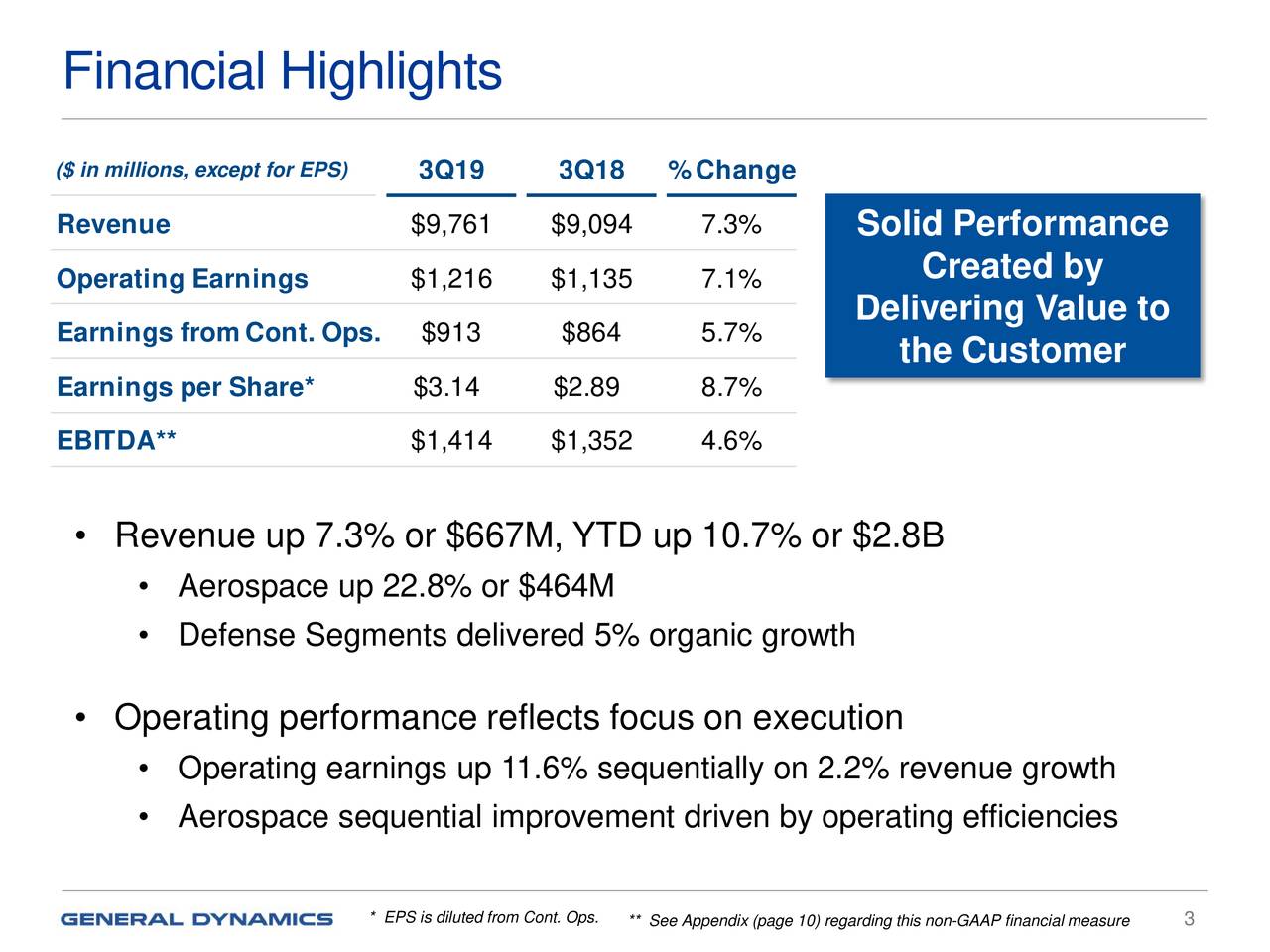

On the other hand, its revenue and earnings growth is likely to accelerate in the coming quarters. In the latest quarter, it generated 7% year over year revenue growth. Diluted earnings per share also increased at a high single-digit rate.

“Our continued focus on operating excellence and driving cost efficiencies, coupled with new business opportunities, should enable us to build on these results,” Phebe N. Novakovic, chairman, and the chief executive officer said.”

Cash Returns and Valuations are Attractive

Its cash returns are safe. Indeed, the company is in a position to offer higher returns in the coming quarters. It generated $1.1 billion in operating cash flows compared to dividend payments of $295 million.

The huge gap in operating cash flows and dividend payments allowed it to return approximately $450 million in share buybacks. In addition, General Dynamics stock price is trading at attractive valuations despite sharp year to date rally.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account