GE (NYSE: GE) stock price bounced to the highest level in the past twelve months, thanks to the big changes in the business model following the arrival of a new CEO. The company needs to sustain the recent momentum along with making more big changes in the operational strategies to prosper in 2020.

The company has announced a business plan of focusing on industrial, aerospace and power-related businesses. This strategy has created a lot of cash for the struggling industrial company. The company had sold billions of dollars of assets in the past couple of quarters.

GE stock price rose by 50% since the beginning of 2019; the shares are currently trading around $11 at present. The company’s share price performance is also correlated to the final quarter results.

New Business Strategies are Adding to Sentiments

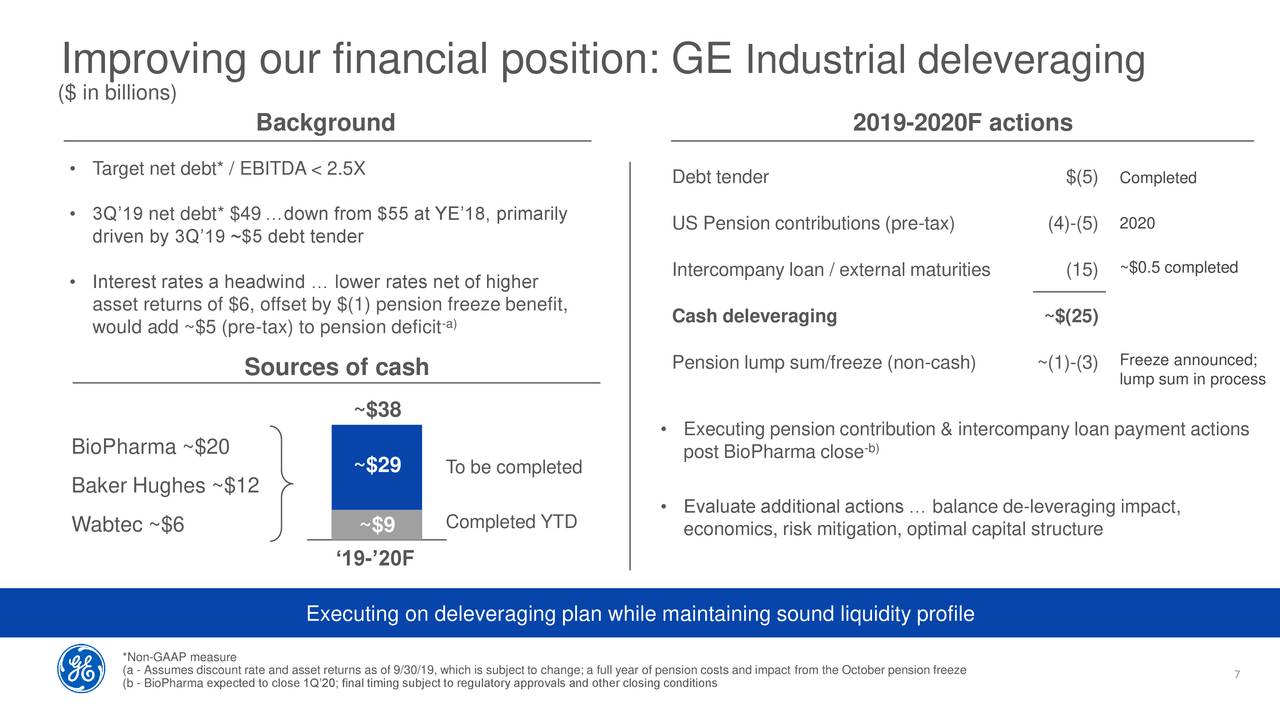

The rally in GE shares has been receiving support from the big business changes announced by GE Chairman and CEO H. Lawrence Culp. These strategies led the company to reduce billions of dollars of debt in the past few quarters.

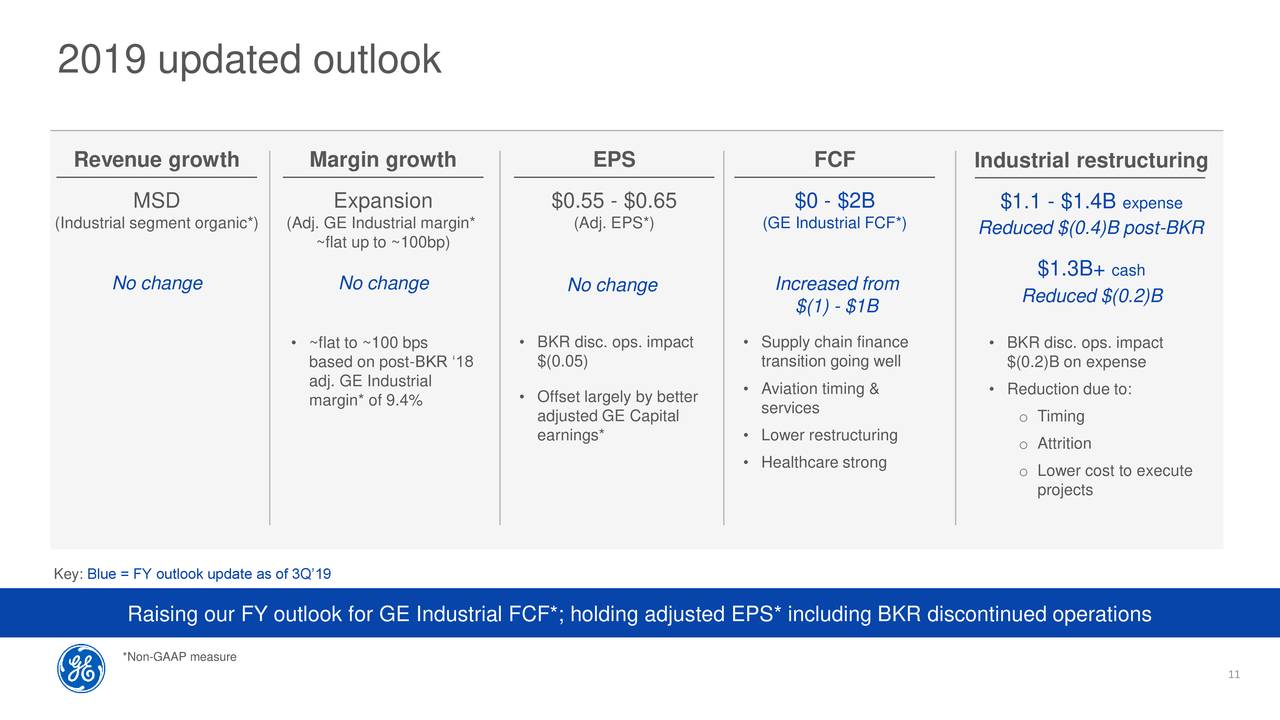

In the past quarter alone, the company sold $9 billion of assets. Consequently, it has also raised free cash flow guidance for the full year to $2 billion compared to the earlier forecast for negative free cash flows.

GE Chairman and CEO H. Lawrence Culp, Jr. said, “We are encouraged by our strong backlog, organic growth, margin expansion, and positive cash trajectory amidst global macro uncertainty. We are raising our Industrial free cash flow outlook again even with external headwinds from the 737 MAX and tariffs.”

Outlook is Improving

Although the company has increased its FCF guidance and maintained an adjusted earnings outlook, investors are expecting a further improvement in financial numbers. Their industrial businesses are generating positive results while the company is experiencing growth in backlog from the power segment. Investors should also keep an eye on 737 MAX related activities.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account