French finance minister Bruno Le Maire (pictured) said eurozone finance ministers should be ready to use a fiscal stimulus if the situation deteriorates due to the coronavirus outbreak.

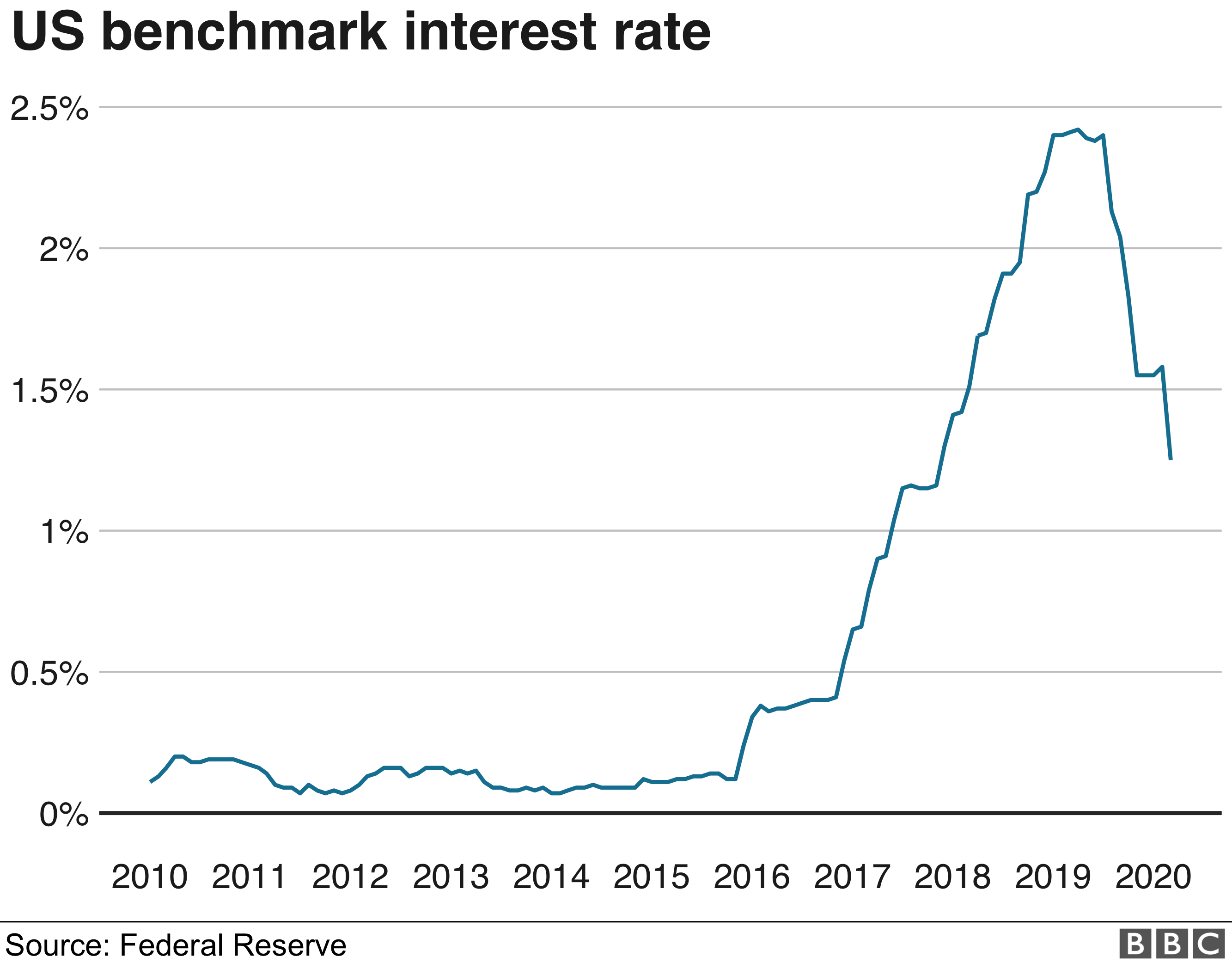

Le Maire said that the European Central Bank (ECB) should help boost lending to struggling firms by easing interest rates. The US Federal Reserve surprised markets by cutting rates yesterday in a bid to boost the American economy in the face of the virus outbreak.

“Monetary policy is not the best weapon today. Rates are already low, and that’s particularly true for the ECB,” Le Maire said. “The fiscal instrument is more effective than the monetary instrument today.”

The ECB’s key interest rate affects the cost of personal loans, credit card rates, as well as the price of loans and bonds to large corporations and small firms.

French Finance Minister expects the negative impact of coronavirus on French growth this year will be over 0.1 percentage point compared to his previous forecast. France added it will support companies who experience the negative impact of coronavirus on earnings.

The Bank of England is likely to cut interest rates in the coming days amid fears over the global economic collapse. Bank governor Mark Carney said an early cut is under consideration. The UK central bank may permit banks to utilize “rainy day” funds to cope with the economic situation.

“We don’t want viable businesses to go out of business because of the very necessary steps that need to be taken to protect and serve the British public,” Mark Carney said.

The US slashed rates by 50 basis points to a target range of 1.00 per cent to 1.25 per cent yesterday. The last emergency interest rate cut from the US Federal Reserve was during the global financial crisis of 2008. Australia and Malaysia have also dropped their rates.

“The virus and the measures that are being taken to contain it will surely weigh on economic activity for some time, both here and abroad,” Federal Reserve Chair Jerome Powell said at a press conference in Washington.

The World Bank also stepped in with the announcement of $12bn support for affected countries dealing with the economic impacts of the virus.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account